Zomato was founded in 2008 by IIT alumni Deepinder Goyal and Pankaj Chaddah, initially under the name FoodieBay. Based in Gurgaon, Haryana, it began as a simple restaurant directory, aiming to make dining out and food delivery easier. In 2010, it rebranded as Zomato and gradually evolved into a leading online food delivery and restaurant discovery service.

Zomato’s mission is straightforward: "To provide better food for more people." Staying true to this mission, Zomato has emerged as a market leader, offering customers a wide range of choices whether they want to dine out or have food delivered to their doorstep.

Initially starting in Haryana, Zomato rapidly expanded across India’s major metros and numerous tier-2 cities. While it ventured into international markets, Zomato eventually chose to focus on strengthening its presence in India.

Zomato- Origins and Growth

Swiggy, founded by Sriharsha Majety and Nandan Reddy, is Zomato's direct competitor. They initially started an e-commerce platform called Bundi, which provided shipping and courier services. After shutting down Bundl, they teamed up with Rahul Jaimini, a former software developer at Myntra, and founded Swiggy in 2014, focusing primarily on food delivery.

Based in Bengaluru, Swiggy’s mission is to improve the quality of life for urban consumers by offering unparalleled convenience. Their tagline, “You desire it, we’ll deliver it,” encapsulates their approach to customer service.

Swiggy entered a market where competitors like Foodpanda and TinyOwl were struggling. However, Swiggy improved delivery efficiency and reliability, quickly establishing itself as a major competitor to Zomato.

Swiggy- Origins and Growth

Founded by Sriharsha Majety and Nandan Reddy, Swiggy stands as a direct rival to Zomato.

They originally founded an E-commerce platform named Bundi which was involved in the shipping and courier service all over India. However, they shut down the company and approached Rahul Jaimini, a former Software developer in Myntra. Together, they founded Swiggy in 2014, with the main focus being on food delivery

When Swiggy entered the market, they were faced with a poor performing sector where brands such as foodpanda and tinyowl were struggling to make ends meet. Swiggy however was able to improve their efficiency in delivery times and focused on being a reliable and quick solution to food delivery needs. This helped them overcome poor market conditions and soon enough, they established themselves to be a major competitor to Zomato.

Now that you are caught up to date with the two, let us take a closer look at their performances and other factors.

Also Learn: Exploring the Straddle Options Strategy: 9:20 0 DTE Straddle Explained with Key Adjustments

