Our moment in the spotlight

Read our latest news & industry insights on leading publications

Dual dominance in the market Reliance Jio and Bharti Airtel are the two companies dominating the Indian telecom market, as of December 2023, Jio has 459.81 million subscribers, while Airtel has 257.37 million subscribers. Vodafone Idea and BSNL have 127.28 million and 21.28 million subscribers respectively. Read more

From a technical perspective, the post-budget market is often characterised by volatility. Traders can utilise moving averages to identify support and resistance levels, providing a clearer picture of market sentiment and potential entry or exit points. Read more

From a technical perspective, the post-budget market is often characterised by volatility. Traders can utilise moving averages to identify support and resistance levels, providing a clearer picture of market sentiment and potential entry or exit points. Read more

According to Trivesh, the forthcoming budget is expected to prioritise infrastructure development and enhanced connectivity, likely benefiting the construction and steel sectors with projected growth rates of 8 percent and 12 percent, respectively. Additionally, the defence and tourism sectors could see gains from sustained capital expenditures. Read more

According to Trivesh, the forthcoming budget is expected to prioritise infrastructure development and enhanced connectivity, likely benefiting the construction and steel sectors with projected growth rates of 8 percent and 12 percent, respectively. Additionally, the defence and tourism sectors could see gains from sustained capital expenditures.. Read more

sentiments were expressed by Trivesh D, COO at Tradejini. He stated that the market at record highs might become volatile and stay sideways given the lack of direction. Institutional players take a “wait and watch” stance in these circumstances. Read more

sentiments were expressed by Trivesh D, COO at Tradejini. He stated that the market at record highs might become volatile and stay sideways given the lack of direction. Institutional players take a “wait and watch” stance in these circumstances. Read more

Trivesh D, COO, Tradejini has picked Larsen & Toubro (L&T), IRCTC, Hindustan Aeronautics (HAL) and Bharat Electronics as his key budget picks. However, it has suggested investors to stay away from overheated pockets like SME space. Read more

Trivesh D, COO, Tradejini has picked Larsen & Toubro (L&T), IRCTC, Hindustan Aeronautics (HAL) and Bharat Electronics as his key budget picks. However, it has suggested investors to stay away from overheated pockets like SME space. Read more

For the mid-cap and small-cap space, the expert noted while these have registered impressive gains this year (around 21% YTD), but some caution is warranted. While growth potential is enticing, valuations might be stretched, raising concerns about a potential pullback, says Trivesh, COO at Tradejini. Read more

For the mid-cap and small-cap space, the expert noted while these have registered impressive gains this year (around 21% YTD), but some caution is warranted. While growth potential is enticing, valuations might be stretched, raising concerns about a potential pullback, says Trivesh, COO at Tradejini .Read more

Scammers, like their cunning predecessors, have continuously adapted their methods to exploit vulnerabilities in the digital age. Unlike the past when manipulations relied on phone calls and paper trails, as Harshad Mehta infamously did, modern scams weaponize cyber technology to deceive and manipulate investors.Read more

Scammers, like their cunning predecessors, have continuously adapted their methods to exploit vulnerabilities in the digital age. Unlike the past when manipulations relied on phone calls and paper trails, as Harshad Mehta infamously did, modern scams weaponize cyber technology to deceive and manipulate investors.Read more

Indian markets face potential risks that could disrupt the current rally. Concerns over the financial health of SMEs, historically prone to corrections after rapid growth unsupported by fundamentals, loom large. The small-cap Nifty’s current high P/E ratio of 29 underscores vulnerability. Additionally, policy shifts following recent political changes could introduce uncertainties impacting specific sectors.Read more

Indian markets face potential risks that could disrupt the current rally. Concerns over the financial health of SMEs, historically prone to corrections after rapid growth unsupported by fundamentals, loom large. The small-cap Nifty’s current high P/E ratio of 29 underscores vulnerability. Additionally, policy shifts following recent political changes could introduce uncertainties impacting specific sectors.Read more

Trivesh D, COO of Tradejini, also mentioned that the Sensex could reach another milestone before the Union Budget.”Today, the market reaching 80,000 is a sign of the strong momentum we have been seeing. This growth, even with valuation concerns, reflects a bullish market outlook,” he said.Read more

Trivesh D, COO of Tradejini, also mentioned that the Sensex could reach another milestone before the Union Budget.”Today, the market reaching 80,000 is a sign of the strong momentum we have been seeing. This growth, even with valuation concerns, reflects a bullish market outlook,” he said.Read more

Tradejini’s COO explains, “for end customers, this move promises several benefits. A uniform fee structure means that the savings from transaction charges are more likely to be passed on to clients rather than being pocketed by large brokers.”.Read more

Tradejini’s COO explains, “for end customers, this move promises several benefits. A uniform fee structure means that the savings from transaction charges are more likely to be passed on to clients rather than being pocketed by large brokers.”.Read more

Markets are dynamic and constantly evolving. Sticking rigidly to a preconceived notion or strategy can be detrimental. It’s crucial to remain flexible and adapt to new information and changing market conditions.

For instance, during the pandemic, investors who quickly adapted to the new reality—such as the increased demand for technology and healthcare stocks—were able to capitalize on emerging opportunities.Read more

Markets are dynamic and constantly evolving. Sticking rigidly to a preconceived notion or strategy can be detrimental. It’s crucial to remain flexible and adapt to new information and changing market conditions.

For instance, during the pandemic, investors who quickly adapted to the new reality—such as the increased demand for technology and healthcare stocks—were able to capitalize on emerging opportunities.Read more

The valuations of mid and small-cap companies continue to be in the expensive and extremely bullish category. On account of smaller m-caps, these companies are susceptible to significant volatility which may induce investors to participate in such companies without a clear understanding of the operations and future growth prospects of these companies. I advise investors to maintain discipline in stock selection and the decision should not be merely based on speculation and FOMO to ensure long-term wealth is built.Read more

The valuations of mid and small-cap companies continue to be in the expensive and extremely bullish category. On account of smaller m-caps, these companies are susceptible to significant volatility which may induce investors to participate in such companies without a clear understanding of the operations and future growth prospects of these companies. I advise investors to maintain discipline in stock selection and the decision should not be merely based on speculation and FOMO to ensure long-term wealth is built.Read more

The market capitalisation of BSE-listed firms hit an all-time high of Rs 438.41 lakh crore on Thursday, fuelled by a record-breaking rally in equities where the Sensex breached the historic 79,000 mark for the first time. Rallying for the fourth day running, the 30-share BSE Sensex jumped 568.93 points or 0.72% to settle at a new closing peak of 79,243.18 on Thursday.Read more

The market capitalisation of BSE-listed firms hit an all-time high of Rs 438.41 lakh crore on Thursday, fuelled by a record-breaking rally in equities where the Sensex breached the historic 79,000 mark for the first time. Rallying for the fourth day running, the 30-share BSE Sensex jumped 568.93 points or 0.72% to settle at a new closing peak of 79,243.18 on Thursday.Read more

“Strong corporate performance reinforces market stability and investor trust. Equally important will be the government’s effectiveness in implementing pro-growth policies that stimulate economic activity. The upcoming Union Budget will be closely watched for potential sector-specific policies,” said Tradejini Chief Operating Officer Trivesh D.Read more

“Strong corporate performance reinforces market stability and investor trust. Equally important will be the government’s effectiveness in implementing pro-growth policies that stimulate economic activity. The upcoming Union Budget will be closely watched for potential sector-specific policies,” said Tradejini Chief Operating Officer Trivesh D.Read more

Trivesh D COO of Tradejini said that the suspicion of front running is not on the fund house but on an individual. What often happens is that an employee or management is front-running then that fund goes down consistently but in case of quants the performance is consistently good.Read more

Trivesh D COO of Tradejini said that the suspicion of front running is not on the fund house but on an individual. What often happens is that an employee or management is front-running then that fund goes down consistently but in case of quants the performance is consistently good.Read more

