In September 2022 a notice received by Gameskraft, operator of Rummy Culture required them to pay GST of ₹20,989 crore.

This included the skill based real money gaming sector similar to “betting and gambling” requiring 28% GST to be charged on the full value of the bet instead of on the platform fee charged by the operator.

The company, based out of Bangalore had filed a petition in the Karnataka High Court. The high court subsequently quashed the Directorate General of GST Intelligence's order in May 2023.

This brought the GST Council into the issue and it decided in July 2023 to levy 28% tax on skill-based gaming at full value removing the distinction in GST between “games of skill” and “games of chance”.

A game of skill is when a player invests his/her time in learning, practising and refining his skill to perform in a particular game. The Supreme Court noted that games of skill would be where:

- Success depends principally upon the superior knowledge, training, attention, experience and adroitness of the player and game of skill to have a predominance of skill factor.

- The principal legislation governing gambling in India is the Public Gambling Act, 1867 (“PGA”) creates an important exception in favour of games of skill, provisions of the PGA shall [not] be held to apply to any ‘game of mere skill’ wherever played. (Source: Dream 11 website)

The centre also filed a special leave petition against the favourable order received by Gameskraft in the Supreme Court, who set that order aside.

In the month of September 2023, the Directorate General of GST Intelligence sent across notices of over ₹ 55,000 crores to the real-money gaming companies including ₹ 25,000 crore to fantasy sports platform Dream 11.

One of the largest notices in Indian indirect tax history. These notices were for the period July 2017 to March 2022, final date to issue a show cause notice for the period July 2017 to March 2018 was. 30 September 2023

What was the recent update by the GST Council and state wise opinion?

The Finance Ministry had notified that October 1 be the appointed date for implementation of these provisions where casinos and online skill based real money gaming to be considered similar to betting and gambling as “actionable claims”.

Despite states like Goa and Sikkim (where casinos provide tax revenue and employment) asking for the levy not to be on the bet value but Gross Gaming Revenue i.e., the platform/operator fee charged and Delhi opposing the levy of the online gaming tax.

On August 2, it had recommended that GST be levied on buy-ins instead of every bet placed, in order to avoid double taxation.

How will the effects of the GST Council decisions impact the listed players?

The two major publicly listed companies in the casinos and online gaming space are Nazara Technologies run by Nitish Mittersain which counts Rakesh Jhunjunwala family and Nikhil Kamath family as investors.

The second is casino operator Delta Corp run by Jaydev Mody, son-in law of former Attorney General of India Soli Sorabjee.

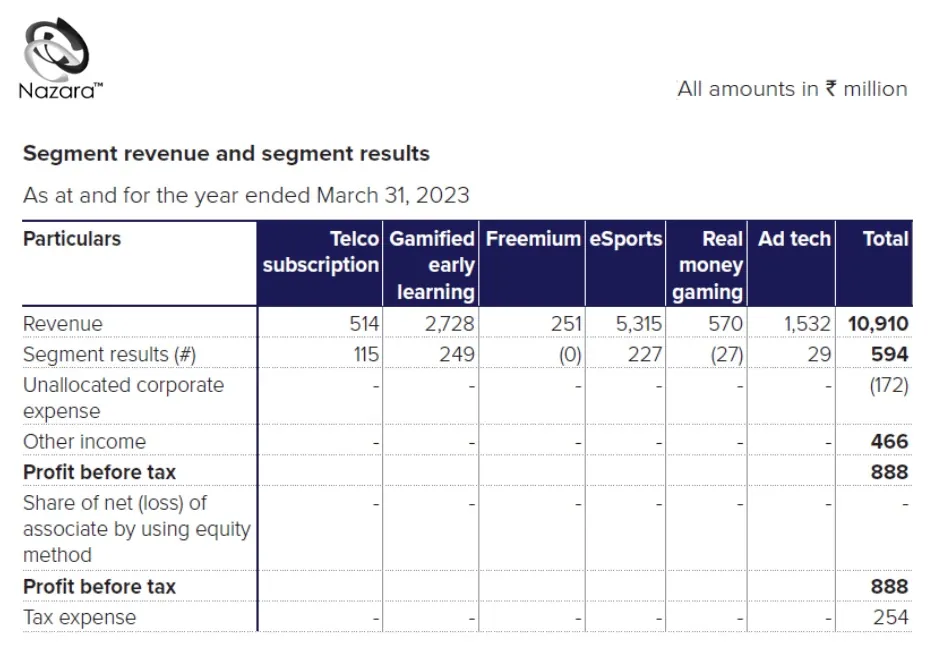

Nazara Technologies stated in July in a note to stock exchanges that skill based real-money gaming which is affected by the decision represents 5.2% of overall consolidated revenue.

This also represents (3.3%)of profit before tax and the company is taking steps to ensure minimum impact on overall revenues (Refer Segment Report below)

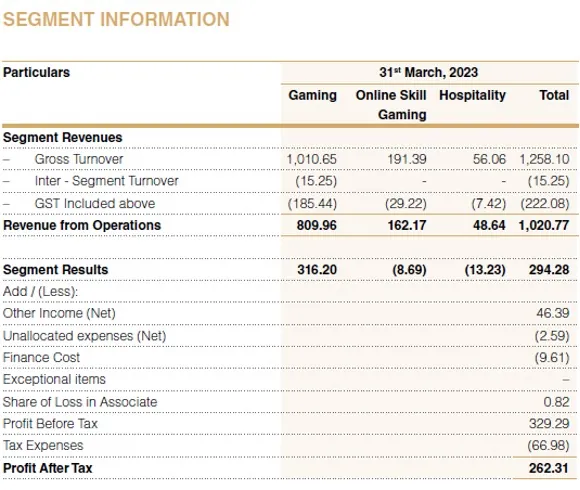

Delta Corp the casino operator, has been more heavily affected. On the 22nd of September, they received GST Notices for ₹16,800 crores for the period July 2017 to March 2022.

This is significant to the company, at the time of writing this, their market capitalization is ₹3,821 crore.

Delta Corp (as seen in the segment report) derives 95.2% of their revenue from casino gaming and online skill gaming i.e., real money and 93.4% of their profit before tax.

The notices will be a significant risk for the future of the company and the casino industry.

While the two states where the company has their casino presence (Goa and Sikkim) seem to be in support of the industry whether they can make changes nationally remain to be seen.

What do you need to watch for?

The hearings in the Gameskraft case are to continue in the Supreme Court.

Investors will need to pay attention to the outcome of this case, being in the Supreme Court it will surely be used as a precedent.

How can the result of the case affect the companies?

The government maintains that the amendment was a clarification to the law not a change in the law, therefore the notices are not retrospective taxation.

Considering their quantum of total revenue and profit coming from real-money gaming, Nazara is unlikely to be significantly affected.

For Delta considering that majority of their revenue and profit stems from Casinos and not online gaming, it is likely that even a favourable decision may not stop their exposure to significant litigation. Without intervention from the state govts e.g. Goa and Sikkim at the centre to grant the casinos relief.

Barring that, it will be in a difficult position financially.