Funding-

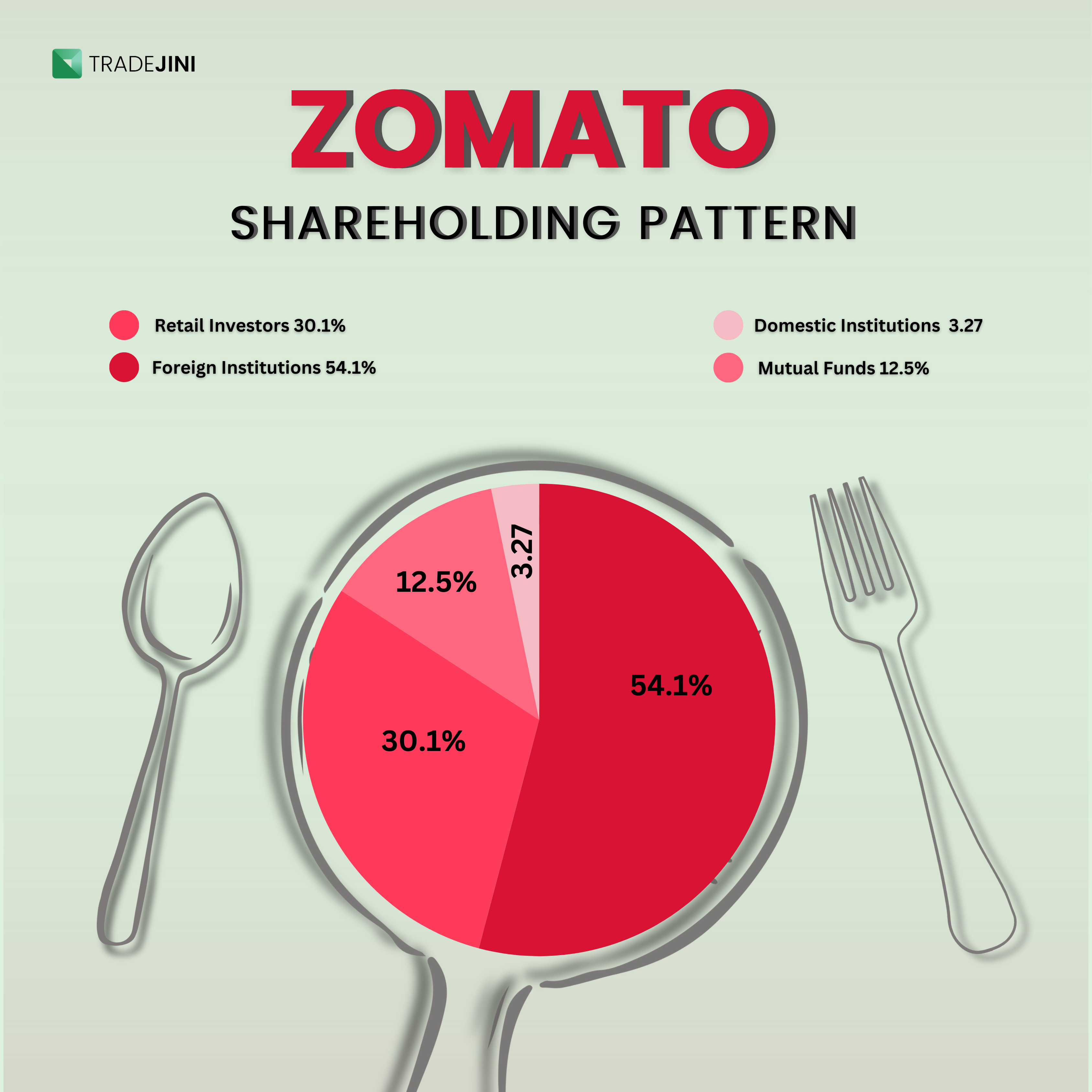

Both Zomato and Swiggy have undergone multiple rounds of funding.

- Zomato has raised approximately ₹24,600 crores across 23 rounds of funding. The most recent was a post-IPO secondary funding round on November 28, 2023, where it raised ₹3,336 crores.

