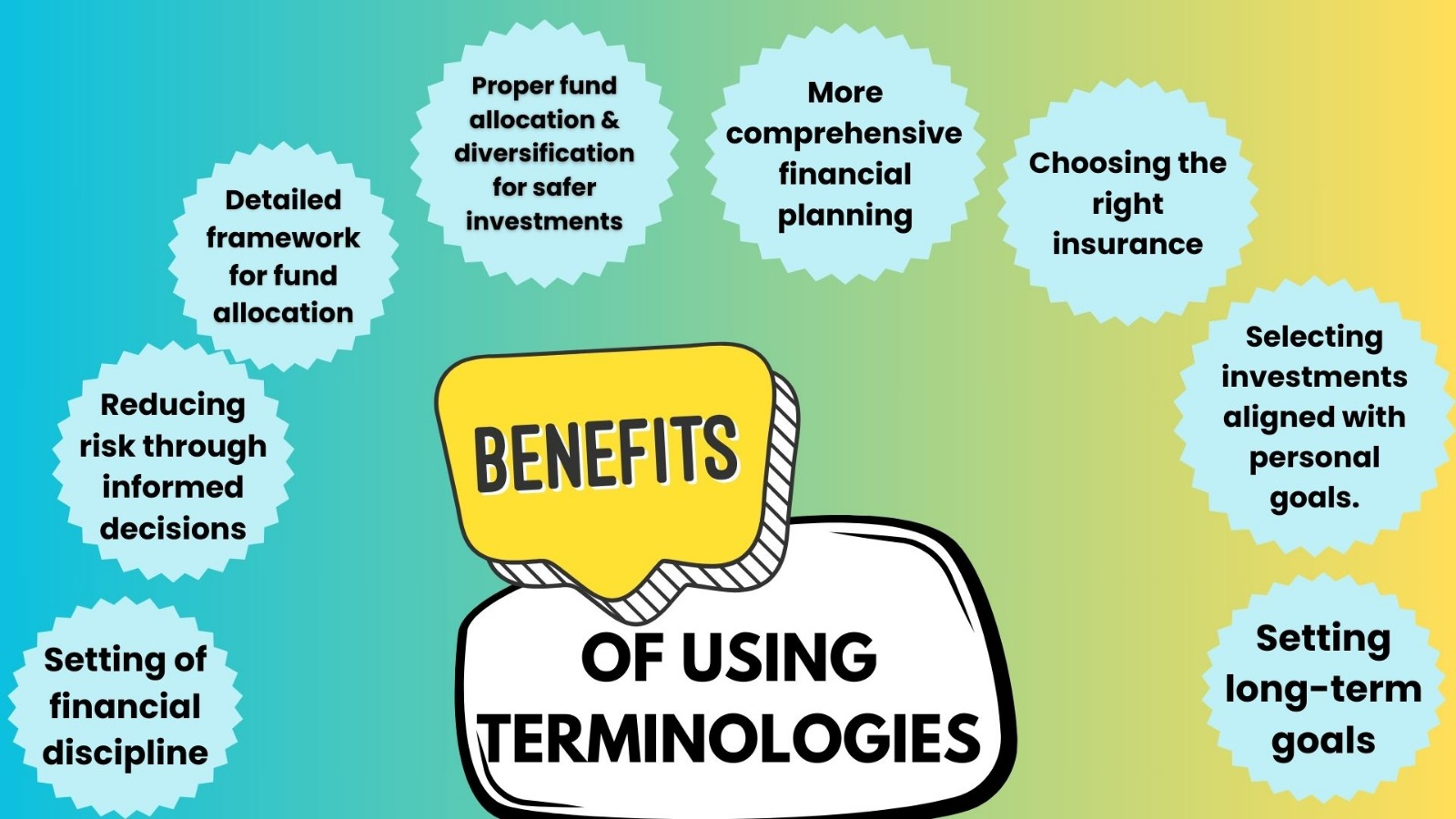

Financial literacy starts with the basics, grasping the various terminologies that are used for a proper understanding of how to go about your financial planning.