Deciding whether to prioritize Indian or US stocks depends on various factors, including investment goals, risk tolerance, and market outlook. US stocks generally offer more stability and are part of a more mature market, providing safer investment opportunities. On the other hand, Indian stocks can offer higher growth potential, albeit with increased volatility. A balanced approach, including diversifying investments across both markets, can help manage risk and maximize returns.Read more

Deciding whether to prioritize Indian or US stocks depends on various factors, including investment goals, risk tolerance, and market outlook. US stocks generally offer more stability and are part of a more mature market, providing safer investment opportunities. On the other hand, Indian stocks can offer higher growth potential, albeit with increased volatility. A balanced approach, including diversifying investments across both markets, can help manage risk and maximize returns.Read more

“Given the current political uncertainty in India and with US interest rates still appealing, FPIs have shifted to a risk-off mode,”Krishna Appala, smallcase manager & senior research analyst at Capitalmind, said

Another reason could be profit booking by FPIs in anticipation of a market correction, particularly around results day, Tradejini’s Mr. Trivesh said.Read more

“Given the current political uncertainty in India and with US interest rates still appealing, FPIs have shifted to a risk-off mode,”Krishna Appala, smallcase manager & senior research analyst at Capitalmind, said

Another reason could be profit booking by FPIs in anticipation of a market correction, particularly around results day, Tradejini’s Mr. Trivesh said.Read more

Trivesh D, COO, Tradejini believes high market volatility may continue for another week or two due to mixed portfolio allocation after the elections. The banking sector is expected to outperform with a projected earnings growth of 14% CAGR.Read more

Trivesh D, COO, Tradejini believes high market volatility may continue for another week or two due to mixed portfolio allocation after the elections. The banking sector is expected to outperform with a projected earnings growth of 14% CAGR.Read more

I think the market will move sideways or down rather than up for a while after the market’s June 3, 2024, rally ended with a significant decline on Results Day. Many companies that were rallying due to political influence might see significant corrections to their stock prices. However, in the end, I believe that performance drives valuation and that external environment-related rallies and corrections are merely transitory.Read more

I think the market will move sideways or down rather than up for a while after the market’s June 3, 2024, rally ended with a significant decline on Results Day. Many companies that were rallying due to political influence might see significant corrections to their stock prices. However, in the end, I believe that performance drives valuation and that external environment-related rallies and corrections are merely transitory.Read more

Trivesh D, COO of TRADEJINI said, “An increase in VIX indicates heightened fear among market participants regarding election results, which has resulted in a rise in the fear gauge index. The VIX is acting similar to the period right before the results of the Lok Sabha election were announced in 2019. During the 2014 Lok Sabha elections, the India VIX reached a historical high of 39.30, and in the 2019 Lok Sabha elections, it almost reached the 30 mark”.Read more

Trivesh D, COO of TRADEJINI said, “An increase in VIX indicates heightened fear among market participants regarding election results, which has resulted in a rise in the fear gauge index. The VIX is acting similar to the period right before the results of the Lok Sabha election were announced in 2019. During the 2014 Lok Sabha elections, the India VIX reached a historical high of 39.30, and in the 2019 Lok Sabha elections, it almost reached the 30 mark”.Read more

What does India VIX trading above 25 points mean to investors? By Trivesh D, COO of Tradejini?

The India VIX is currently trading in the range of 29–30, up over 39–44%, after falling 15% on Monday as exit polls lifted market sentiments. However, an increase in VIX indicates heightened fear among market participants regarding election results, which has resulted in the fear gauge index. The way the VIX is acting right now is a lot like the period right before the results of the Lok Sabha election were announced in 2019.Read more

What does India VIX trading above 25 points mean to investors? By Trivesh D, COO of Tradejini?

The India VIX is currently trading in the range of 29–30, up over 39–44%, after falling 15% on Monday as exit polls lifted market sentiments. However, an increase in VIX indicates heightened fear among market participants regarding election results, which has resulted in the fear gauge index. The way the VIX is acting right now is a lot like the period right before the results of the Lok Sabha election were announced in 2019.Read more

The rising VIX isn’t solely due to election dynamics, but also due to global factors such as escalating tensions in the Middle East; rising US Treasury yields also exacerbated market concerns, according to Trivesh D, chief operating officer, Tradejini. Read more

The rising VIX isn’t solely due to election dynamics, but also due to global factors such as escalating tensions in the Middle East; rising US Treasury yields also exacerbated market concerns, according to Trivesh D, chief operating officer, Tradejini. Read more

“An increase in VIX indicates heightened fear among market participants regarding election results, which has resulted in a rise in the fear gauge index. The VIX is acting similar to the period right before the results of the Lok Sabha election were announced in 2019. During the 2014 Lok Sabha elections, the India VIX reached a historical high of 39.30, and in the 2019 Lok Sabha elections, it almost reached the 30 mark.” said Trivesh D, COO of TRADEJINI. Read more

“An increase in VIX indicates heightened fear among market participants regarding election results, which has resulted in a rise in the fear gauge index. The VIX is acting similar to the period right before the results of the Lok Sabha election were announced in 2019. During the 2014 Lok Sabha elections, the India VIX reached a historical high of 39.30, and in the 2019 Lok Sabha elections, it almost reached the 30 mark.” said Trivesh D, COO of TRADEJINI. Read more

India, the world’s largest democracy with an estimated population of 144.17 crore, is undergoing a digital transformation. This, coupled with strong economic fundamentals and a young demographic, presents exciting opportunities for the nation’s future. Read more

India, the world’s largest democracy with an estimated population of 144.17 crore, is undergoing a digital transformation. This, coupled with strong economic fundamentals and a young demographic, presents exciting opportunities for the nation’s future. Read more

India Has the Significantly transformed its approach to sustainability and environmental Stewardship in recent years. Confronted with the challenges of climate change, the country has increasingly integrated green finance into its economic strategy. Green finance, which directs investments towards sustainable and eco-friendly projects, has become a crucial driver in advancing renewable energy initiatives in India. Read more

India Has the Significantly transformed its approach to sustainability and environmental Stewardship in recent years. Confronted with the challenges of climate change, the country has increasingly integrated green finance into its economic strategy. Green finance, which directs investments towards sustainable and eco-friendly projects, has become a crucial driver in advancing renewable energy initiatives in India. Read more

“Beyond these industry-specific factors, broader economic tailwinds are also at play. The upcoming marriage season and potential government spending are all expected to boost consumer spending, positively impacting the auto sector,” said Trivesh. Read more

“Beyond these industry-specific factors, broader economic tailwinds are also at play. The upcoming marriage season and potential government spending are all expected to boost consumer spending, positively impacting the auto sector,” said Trivesh. Read more

A BJP win would probably boost investor confidence, which would be especially advantageous for large-cap firms. Energy, healthcare, and infrastructure are the sectors that stand to gain from it. Since Modi’s flagship economic initiative has been ‘Make in India’, the manufacturing sector is also anticipated to perform better in the post-election rally than the market. Read more

A BJP win would probably boost investor confidence, which would be especially advantageous for large-cap firms. Energy, healthcare, and infrastructure are the sectors that stand to gain from it. Since Modi’s flagship economic initiative has been ‘Make in India’, the manufacturing sector is also anticipated to perform better in the post-election rally than the market. Read more

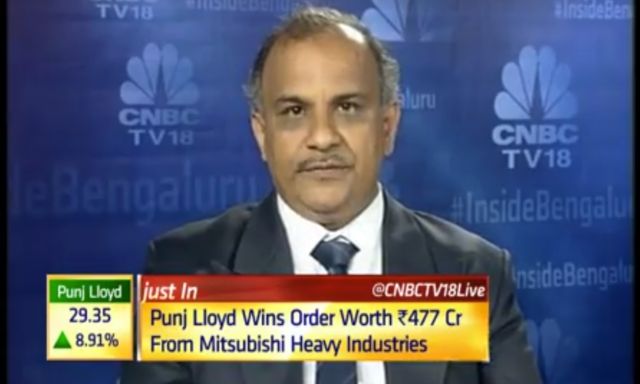

In this episode of Market Minutes, Lovisha Darad discusses about what factors will guide market trends on May 29, following mixed global cues. Some of the top stocks to watch out in today’s trade are PNB Housing, Brigade Enterprises, Oil India, among others. Also, catch Trivesh D from Tradejini on Voice of the Day segment. Market Minutes is a morning podcast that puts the spotlight on hot stocks, key data points, and developing trends. Read more