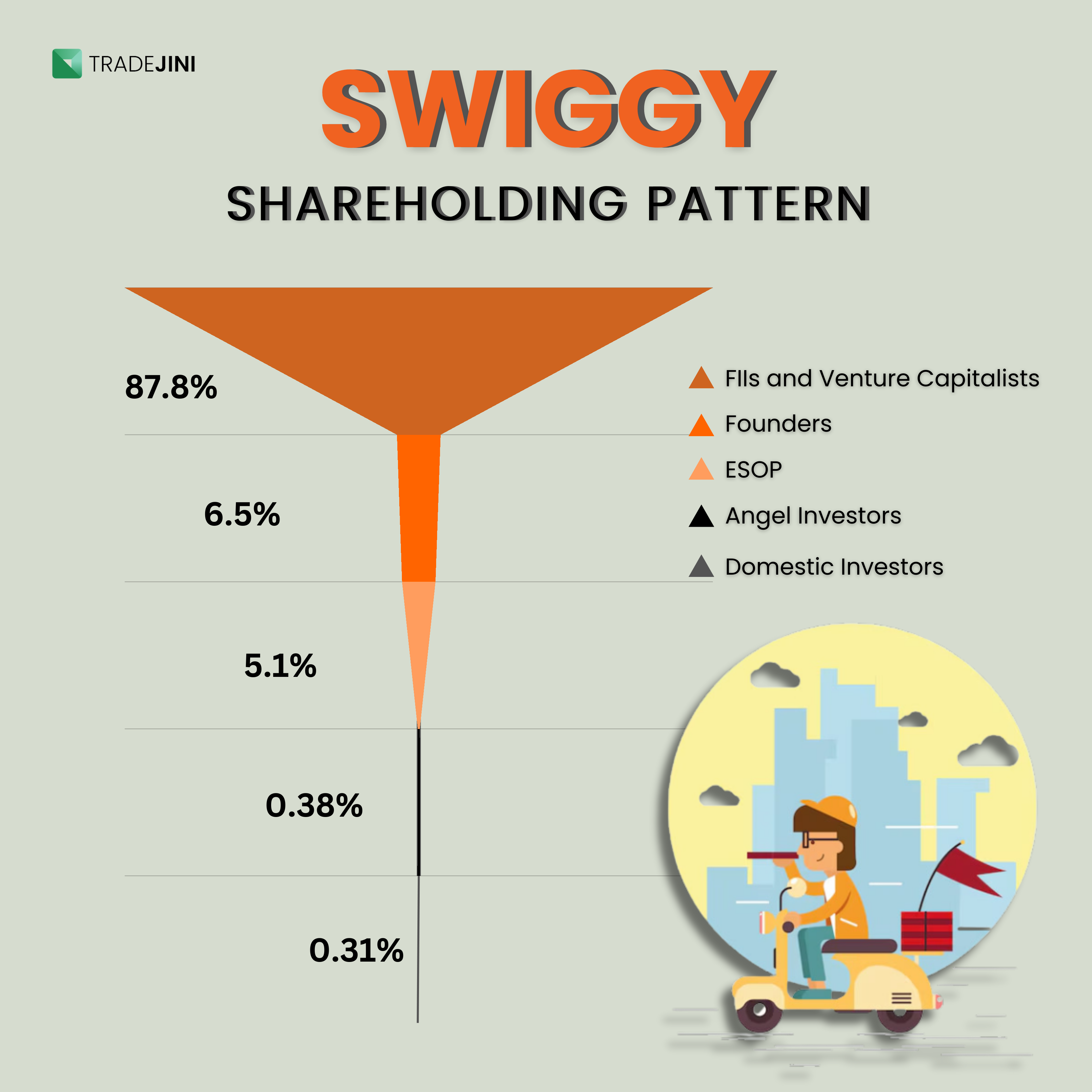

- Swiggy has raised a total of ₹30,000 crores over 16 rounds of funding. In its most recent round on January 24, 2022, it raised ₹5,810 crores from venture capitalists.

Here are the top three major stakeholders of Swiggy

Operations Models-

Zomato and Swiggy, being in the same sector, have similar streams of revenue. Zomato has operations in over 10,000 cities in 24 countries around the world. Swiggy, on the other hand, operates in 800 cities but only in India and Sri Lanka.

Sources of Revenue

For both Zomato and Swiggy, food delivery remains the primary source of revenue. Both companies primarily generate revenue from food delivery, which includes:

- Delivery fees: Charges for delivering the food to the doorstep. Can increase during times of high demand and challenging climatic conditions.

- Commission: Paid by restaurants to Zomato/Swiggy for each order placed through their platform.

- Platform fee: A small fee for maintaining the app or website, charged per order.

- Subsidiary sources: Revenue received from various other sources such as holdings, membership premiums, affiliations with payment services and banks.

Zomato generates around ₹6,160 crore from food delivery alone, which accounts for approximately 75-80% of its total income. On the other hand, Swiggy derives about 60% of its total revenue from food delivery alone, amounting to approximately ₹6,375 crore.

The sole focus of Zomato being on food delivery results in a higher percentage of revenue from that avenue.

Swiggy has a diversified focus, which includes quick commerce, thus resulting in a lower percentage share from food delivery services.

Zomato also generates revenue from Zomato Gold membership, which charges users a premium for faster delivery and services along with discounts and offers.

Similarly, Swiggy offers a ‘One’ membership which provides members with free delivery costs for deliveries (both food and groceries) along with other discounts.