These 30 terms are essential to understand if you work in the finance industry

1) Personal Finance- Personal finance is a broad scope that covers an individual's savings, expenses, and investments.

2) Demat Accounts- It stands for Dematerialized Account, which helps investors hold investments digitally. Assets such as shares, mutual funds, and bonds can be held electronically instead of a physical copy.

3) Depository Participant- It is a financial institution that acts as a middleman between an investor and a depository. These participants hold ownership records for financial securities.

4) CDSL- Central Depository Services Limited is one of the two depository participants in India.

5) NSDL- National Securities Depository Limited is another depository participant in India.

6) Asset- An asset is a resource that is purchased with the aspiration of giving financial returns.

7) Liability- Liability is anything that reduces in financial value or something that a company owes.

8) NSE- National Stock Exchange, is a leading stock exchange in India and it’s biggest.

9) NIFTY 50- It is the benchmark index of the NSE, which consists of the top 50 traded stocks by market capitalization.

10) BSE- Bombay Stock Exchange is India’s oldest and second-largest stock exchange.

11) SENSEX- It is the benchmark index of the BSE, which consists of the top 30 established large-cap companies.

12) Stock- A stock is a financial asset representing partial ownership in a company, also known as equity. Each stock unit, known as a share, gives the holder a proportional claim on the company’s assets and profits.

13) The net assets of the company are its book value- To put it another way, it is the stock that the investors own.

14) Face value- The face value of a share is the initial value of it when it was first issued by a company to its shareholders.

15) Future value- It is the expected value of an asset based on an assumed growth rate.

16) P/E ratio- Also known as Price- to- price-to-earnings ratio, is the value of a company's share price to its earnings per share.

17) ROE AND ROCE- Return On Equity is a ratio of a company’s net income to the total shareholder's equity which is used as a measure of profitability. Return On Capital Employed is a ratio of earnings before interest and tax by capital employed, which is used to measure the capital efficiency of a company.

18) IPO- Initial Public Offering is when a private limited company offers its share for sale to the public for the first time. Post-IPO it is known as a Public Limited Company.

19) FPO- It stands for Follow-on Public Offer. This is done when an already listed company issues new shares to the public to raise further capital.

20) Bonds - Bonds are debt securities that people can invest in. Essentially, investments are lending money to a company or a government at a fixed interest rate for a certain amount of time. Owners of these bonds are also known as debtholders.

21) Capital Gains- Capital Gains are the increase in the value of an asset in comparison to its purchase price. The increase in the value invested in a stock is known as capital gains. It is an unrealized gain.

22) Capital Gains Tax- It is a tax paid after selling off an asset. The amount that is taxed is the increase in value of the asset compared to its original price.

23) Dividends- Dividends are essentially the distribution of excess profits among shareholders.

24) Dividend yield- It is a ratio of a company's annual dividend per share to the current price of the share.

25) Stock Split - A stock split is when a company decides to increase its total number of outstanding shares but not the overall value of the company. This is usually done to increase the liquidity of the company.

26) Bonus Shares- A bonus share is a fully paid-up share that is offered to existing shareholders free of charge. Typically, businesses with accumulated earnings but little liquidity issue these.

27) Credit Score- Also known as a CIBIL score in India, is a three-digit score that ranges from 300 to 900, which is the culmination of an individual's credit borrowing history. A higher score helps get faster loans at better interest rates.

28) Mutual Funds- Mutual funds are a basket of many investor’s funds that will be handled by a fund manager, who then diversifies the investments for a safe and stable return. Investing in mutual funds provides investors access to professionally managed funds.

29) REIT- It stands for Real Estate Investment Funds. SEBI introduced them in 2007. This is a financial instrument that permits investors to invest in real estate without directly owning it.

30) SIPs- Systematic Investment Plans—enable investors to invest a pre-decided amount at regular intervals in stocks and mutual funds. SIPs help create long-term wealth and impart financial discipline.

Conclusion

Trading, investing, saving, and meeting your financial goals have never been easier. Thanks to digitalization, access to financial knowledge is innumerable. Making informed decisions helps one achieve their financial goals efficiently while minimizing their risk. We hope that this article nudges you in the right direction.