In this episode of Market Minutes, Lovisha Darad discusses about what factors will guide market trends on May 29, following mixed global cues. Some of the top stocks to watch out in today’s trade are PNB Housing, Brigade Enterprises, Oil India, among others. Also, catch Trivesh D from Tradejini on Voice of the Day segment. Market Minutes is a morning podcast that puts the spotlight on hot stocks, key data points, and developing trends. Read more

Echoing similar sentiments, Trivesh D, COO of Tradejini says “By exclusively investing in FDs, the opportunity cost lost is very high. One misses out on the potential for higher returns offered by listed stocks and bonds which have provided returns in the range of 12% – 15%. Historically, the stock market has outperformed FDs, particularly over the long term, where the effect of marginal compounding significantly enhances wealth accumulation. Read more

Echoing similar sentiments, Trivesh D, COO of Tradejini says “By exclusively investing in FDs, the opportunity cost lost is very high. One misses out on the potential for higher returns offered by listed stocks and bonds which have provided returns in the range of 12% – 15%. Historically, the stock market has outperformed FDs, particularly over the long term, where the effect of marginal compounding significantly enhances wealth accumulation. Read more

Trivesh D, COO at Tradejini, sees promising growth prospects for Nifty to move towards 24,000, albeit with minor corrections on the way. “This rally distinguishes itself by its reliance on adequately valued large-cap stocks, while segments of the market with inflated valuations take a backseat. I believe this trend of large-cap outperformance is anticipated to continue, bolstering the bullish momentum and fostering stability,” he opined. Read more

Trivesh D, COO at Tradejini, sees promising growth prospects for Nifty to move towards 24,000, albeit with minor corrections on the way. “This rally distinguishes itself by its reliance on adequately valued large-cap stocks, while segments of the market with inflated valuations take a backseat. I believe this trend of large-cap outperformance is anticipated to continue, bolstering the bullish momentum and fostering stability,” he opined. Read more

“Looking ahead to the Lok Sabha election outcome, it seems the market is set to continue its trajectory without major corrections, given that the markets are already factoring in the results. Despite recent declines due to foreign investor sell-offs, significant corrections are unlikely unless there is a major event,” said Trivesh D., COO at Tradejini. Read more

“Looking ahead to the Lok Sabha election outcome, it seems the market is set to continue its trajectory without major corrections, given that the markets are already factoring in the results. Despite recent declines due to foreign investor sell-offs, significant corrections are unlikely unless there is a major event,” said Trivesh D., COO at Tradejini. Read more

What if I told you that the Indian debt markets have been experiencing extraordinary growth and opportunity recently? Indians have historically placed their trust in fixed income investments like FD’s, primarily because they offer a perceived security, superior to that of equity and debt markets. This is why only 15% of Indians have DEMAT accounts. Read more

What if I told you that the Indian debt markets have been experiencing extraordinary growth and opportunity recently? Indians have historically placed their trust in fixed income investments like FD’s, primarily because they offer a perceived security, superior to that of equity and debt markets. This is why only 15% of Indians have DEMAT accounts. Read more

Mutual funds, which manage long-term wealth for domestic investors, emphasise the Indian market’s underlying development potential and are less affected by short-term events such as elections, allowing them to continue investing in stocks, Tradejini COO Trivesh D said. Read more

Mutual funds, which manage long-term wealth for domestic investors, emphasise the Indian market’s underlying development potential and are less affected by short-term events such as elections, allowing them to continue investing in stocks, Tradejini COO Trivesh D said. Read more

Prior to the outflow, the investors infused Rs 35,098 crore in March and Rs 1,539 crore in February in Indian equities. Elaborating on the outlook, Trivesh D, COO, Tradejini, noted, “Looking ahead, post-general elections, corporate India’s strong financial performance in Q4 FY24 is anticipated to be rewarded. While FPIs may adopt a cautious stance until the election results are clear, favourable outcomes and established political stability could see their return in significant numbers.” He added that the investors could be profit booking in expectation of a correction in the market, specifically near the results day.

Read more

Prior to the outflow, the investors infused Rs 35,098 crore in March and Rs 1,539 crore in February in Indian equities. Elaborating on the outlook, Trivesh D, COO, Tradejini, noted, “Looking ahead, post-general elections, corporate India’s strong financial performance in Q4 FY24 is anticipated to be rewarded. While FPIs may adopt a cautious stance until the election results are clear, favourable outcomes and established political stability could see their return in significant numbers.” He added that the investors could be profit booking in expectation of a correction in the market, specifically near the results day.

Read more

While FPIs may adopt a cautious stance until the election results are clear, favourable outcomes and established political stability could see their return in significant numbers, Trivesh D., COO at Tradejini, said. According to the data with the depositories, Foreign Portfolio Investors (FPIs) experienced a net outflow of ₹17,083 crore in equities this month (till May 10). Read more

While FPIs may adopt a cautious stance until the election results are clear, favourable outcomes and established political stability could see their return in significant numbers, Trivesh D., COO at Tradejini, said. According to the data with the depositories, Foreign Portfolio Investors (FPIs) experienced a net outflow of ₹17,083 crore in equities this month (till May 10). Read more

Another reason could be profit booking by FPIs in anticipation of a market correction, particularly around results day, Tradejini’s Trivesh said. On the global front, the US Fed has indicated no rate cuts until inflation cools, thus raising scepticism over the possibility of an early rate cut. It led to the appreciation in US dollar leading to a surge in US Treasury yields. On the other hand, FPIs withdrew Rs 1,602 crore from the debt market during the period under review. Read more

Another reason could be profit booking by FPIs in anticipation of a market correction, particularly around results day, Tradejini’s Trivesh said. On the global front, the US Fed has indicated no rate cuts until inflation cools, thus raising scepticism over the possibility of an early rate cut. It led to the appreciation in US dollar leading to a surge in US Treasury yields. On the other hand, FPIs withdrew Rs 1,602 crore from the debt market during the period under review. Read more

Trivesh D., Chief Operating Officer at Tradejini, believes the 2024 general election outcome may not greatly influence the stock market in the short run. However, the long-term impact could be significant. He said if the election outcome is unexpected, it could cause market disruptions, which could be short-lived. In an interview with Mint, Trivesh shared his views on sectors he is positive about and why investors should invest in bonds too. Read more

Trivesh D., Chief Operating Officer at Tradejini, believes the 2024 general election outcome may not greatly influence the stock market in the short run. However, the long-term impact could be significant. He said if the election outcome is unexpected, it could cause market disruptions, which could be short-lived. In an interview with Mint, Trivesh shared his views on sectors he is positive about and why investors should invest in bonds too. Read more

A 1000-point Sensex drop suggests a potential course correction after a period of strong gains. The uptick in the India VIX also signifies heightened investor anxiety over the last few days.This is likely due to a confluence of global factors, such as fears around the Fed’s rate hike decision and domestic concerns. In my view, a balanced approach is crucial. Long-term investors might see this pullback as a buying opportunity, but staying cautious until market sentiment stabilizes is prudent. Read more

A 1000-point Sensex drop suggests a potential course correction after a period of strong gains. The uptick in the India VIX also signifies heightened investor anxiety over the last few days.This is likely due to a confluence of global factors, such as fears around the Fed’s rate hike decision and domestic concerns. In my view, a balanced approach is crucial. Long-term investors might see this pullback as a buying opportunity, but staying cautious until market sentiment stabilizes is prudent. Read more

India’s IPO market has witnessed a remarkable transformation in recent years. The journey of IPOs in the 1970s marked a turning point for the nation’s capital market, and today, India has emerged as the global leader in the number of IPOs. In Q4 2023, 31 IPOs were launched on India’s primary markets, a 72% increase over Q4 2022 and 41% over Q3 2023. This surge in IPO activity indicates a favourable mood among investors, attracting new players to the markets and opening doors for future expansion. Read more