Avenues of expenditure:

| Zomato | Swiggy |

| Total Expenses- ₹11,763 crore | Total Expenses- ₹13,947 crore |

| Operations and logistics | Food delivery operations |

| Technology and infrastructure | Technology, logistics, and dark store management |

| Marketing and promotional activities | Marketing and promotions |

| Expansion and scaling of Blinkit | Instamart (quick commerce) expenses |

Learn about: A Guide to Mergers: Types, Effects, and What Happens to Your Stocks? 🤔

Quick commerce service

Both Zomato and Swiggy are fierce competitors in the quick commerce sector. Zomato with their Blinkit and Swiggy with their Instamart have been making significant strides in the quick commerce segment.

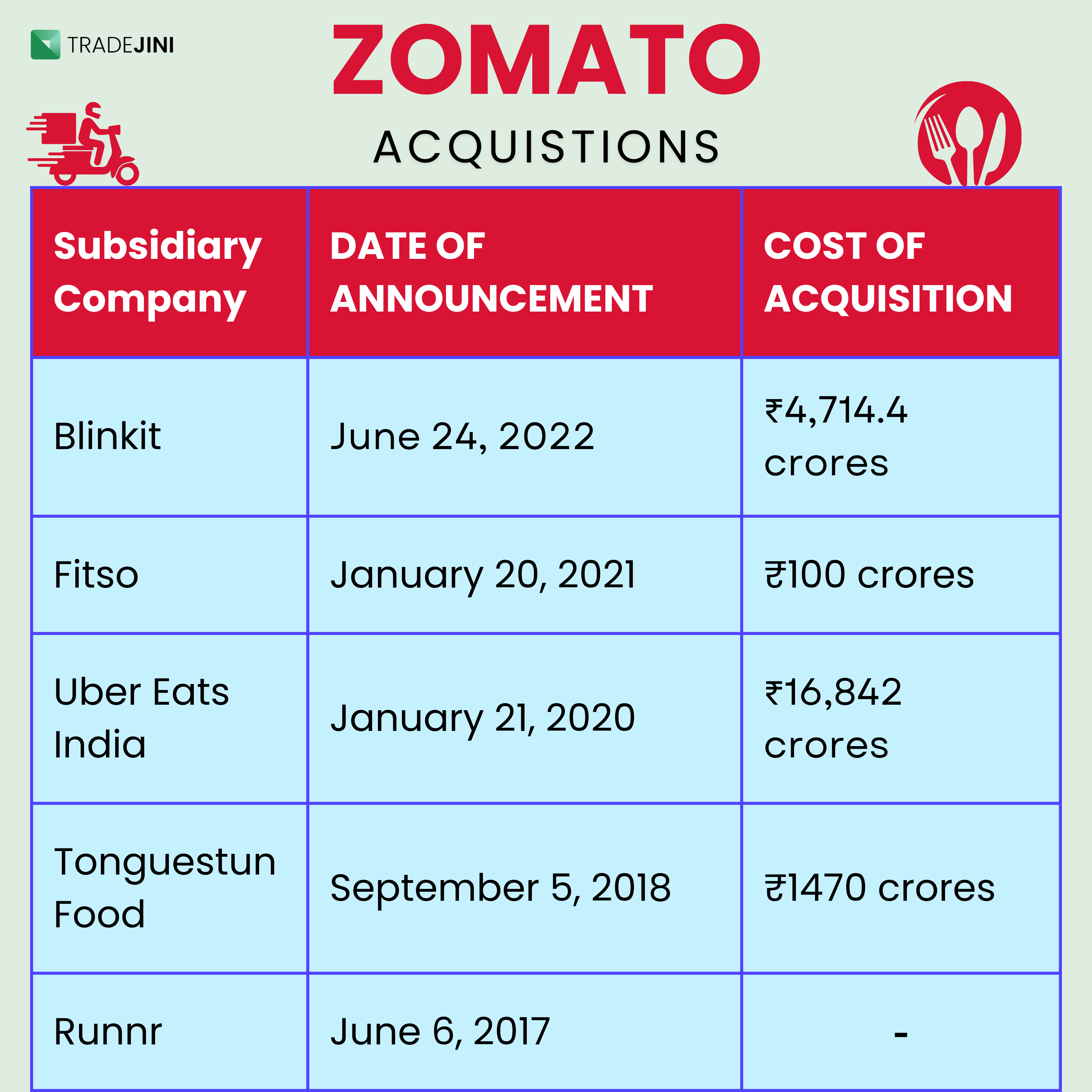

Blinkit-

formerly known as Grofers, Blinkit was founded in 2012. They provide e-commerce services to customers and operate dark stores all across India. It was acquired in 2022 by Zomato at ₹4,714.4 crores. Ever since being acquired, Blinikit has almost tripled in revenue and has been one of the most profitable acquisitions in recent history, providing Zomato with a remarkable source of income.

Some reports suggest that Blinkit is worth more than the parent company Zomato themselves. Blinkit generated ₹942 crores of profit as of June 2024, which is a phenomenal rise of 2.4x times from June 2023. Blinkit’s operations have been benefited thanks to Zomato’s massive infrastructure and coverage network. They promise a grocery delivery speed of 10 minutes and offer basic groceries and provisions along with beauty and personal care products, clothes, medicines, books and electronics.

Now coming to-

Swiggy Instamart,

It was launched in August 2020, Instamart is Swiggy's step into the Q-commerce segment which operates in over 25 cities in India with a strong fleet of delivery executives. Instamart is integrated with Insanelygood, another q-commerce platform to provide a seamless user experience, ensuring customer satisfaction. Additionally, the merger is expected to reduce costs and enhance the value proposition for both customers and investors.

Instamart also offers almost all the products that Blinkit offers. However, while users need to download both Zomato and Blinkit apps to access food delivery and e-commerce services separately, Swiggy offers both services seamlessly within a single app.

Financial Performance-

Zomato has been a public company since its IPO in July 2021. Its stock performance has gained significant momentum, delivering an 187% annual return as of this writing. Zomato reported a net profit of₹470 crores in June 2024, with a market cap of ₹2,45,375 crores.

The valuation of Swiggy is estimated to be around ₹1150 crores. They are also set to launch an IPO of their own where they plan to raise ₹5000 crores through a fresh issue and have already filed the DRHP. Swiggy’s revenue has been continuously improving with one estimate stating a growth of 36%—from Rs 8,265 crore in FY23 to Rs 11,247 crore in FY24. Swiggy Instamart, an extension of Swiggy, is also valued at around 1100 crores.

Both the companies have shown tremendous performance in terms of revenue growth and profitability. Their subsidiaries have equally performed well in terms of financials.