India’s IPO market has witnessed a remarkable transformation in recent years. The journey of IPOs in the 1970s marked a turning point for the nation’s capital market, and today, India has emerged as the global leader in the number of IPOs. In Q4 2023, 31 IPOs were launched on India’s primary markets, a 72% increase over Q4 2022 and 41% over Q3 2023. This surge in IPO activity indicates a favourable mood among investors, attracting new players to the markets and opening doors for future expansion. Read more

There is no guarantee the market will follow the historic election year pattern in 2024. While ‘Sell in May and Go Away’ has held weight in some past years, elections can be a paradigm shift. Historically, these periods see a boost in market sentiment due to several factors. Firstly, increased government spending injects liquidity and stimulates consumption. Secondly, budgets often prioritize public appeasement, further influencing markets. Read more

There is no guarantee the market will follow the historic election year pattern in 2024. While ‘Sell in May and Go Away’ has held weight in some past years, elections can be a paradigm shift. Historically, these periods see a boost in market sentiment due to several factors. Firstly, increased government spending injects liquidity and stimulates consumption. Secondly, budgets often prioritize public appeasement, further influencing markets. Read more

As Trivesh D., COO at Tradejini, pointed out, the Indian stock market saw a 25 per cent increase in FY24, and the outlook for the current financial year also looks favourable. Trivesh highlighted that new investors tend to think they suffer during elevated rates, and existing investors benefit, but the truth is far from reality. Read more

As Trivesh D., COO at Tradejini, pointed out, the Indian stock market saw a 25 per cent increase in FY24, and the outlook for the current financial year also looks favourable. Trivesh highlighted that new investors tend to think they suffer during elevated rates, and existing investors benefit, but the truth is far from reality. Read more

Digital interfaces and now 5G have enabled businesses across industries to democratise most services and commerce even at the grassroots level. Online investing and trading is an exemplary testament to the power of digital. However, for fintechs, relying on GenAI insights alone might not be an effective approach, highlights Kishore Kumar J, CEO, Tradejini in an exclusive conversation with Express Computer. Read more

Digital interfaces and now 5G have enabled businesses across industries to democratise most services and commerce even at the grassroots level. Online investing and trading is an exemplary testament to the power of digital. However, for fintechs, relying on GenAI insights alone might not be an effective approach, highlights Kishore Kumar J, CEO, Tradejini in an exclusive conversation with Express Computer. Read more

Investors and market analysts are gearing up for election season; eager to either enjoy or anticipate the potential impact on the market. The Indian stock market has always been volatile in the pre-election season. In the past 40 years, there have been 11 elections conducted and each of them had a pre-election rally in motion. Nevertheless, this year’s traditional rally was not evident. The Nifty 50 has only moved by 7.68% (as of April 6th, 2024) since the pre-election season began, which is less than the average return given by the Sensex of the previous six months to the election outcome during all of these elections, which has been 14.3 per cent. Read more

Investors and market analysts are gearing up for election season; eager to either enjoy or anticipate the potential impact on the market. The Indian stock market has always been volatile in the pre-election season. In the past 40 years, there have been 11 elections conducted and each of them had a pre-election rally in motion. Nevertheless, this year’s traditional rally was not evident. The Nifty 50 has only moved by 7.68% (as of April 6th, 2024) since the pre-election season began, which is less than the average return given by the Sensex of the previous six months to the election outcome during all of these elections, which has been 14.3 per cent. Read more

“India’s strong GDP growth, manageable fiscal situation, and controlled inflation paint a positive backdrop. This, coupled with the potential for global interest rate cuts and stable oil prices, could be a sweet spot for Indian equities,” stated Trivesh D, COO, Tradejini. Read more

“India’s strong GDP growth, manageable fiscal situation, and controlled inflation paint a positive backdrop. This, coupled with the potential for global interest rate cuts and stable oil prices, could be a sweet spot for Indian equities,” stated Trivesh D, COO, Tradejini. Read more

Trivesh D, COO, Tradejini says investing in Nifty Realty index funds is not all sunshine and rainbows and it is important to carefully consider your risk tolerance. The Nifty Realty Index, a barometer for India’s real estate sector, has presented a fascinating story over the past year. In a surprising turn of events, the index defied traditional market trends by soaring in Q2 FY24, only to experience a slump in the following quarters. Read more

Trivesh D, COO, Tradejini says investing in Nifty Realty index funds is not all sunshine and rainbows and it is important to carefully consider your risk tolerance. The Nifty Realty Index, a barometer for India’s real estate sector, has presented a fascinating story over the past year. In a surprising turn of events, the index defied traditional market trends by soaring in Q2 FY24, only to experience a slump in the following quarters. Read more

Trivesh D, COO, Tradejini, noted that the current IPO trend is not indicating a slowdown, with IPOs worth approximately ₹60,000 crore lined up in 2024. Also, the upcoming elections could potentially boost market sentiment and IPO activity if the outcome is favourable, he added. “Given the favourable macroeconomic conditions, including the expected GDP growth and India’s manufacturing story, I feel…Read more

Trivesh D, COO, Tradejini, noted that the current IPO trend is not indicating a slowdown, with IPOs worth approximately ₹60,000 crore lined up in 2024. Also, the upcoming elections could potentially boost market sentiment and IPO activity if the outcome is favourable, he added. “Given the favourable macroeconomic conditions, including the expected GDP growth and India’s manufacturing story, I feel…Read more

This will increase the number of investors in the stock market. At present, retail investors stay away from the market because their money does not reach them on the same day. Now the brokers will no longer have their money. This will reduce the risk. The confidence of retail investors will increase. After full implementation, the number of demat will increase rapidly. Read more

This will increase the number of investors in the stock market. At present, retail investors stay away from the market because their money does not reach them on the same day. Now the brokers will no longer have their money. This will reduce the risk. The confidence of retail investors will increase. After full implementation, the number of demat will increase rapidly. Read more

The shift to same-day trade settlement or “T+0” cycle could be a potential game changer for India, but a clear guidance is critical that can help participants make informed decisions in an evolving market landscape, says Trivesh D, chief operating officer at online stock trading platform Tradejini. Read more

The shift to same-day trade settlement or “T+0” cycle could be a potential game changer for India, but a clear guidance is critical that can help participants make informed decisions in an evolving market landscape, says Trivesh D, chief operating officer at online stock trading platform Tradejini. Read more

The current ecosystem might require improvements for T+0 functionality, such as margin reporting standardization, risk management strategies, settlement guidelines, and price differential arbitrage protection, said Trivesh D, chief operating officer of Tradejini. Trivesh also believes that unless participation in T+0 is made mandatory, the impact will

be miniscule. Read more

The current ecosystem might require improvements for T+0 functionality, such as margin reporting standardization, risk management strategies, settlement guidelines, and price differential arbitrage protection, said Trivesh D, chief operating officer of Tradejini. Trivesh also believes that unless participation in T+0 is made mandatory, the impact will

be miniscule. Read more

Trivesh D., Chief Operating Officer at Tradejini says “Can you imagine RCB without Virat Kohli’s consistent runs, ABD’s versatile performance, Maxwell’s aggressive batting, Faf Du Plessis’s reliable presence, and Chris Gayle’s hit-or-miss excitement? It’s like envisioning an investment portfolio without gold and real estate for stability, mutual fund SIPs for all-around growth, the debt market for its bold moves, the equity market for its steady potential, and futures & options for the chance of striking it big. Both scenarios lack the strategic variety essential for triumph.”. Read more

Trivesh D., Chief Operating Officer at Tradejini says “Can you imagine RCB without Virat Kohli’s consistent runs, ABD’s versatile performance, Maxwell’s aggressive batting, Faf Du Plessis’s reliable presence, and Chris Gayle’s hit-or-miss excitement? It’s like envisioning an investment portfolio without gold and real estate for stability, mutual fund SIPs for all-around growth, the debt market for its bold moves, the equity market for its steady potential, and futures & options for the chance of striking it big. Both scenarios lack the strategic variety essential for triumph.”. Read more

To minimize risk and optimize profits, diversify your assets, much like people do with different colors during Holi. Investing in a variety of asset types, including bonds, equities, and real estate, will help you build a balanced portfolio that can withstand changes in the market.”Can you imagine RCB without Virat Kohli’s consistent runs, ABD’s versatile performance, Maxwell’s aggressive batting, Faf Du Plessis’s dependable presence, and Chris Gayle’s hit-or-miss excitement?” asks Trivesh D., Chief Operating Officer of Tradejini. Read more

To minimize risk and optimize profits, diversify your assets, much like people do with different colors during Holi. Investing in a variety of asset types, including bonds, equities, and real estate, will help you build a balanced portfolio that can withstand changes in the market.”Can you imagine RCB without Virat Kohli’s consistent runs, ABD’s versatile performance, Maxwell’s aggressive batting, Faf Du Plessis’s dependable presence, and Chris Gayle’s hit-or-miss excitement?” asks Trivesh D., Chief Operating Officer of Tradejini. Read more

As an investor myself, I understand the importance of diversification in investment portfolios. Diversification is the process of spreading investments across different asset classes, sectors, and geographies to minimise risk and maximise returns. It is a crucial strategy that helps investors achieve their long-term financial goals while mitigating the risks associated with short-term market fluctuations. Between April 2023 and January 2024, Indian investors put 17.66 lakh crore rupees in bank deposits, 3.96 lakh crore rupees in mutual funds, and… Read more

As an investor myself, I understand the importance of diversification in investment portfolios. Diversification is the process of spreading investments across different asset classes, sectors, and geographies to minimise risk and maximise returns. It is a crucial strategy that helps investors achieve their long-term financial goals while mitigating the risks associated with short-term market fluctuations. Between April 2023 and January 2024, Indian investors put 17.66 lakh crore rupees in bank deposits, 3.96 lakh crore rupees in mutual funds, and… Read more

Investing in US stocks from India has experienced a surge in popularity, appealing to both experienced investors and ordinary individuals. The reasons for this growing trend range from wealth creation and geographical diversification to reducing dependence on the Indian economy. With well-defined taxation policies, feeder funds offer a convenient avenue for accessing foreign investments. Different geographies tend to show varying performance across different calendar years. Read more

Investing in US stocks from India has experienced a surge in popularity, appealing to both experienced investors and ordinary individuals. The reasons for this growing trend range from wealth creation and geographical diversification to reducing dependence on the Indian economy. With well-defined taxation policies, feeder funds offer a convenient avenue for accessing foreign investments. Different geographies tend to show varying performance across different calendar years. Read more

Trivesh D, Chief Operating Officer at Tradejini, said the diminishing impact of the Fed’s rate decisions on the Indian market is due to reduced dependency on foreign portfolio investors (FPIs). “This shift reduces the market’s vulnerability to major fluctuations based on Fed rate cuts,” he said. Read more

Trivesh D, Chief Operating Officer at Tradejini, said the diminishing impact of the Fed’s rate decisions on the Indian market is due to reduced dependency on foreign portfolio investors (FPIs). “This shift reduces the market’s vulnerability to major fluctuations based on Fed rate cuts,” he said. Read more

“While the immediate impact on the number of IPOs was a slowdown for a while, the intent by SEBI was for long-term benefit, aiming for a transparent IPO market,” said Trivesh D, chief operating officer of brokerage Tradejini. Read more

“While the immediate impact on the number of IPOs was a slowdown for a while, the intent by SEBI was for long-term benefit, aiming for a transparent IPO market,” said Trivesh D, chief operating officer of brokerage Tradejini. Read more

Albeit, Trivesh D, chief operating officer, brokerage platform Tradejini, has deduced that such stocks could fall 10 per cent. He said, “The near-term outlook for small and mid-cap stocks in India appears subdued, mirroring the cautious sentiment of a broader market. A modest correction of around 10 per cent is likely within the sector due to profit booking, year-end accounting adjustments, and valuation biases.” He also said that, the current market adjustment reflects a return to more sustainable pricing. Read more

Albeit, Trivesh D, chief operating officer, brokerage platform Tradejini, has deduced that such stocks could fall 10 per cent. He said, “The near-term outlook for small and mid-cap stocks in India appears subdued, mirroring the cautious sentiment of a broader market. A modest correction of around 10 per cent is likely within the sector due to profit booking, year-end accounting adjustments, and valuation biases.” He also said that, the current market adjustment reflects a return to more sustainable pricing. Read more

The Federal Reserve’s upcoming policy meeting is a key event, especially with the crucial Lok Sabha elections on the horizon in India. A stable government post-election could attract foreign investment and strengthen the rupee, potentially influencing the Fed’s interest rate decision. Beyond domestic US data like inflation and growth, the Fed will be watching global factors like the rupee-dollar exchange rate and crude oil prices. Read more

The Federal Reserve’s upcoming policy meeting is a key event, especially with the crucial Lok Sabha elections on the horizon in India. A stable government post-election could attract foreign investment and strengthen the rupee, potentially influencing the Fed’s interest rate decision. Beyond domestic US data like inflation and growth, the Fed will be watching global factors like the rupee-dollar exchange rate and crude oil prices. Read more

“The near-term outlook for small and mid-cap stocks in India appears subdued, mirroring the cautious sentiment of a broader market. A modest correction of around 10 per cent is likel within the sector due to profit booking, year-end accounting adjustments, and valuation biases,” brokerage platform Tradejini chief operating officer Trivesh D said. Read more

“The near-term outlook for small and mid-cap stocks in India appears subdued, mirroring the cautious sentiment of a broader market. A modest correction of around 10 per cent is likel within the sector due to profit booking, year-end accounting adjustments, and valuation biases,” brokerage platform Tradejini chief operating officer Trivesh D said. Read more

“The near-term outlook for small and mid-cap stocks in India appears subdued, mirroring the cautious sentiment of a broader market. A modest correction of around 10 per cent is likel within the sector due to profit booking, year-end accounting adjustments, and valuation biases,” brokerage platform Tradejini chief operating officer Trivesh D said. Read more

“The near-term outlook for small and mid-cap stocks in India appears subdued, mirroring the cautious sentiment of a broader market. A modest correction of around 10 per cent is likel within the sector due to profit booking, year-end accounting adjustments, and valuation biases,” brokerage platform Tradejini chief operating officer Trivesh D said. Read more

“The near-term outlook for small and mid-cap stocks in India appears subdued, mirroring the cautious sentiment of a broader market. A modest correction of around 10 per cent is likel within the sector due to profit booking, year-end accounting adjustments, and valuation biases,” brokerage platform Tradejini chief operating officer Trivesh D said. Read more

“The near-term outlook for small and mid-cap stocks in India appears subdued, mirroring the cautious sentiment of a broader market. A modest correction of around 10 per cent is likel within the sector due to profit booking, year-end accounting adjustments, and valuation biases,” brokerage platform Tradejini chief operating officer Trivesh D said. Read more

“The near-term outlook for small and mid-cap stocks in India appears subdued, mirroring the cautious sentiment of a broader market. A modest correction of around 10 per cent is likel within the sector due to profit booking, year-end accounting adjustments, and valuation biases,” brokerage platform Tradejini chief operating officer Trivesh D said. Read more

“The near-term outlook for small and mid-cap stocks in India appears subdued, mirroring the cautious sentiment of a broader market. A modest correction of around 10 per cent is likel within the sector due to profit booking, year-end accounting adjustments, and valuation biases,” brokerage platform Tradejini chief operating officer Trivesh D said. Read more

Trivesh D, COO at Tradejini sees several factors at play behind the correction in the smallcap segment. “This correction could be driven by a few factors. Firstly, regulatory concerns regarding excessive inflows into small-cap funds raise questions about the ability to maintain portfolio quality due to the limited pool of investible small companies. Secondly, potential regulatory actions to address frothy valuations and the ongoing correction in the broader market are likely to exacerbate the downward pressure on small caps,” said Trivesh. Read more