Metrics-

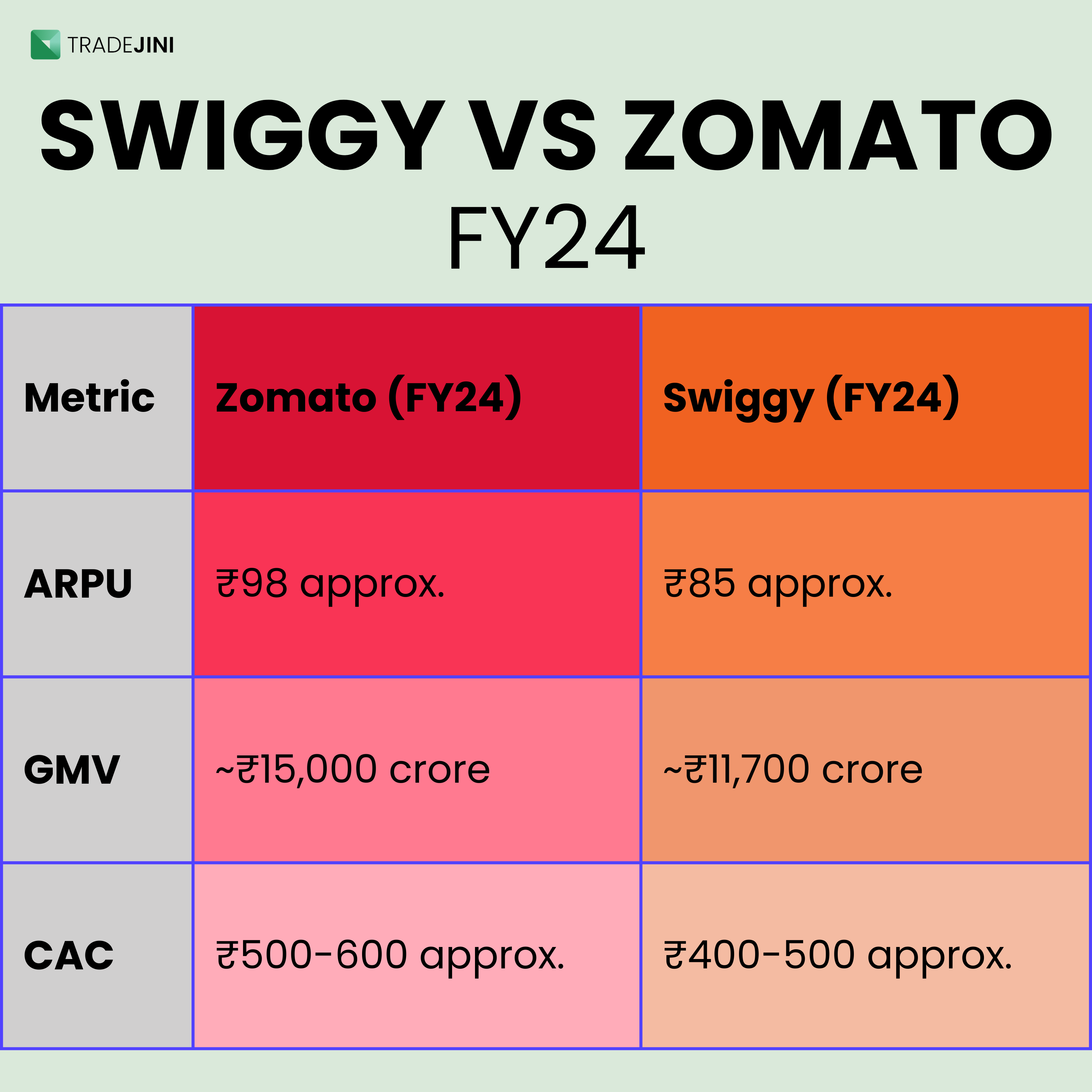

Let us also take into consideration, some of the customer metrics

Average Revenue Per User (ARPU): The average revenue a company earns per customer, showing individual contribution to total revenue.

Gross Merchandise Value (GMV): The total value of products sold on a platform, indicating the business's size and transaction volume.

Customer Acquisition Cost (CAC): The expense a company incurs to acquire a new customer, including marketing and promotional costs.

From this data, we see Zomato generates more revenue per user and handles higher transaction volumes, but at the cost of higher customer acquisition. Swiggy, on the other hand, is more efficient in acquiring customers with a lower CAC, though it generates slightly less revenue per user.

Essentially, Zomato is focusing on extracting more value from each customer, while Swiggy emphasizes cost-efficiency in growing its user base. Both approaches have their merits depending on whether growth or profitability is the priority.

The hunger games-

Zomato and Swiggy have both become key players in India’s food delivery and quick commerce markets, each taking distinct paths to success. Zomato, with its established stock market presence and the rapid growth of Blinkit, shows strong profitability. Swiggy, with its diversified offerings and upcoming IPO, is poised to make its own impact on the public market.

The competition between these two remains intense, and it will be fascinating to see whether Zomato’s market head start or Swiggy’s broader approach will ultimately give one the edge. Investors and consumers alike will be closely watching as the next phase of this rivalry unfolds

Also Read: What Is A Covered Call Options Strategy? Meaning, Features, Benefits & Examples