Trivesh D, COO at Tradejini sees several factors at play behind the correction in the smallcap segment. “This correction could be driven by a few factors. Firstly, regulatory concerns regarding excessive inflows into small-cap funds raise questions about the ability to maintain portfolio quality due to the limited pool of investible small companies. Secondly, potential regulatory actions to address frothy valuations and the ongoing correction in the broader market are likely to exacerbate the downward pressure on small caps,” said Trivesh. Read more

“Ultimately, T+0 is a double-edged sword. It empowers investors but demands a learning curve. Brokers will need to adapt, and regulators will need to guide the transition,” said Trivesh D, COO, Tradejini – Discount Broking Company. He said that while there will be growing pains, a well-implemented T+0 can significantly enhance the Indian stock market’s dynamism and efficiency. Read more

“Ultimately, T+0 is a double-edged sword. It empowers investors but demands a learning curve. Brokers will need to adapt, and regulators will need to guide the transition,” said Trivesh D, COO, Tradejini – Discount Broking Company. He said that while there will be growing pains, a well-implemented T+0 can significantly enhance the Indian stock market’s dynamism and efficiency. Read more

Our Indian market has several remarkable women challenging stereotypes and driving success. Take, for instance, Madhabi Puri Buch’s appointment as Chairperson of SEBI, Radhika Gupta’s value-driven investment philosophy at Edelweiss Asset Management, and Falguni Nayar’s entrepreneurial spirit that fuelled Nykaa’s successful IPO, which demonstrate the impact women are making in a traditionally male-dominated sector. Read more

Our Indian market has several remarkable women challenging stereotypes and driving success. Take, for instance, Madhabi Puri Buch’s appointment as Chairperson of SEBI, Radhika Gupta’s value-driven investment philosophy at Edelweiss Asset Management, and Falguni Nayar’s entrepreneurial spirit that fuelled Nykaa’s successful IPO, which demonstrate the impact women are making in a traditionally male-dominated sector. Read more

Trivesh D, COO, Tradejini says that retirement is typically thought of as a period for leisure and relaxation, but it also comes with special financial challenges, particularly for women. He says, “Since many women stay at home for all or most of their lives, and even those with their own sources of income never bother to save for themselves separately, it can be difficult for them to maintain a regular stream of income during their retirement, especially if they are widowed”. Read more

Trivesh D, COO, Tradejini says that retirement is typically thought of as a period for leisure and relaxation, but it also comes with special financial challenges, particularly for women. He says, “Since many women stay at home for all or most of their lives, and even those with their own sources of income never bother to save for themselves separately, it can be difficult for them to maintain a regular stream of income during their retirement, especially if they are widowed”. Read more

“The outlook for 2024 appears mixed. Many companies are booming due to the economy’s growth of 6.5-7 per cent. Record highs of the Sensex and Nifty showcase the market’s bullishness, but investors should be prepared for potential 3-5 per cent corrections,” said Trivesh D, Chief Operating Officer at Tradejini. “The dominant forces in the market are presently steering it towards a bullish trajectory until the general election. In my view, this bullish trend may witness some near-term correction,” said Trivesh. Read more

“The outlook for 2024 appears mixed. Many companies are booming due to the economy’s growth of 6.5-7 per cent. Record highs of the Sensex and Nifty showcase the market’s bullishness, but investors should be prepared for potential 3-5 per cent corrections,” said Trivesh D, Chief Operating Officer at Tradejini. “The dominant forces in the market are presently steering it towards a bullish trajectory until the general election. In my view, this bullish trend may witness some near-term correction,” said Trivesh. Read more

Trivesh D, COO of Tradejini underscored that consolidation is a natural part of the smallcap journey. Historically, the periods of consolidations haven’t necessarily translated into negative returns. They are often followed by strong growth phases in the next six months. Over the past decade, 85 per cent of stocks that multiplied tenfold, were smallcap stocks. Read more

Trivesh D, COO of Tradejini underscored that consolidation is a natural part of the smallcap journey. Historically, the periods of consolidations haven’t necessarily translated into negative returns. They are often followed by strong growth phases in the next six months. Over the past decade, 85 per cent of stocks that multiplied tenfold, were smallcap stocks. Read more

Trivesh D, chief operating officer at Tradejini, said historically markets have delivered positive returns in the run-up to the elections. However, one has to be careful this time around given the sharp run-up over the past year, he added. The Nifty50 has rallied 27 per cent in the past year. Meanwhile, the Nifty Midcap 100 and the Nifty Smallcap 100 indices have surged by 60 per cent and 72 per cent, respectively.

Read more

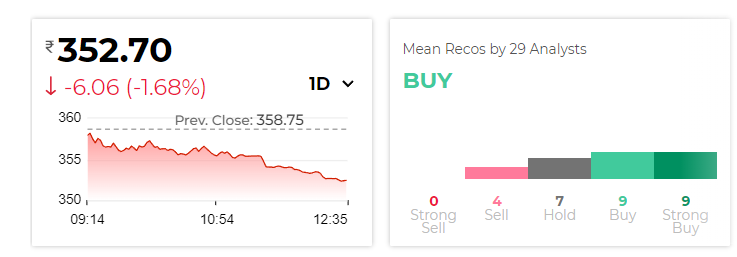

Consensus price targets hint at modest stock market upside this year

Trivesh D, chief operating officer at Tradejini, said historically markets have delivered positive returns in the run-up to the elections. However, one has to be careful this time around given the sharp run-up over the past year, he added. The Nifty50 has rallied 27 per cent in the past year. Meanwhile, the Nifty Midcap 100 and the Nifty Smallcap 100 indices have surged by 60 per cent and 72 per cent, respectively. Read more

Women are missing out on the benefits of equity. A variable market is not just for the first man. This is also an opportunity for those who have the desire and ambition to achieve financial freedom. On Women’s Day, I encourage women to choose the path which has not been taken till now. Read more

Women are missing out on the benefits of equity. A variable market is not just for the first man. This is also an opportunity for those who have the desire and ambition to achieve financial freedom. On Women’s Day, I encourage women to choose the path which has not been taken till now. Read more

Women are missing out on the benefits of equity. A variable market is not just for the first man. This is also an opportunity for those who have the desire and ambition to achieve financial freedom. On Women’s Day, I encourage women to choose the path which has not been taken till now. Read more

Women are missing out on the benefits of equity. A variable market is not just for the first man. This is also an opportunity for those who have the desire and ambition to achieve financial freedom. On Women’s Day, I encourage women to choose the path which has not been taken till now. Read more

The Nifty 50 has had an impressive run. While this growth is certainly attractive, it’s important to remember that the market can be unpredictable and subject to sudden changes. In times like these, it’s wise to take a step back and assess your investments. Selling off completely might be premature. But, also it is advisable to take some profits off the table and diversify investments. Read more

The Nifty 50 has had an impressive run. While this growth is certainly attractive, it’s important to remember that the market can be unpredictable and subject to sudden changes. In times like these, it’s wise to take a step back and assess your investments. Selling off completely might be premature. But, also it is advisable to take some profits off the table and diversify investments. Read more

Trivesh D, COO, Tradejini expects a small correction in the range of 3-5% ahead of the elections. He believes that large and midcaps are significantly overvalued with a potential bubble that needs to burst before it grows too big. For a model portfolio, he advises 30% Stocks, 30% Mutual Funds, 15% Real Estate, 15% Debt Instruments, and 10% in Gold. Edited Excerpts. Read more

Trivesh D, COO, Tradejini expects a small correction in the range of 3-5% ahead of the elections. He believes that large and midcaps are significantly overvalued with a potential bubble that needs to burst before it grows too big. For a model portfolio, he advises 30% Stocks, 30% Mutual Funds, 15% Real Estate, 15% Debt Instruments, and 10% in Gold. Edited Excerpts. Read more

“The upcoming election season could increase market volatility, which may result in higher option premiums. This could benefit expiry traders and positional option sellers. Also, which party wins will have a significant impact. It is expected that there will be a liquidity reduction in the market generally due to elections since a lot of political parties remove funds from the market for elections,” said Trivesh D of Tradejini. Read more

“The upcoming election season could increase market volatility, which may result in higher option premiums. This could benefit expiry traders and positional option sellers. Also, which party wins will have a significant impact. It is expected that there will be a liquidity reduction in the market generally due to elections since a lot of political parties remove funds from the market for elections,” said Trivesh D of Tradejini. Read more

As a couple, managing finances together is essential for building a strong and healthy relationship. It’s not just about dealing with numbers and budgets, but also about understanding and respecting each other’s views on finances. As per the survey, an average couple spends 63 hours per week on unpaid household work. However, only 29% of couples share these tasks equally. Read more

As a couple, managing finances together is essential for building a strong and healthy relationship. It’s not just about dealing with numbers and budgets, but also about understanding and respecting each other’s views on finances. As per the survey, an average couple spends 63 hours per week on unpaid household work. However, only 29% of couples share these tasks equally. Read more

They are now regarded as a crucial resource for financial literacy. Finfluencers simplify complex financial concepts for the common man in financial advisory services. This has led many individuals to abandon traditional sources of advice and start relying on Finfluencer for financial guidance. This reliance on fininfluencers puts consumers at risk in a nation where financial literacy is lower than the global average. Consequently, it was imperative to keep them under control. Read more

They are now regarded as a crucial resource for financial literacy. Finfluencers simplify complex financial concepts for the common man in financial advisory services. This has led many individuals to abandon traditional sources of advice and start relying on Finfluencer for financial guidance. This reliance on fininfluencers puts consumers at risk in a nation where financial literacy is lower than the global average. Consequently, it was imperative to keep them under control. Read more

For clients who were not able to cough up extra margin, the position would have either been squared off or collateral was sold, said Trivesh D, Chief Operating Officer of Tradejini, a Bengaluru-based broking firm. Read more

For clients who were not able to cough up extra margin, the position would have either been squared off or collateral was sold, said Trivesh D, Chief Operating Officer of Tradejini, a Bengaluru-based broking firm.

Read more

‘’China’s stocks have been on a rollercoaster ride lately. I feel like the China indices have had a rough time recently, hitting five-year lows. The CSI300 Index dropped nearly five per cent last week, with signs of panic selling and forced liquidation of leveraged trades,” said Trivesh D, COO at Tradejini. Read more

‘’China’s stocks have been on a rollercoaster ride lately. I feel like the China indices have had a rough time recently, hitting five-year lows. The CSI300 Index dropped nearly five per cent last week, with signs of panic selling and forced liquidation of leveraged trades,” said Trivesh D, COO at Tradejini. Read more

“While everyone is a bit reserved about what the budget might bring, I think that major policy changes or announcements are unlikely to happen due to its proximity to the general election this year. Market sentiment could receive a boost through potential adjustments to the House Rent Allowance (HRA) exemption, enhancements in Sections 80C and 80D deductions, and a focus on capital expenditure in sectors like PSU banks and real estate”. Read more

“While everyone is a bit reserved about what the budget might bring, I think that major policy changes or announcements are unlikely to happen due to its proximity to the general election this year. Market sentiment could receive a boost through potential adjustments to the House Rent Allowance (HRA) exemption, enhancements in Sections 80C and 80D deductions, and a focus on capital expenditure in sectors like PSU banks and real estate”. Read more

According to Trivesh D, Chief Operating Officer of Tradejini, a broking firm, when STT is hiked, the move does not affect option buyers as much as it affects high-frequency traders and those selling options regularly. These groups are more sensitive to changes in market conditions and are likely to be impacted the most, he said. Read more

According to Trivesh D, Chief Operating Officer of Tradejini, a broking firm, when STT is hiked, the move does not affect option buyers as much as it affects high-frequency traders and those selling options regularly. These groups are more sensitive to changes in market conditions and are likely to be impacted the most, he said. Read more

“Though the outlook for PSUs remains positive for 2024, we advise investors to selectively invest as their performance hinges largely on political developments and policy continuity,” said Trivesh D, COO at Bengaluru-based trading platform Tradejini. Read more

“Though the outlook for PSUs remains positive for 2024, we advise investors to selectively invest as their performance hinges largely on political developments and policy continuity,” said Trivesh D, COO at Bengaluru-based trading platform Tradejini. Read more

The COO of online brokerage company Tradejini, Trivesh D, has said that in the lead up to an election year, foreign investors are showing a trend of selling-out their investments, which has also been going on for five years. However, this trend is only short-term and has resulted in a positive outcome for the market, as the valuation has become more reasonable and provided an opportunity for people to buy. Some experts believe that the selling-out is due to the regulation of foreign portfolios for foreign investors (FII) by SEBI. Read more

The COO of online brokerage company Tradejini, Trivesh D, has said that in the lead up to an election year, foreign investors are showing a trend of selling-out their investments, which has also been going on for five years. However, this trend is only short-term and has resulted in a positive outcome for the market, as the valuation has become more reasonable and provided an opportunity for people to buy. Some experts believe that the selling-out is due to the regulation of foreign portfolios for foreign investors (FII) by SEBI. Read more

“Market correction was the need of the hour on account of inflated valuations in most of the mid and small cap stocks with no fundamental and technical backing. The correction can be expected for a few more sessions leading to the vote on account-Budget 2024,” said Trivesh D, COO, Tradejini. Read more

“Market correction was the need of the hour on account of inflated valuations in most of the mid and small cap stocks with no fundamental and technical backing. The correction can be expected for a few more sessions leading to the vote on account-Budget 2024,” said Trivesh D, COO, Tradejini. Read more

Trivesh D, COO, Tradejini, also advises to book a little bit of profit. “It is always better to be cautious and take small profits consistently rather than risk everything and potentially lose big. So, if the market falls, it is a good opportunity to buy more, and if it continues to go up, you’ll still make a small profit. The overall market strategy will be to minimize risk while still allowing traders to benefit from market movements. It’s important to observe the market, wait for the right moment to enter, and trade in small quantities. Don’t go against the trend, and always be cautious. Remember, the market is unpredictable, and it is always better to stay on the safe side,” he advised. Read more

Trivesh D, COO, Tradejini, also advises to book a little bit of profit. “It is always better to be cautious and take small profits consistently rather than risk everything and potentially lose big. So, if the market falls, it is a good opportunity to buy more, and if it continues to go up, you’ll still make a small profit. The overall market strategy will be to minimize risk while still allowing traders to benefit from market movements. It’s important to observe the market, wait for the right moment to enter, and trade in small quantities. Don’t go against the trend, and always be cautious. Remember, the market is unpredictable, and it is always better to stay on the safe side,” he advised. Read more

Catch Trivesh D of Tradejini on the Voice of the Day segment. Market Minutes is a morning podcast that puts the spotlight on hot stocks, key data points, and developing trends. Read more

Catch Trivesh D of Tradejini on the Voice of the Day segment. Market Minutes is a morning podcast that puts the spotlight on hot stocks, key data points, and developing trends. Read more

Trivesh D, COO, Tradejini observed given the upcoming elections, corporate India will tread cautiously in allocating capex budgets for the upcoming year which will be visible in the Q3 earning potential as well. Trivesh believes the upcoming Budget is also unlikely to be a major catalyst for the market, with investor attention focused on Q3 earnings season and the central bank’s monetary policy decisions. Read more

Trivesh D, COO, Tradejini observed given the upcoming elections, corporate India will tread cautiously in allocating capex budgets for the upcoming year which will be visible in the Q3 earning potential as well. Trivesh believes the upcoming Budget is also unlikely to be a major catalyst for the market, with investor attention focused on Q3 earnings season and the central bank’s monetary policy decisions. Read more

Trivesh D, COO at Tradejini said that these short-term corrections would make overall markets healthy and help it achieve record highs once again. “With the current bear phase resulting in a market correction, we can expect this year to see some high records, as historically market corrections before a major event (election) usually yield a fast-paced market rally subsequently,” he opined. Read more

Trivesh D, COO at Tradejini said that these short-term corrections would make overall markets healthy and help it achieve record highs once again. “With the current bear phase resulting in a market correction, we can expect this year to see some high records, as historically market corrections before a major event (election) usually yield a fast-paced market rally subsequently,” he opined. Read more

Over the past few years, there has been a visible shift in the retail investor behaviour, and their growing interest in the derivatives segment of the equity market. Investors seem to be more comfortable taking riskier assets, seeking higher returns in a low-interest environment, says Trivesh D, COO of online stock trading platform Tradejini. Read more

Over the past few years, there has been a visible shift in the retail investor behaviour, and their growing interest in the derivatives segment of the equity market. Investors seem to be more comfortable taking riskier assets, seeking higher returns in a low-interest environment, says Trivesh D, COO of online stock trading platform Tradejini. Read more

“Unlike full-service brokers, who have diverse revenue streams, discount brokers may face challenges, particularly in the collection of Annual Maintenance Charges (AMC) and other statutory charges,” Trivesh said. Read more

“Unlike full-service brokers, who have diverse revenue streams, discount brokers may face challenges, particularly in the collection of Annual Maintenance Charges (AMC) and other statutory charges,” Trivesh said. Read more

This column has been contributed by Trivesh D, COO, Tradejini In the rapidly evolving landscape of India’s stock broking industry, the year 2023 has been a pivotal chapter, witnessing significant shifts in market dynamics and business models. From role of AI to rapid consolidation, the industry is witnessing them all. Read more

This column has been contributed by Trivesh D, COO, Tradejini In the rapidly evolving landscape of India’s stock broking industry, the year 2023 has been a pivotal chapter, witnessing significant shifts in market dynamics and business models. From role of AI to rapid consolidation, the industry is witnessing them all. Read more

When it comes to India, I don’t think there is any foreign investor who does not want to invest in India. China’s recent performance has cooled investor’s enthusiasm, leading them to shift their focus towards India as they are looking for riskier bets but with higher expected returns and political and demographic certainty. Read more

When it comes to India, I don’t think there is any foreign investor who does not want to invest in India. China’s recent performance has cooled investor’s enthusiasm, leading them to shift their focus towards India as they are looking for riskier bets but with higher expected returns and political and demographic certainty.

Read more

While sharing his views on 2024, Trivesh D, COO, Tradejini said, “In 2024, Indian market will experience a period of stability following the general elections. The ruling party is predicted to win, which will then likely lead to a small rally and consolidation in the market for the rest of the year. This stability will provide a positive environment for investors and businesses, promoting growth and development.” Read more

While sharing his views on 2024, Trivesh D, COO, Tradejini said, “In 2024, Indian market will experience a period of stability following the general elections. The ruling party is predicted to win, which will then likely lead to a small rally and consolidation in the market for the rest of the year. This stability will provide a positive environment for investors and businesses, promoting growth and development.” Read more

Trivesh D, COO, Tradejini Let’s take the example of a 25-30-year-old working professional. The first thing they need to do is have an objective plan. Divide your objectives into short-, medium-, and long-term goals. Don’t aim for millionaire status by next month. Start small and specific. Small wins will definitely keep you motivated. Read more

Trivesh D, COO, Tradejini Let’s take the example of a 25-30-year-old working professional. The first thing they need to do is have an objective plan. Divide your objectives into short-, medium-, and long-term goals. Don’t aim for millionaire status by next month. Start small and specific. Small wins will definitely keep you motivated.

Read more

With the evolution of regulations, shorter settlement time for trades and requirement ofupfront margin, no broker would provide their clients the option of linking their tradingaccount with a separate demat account opened elsewhere. Operationally, this will turn outto be a nightmare for brokers if clients began to demand this, said Trivesh D, COO atTradeJini. Read more

With the evolution of regulations, shorter settlement time for trades and requirement ofupfront margin, no broker would provide their clients the option of linking their tradingaccount with a separate demat account opened elsewhere. Operationally, this will turn outto be a nightmare for brokers if clients began to demand this, said Trivesh D, COO atTradeJini. Read more

Revamps website with industry-first features to optimize functionality. In its endeavor to offer customers a seamless and efficient trading experience, Tradejini, a new age, tech-driven discount broking firm, has launched its flagship trading platform CubePlus, an innovative trading platform known for its industry-first features. Read more

Revamps website with industry-first features to optimize functionality. In its endeavor to offer customers a seamless and efficient trading experience, Tradejini, a new age, tech-driven discount broking firm, has launched its flagship trading platform CubePlus, an innovative trading platform known for its industry-first features. Read more

In this video, we discussed the current scenario of stock brokers, technical glitches, and the future of the brokerage industry with Trivesh, COO of Tradejini, a stockbroker with over 10 years of experience in the industry. Read more

In this video, we discussed the current scenario of stock brokers, technical glitches, and the future of the brokerage industry with Trivesh, COO of Tradejini, a stockbroker with over 10 years of experience in the industry. Read more

“While small corrections in the markets may be expected if the official release surpasses the 6 per cent mark, it is important to note that retail confidence in corporate India has been on the rise over the past 12-18 months. The pressure of FPI selloffs has diminished, and the Indian equity markets are presently enjoying a positive outlook, with both benchmark indices achieving unprecedented highs in November 2023,” Trivesh said. Read more

“While small corrections in the markets may be expected if the official release surpasses the 6 per cent mark, it is important to note that retail confidence in corporate India has been on the rise over the past 12-18 months. The pressure of FPI selloffs has diminished, and the Indian equity markets are presently enjoying a positive outlook, with both benchmark indices achieving unprecedented highs in November 2023,” Trivesh said. Read more

“The Fed’s resolute commitment to maintaining record-high interest rates, a strategy to combat inflation, is expected to persist, with no imminent plans for a reduction. This decision, while unlikely to trigger significant repercussions in the Indian stock market, underscores the fact that market participants have already factored in the effects of these unprecedented interest rates and the recent election dynamics,” said Trivesh. Read more

“The Fed’s resolute commitment to maintaining record-high interest rates, a strategy to combat inflation, is expected to persist, with no imminent plans for a reduction. This decision, while unlikely to trigger significant repercussions in the Indian stock market, underscores the fact that market participants have already factored in the effects of these unprecedented interest rates and the recent election dynamics,” said Trivesh. Read more

“It is anticipated that the MPC’s decision will have limited impact on the market, given that the effects of previous policy actions have already been factored in. Additionally, the recent positive push in the markets due to election results has propelled them to record highs,” said Trivesh D, COO, Tradejini.

Read more

“It is anticipated that the MPC’s decision will have limited impact on the market, given that the effects of previous policy actions have already been factored in. Additionally, the recent positive push in the markets due to election results has propelled them to record highs,” said Trivesh D, COO, Tradejini. Read more

“Historically, November has been among the most prosperous for the Nifty 50 and the overall Indian stock market,” said Trivesh D, COO Tradejini. “Current factors like strong corporate earnings, lower inflation, improved GDP numbers, strong private and government capex, and positive global cues could propel the market to new heights, with the election results acting as a potential immediate trigger.” Read more

“Historically, November has been among the most prosperous for the Nifty 50 and the overall Indian stock market,” said Trivesh D, COO Tradejini. “Current factors like strong corporate earnings, lower inflation, improved GDP numbers, strong private and government capex, and positive global cues could propel the market to new heights, with the election results acting as a potential immediate trigger.” Read more

The current market is experiencing dynamism, which be attributed to positive political developments in India influencing the stock market, easing tensions in the Israel-Hamas conflict, reduced recession indicators in the US, and a rebound Indian Rupee, said Trivesh D, COO, Tradejini. Read more

The current market is experiencing dynamism, which be attributed to positive political developments in India influencing the stock market, easing tensions in the Israel-Hamas conflict, reduced recession indicators in the US, and a rebound Indian Rupee, said Trivesh D, COO, Tradejini. Read more

Fueling this IPO frenzy is a remarkable surge in retail investor engagement, empowered by seamless access to online trading platforms and an escalating understanding of the stock market. Inflated grey market premiums create a buzz, enticing investors to actively participate in the IPO bonanza, said Trivesh D, COO, Tradejini. Read more