Exchange-level trailing stop-loss orders can be used on CubePlus by Tradejini, which directly places your order in the exchange. Unlike other brokers where the order is held in their system, Tradejini's approach allows for better and faster execution. This direct placement at the exchange ensures that your trailing stop-loss orders are executed promptly, enhancing your ability to manage trades effectively and capitalize on market movements swiftly.

Why Use Trailing Stop-Loss Orders?

Trailing stop-loss orders are a powerful tool for traders and investors who want to maximize their gains while minimizing their losses. Unlike a regular stop-loss order, a trailing stop-loss automatically adjusts itself as the price of a security moves in favor of the trade. This feature allows traders to lock in profits and protect against downside risk, ensuring that they can benefit from favorable price movements without constantly monitoring their positions.

How Do Trailing Stop-Loss Orders Work?

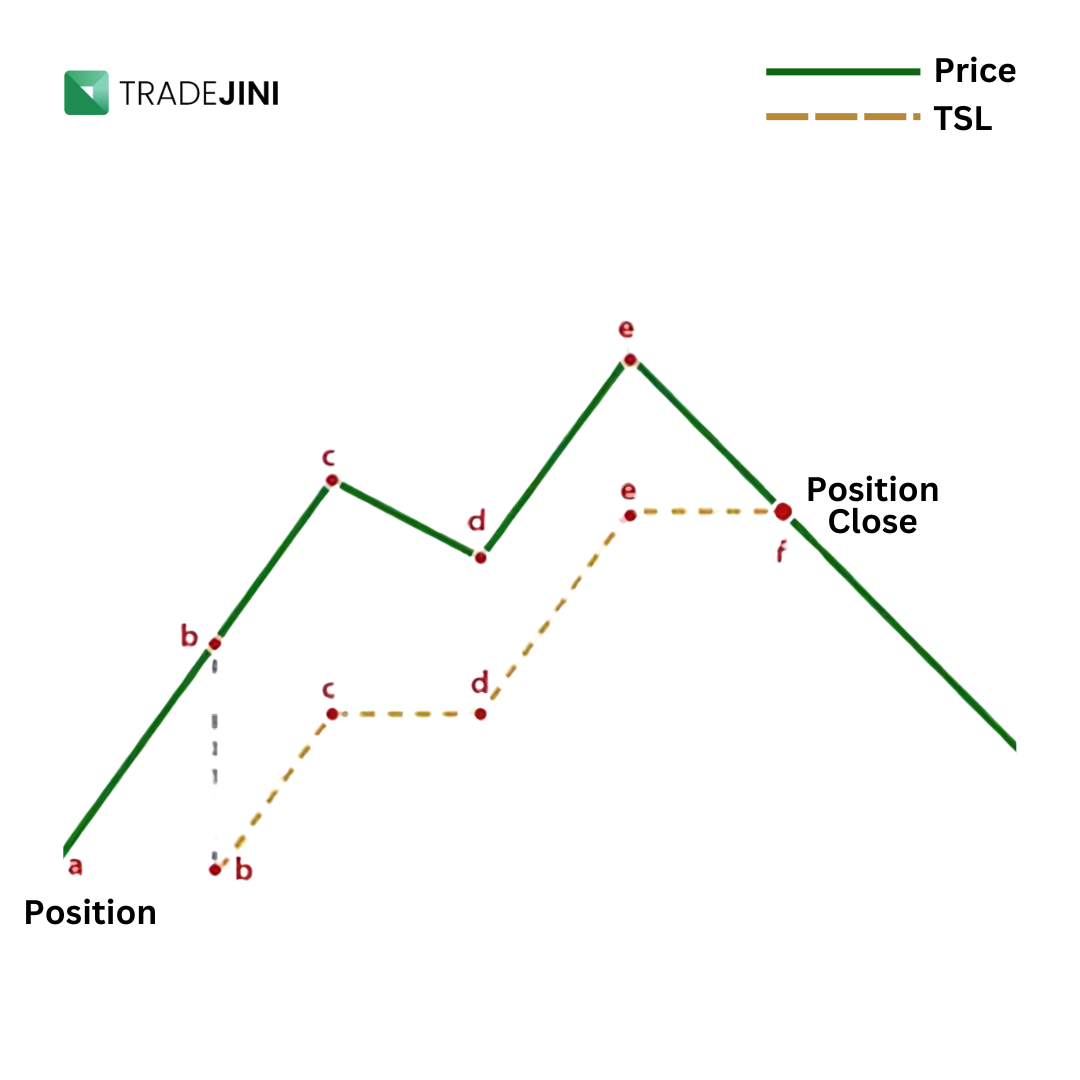

A trailing stop-loss order sets the stop price at a fixed amount or points below the market price for a long position (or above the market price for a

short position). As the market price moves in a favorable direction, the stop price moves accordingly, maintaining the set distance. However, if the market price changes direction, the stop price remains at its last level, providing a cushion to protect profits.

For instance, if you set a trailing stop-loss with a trail of 2 points for a stock currently trading at ₹100, the stop price would initially be set at ₹98. If the stock price rises to ₹110, the stop price would adjust to ₹108, maintaining the 2-point trail. If the stock then drops to ₹109, the stop price remains at ₹108, potentially triggering the order if the price continues to fall.

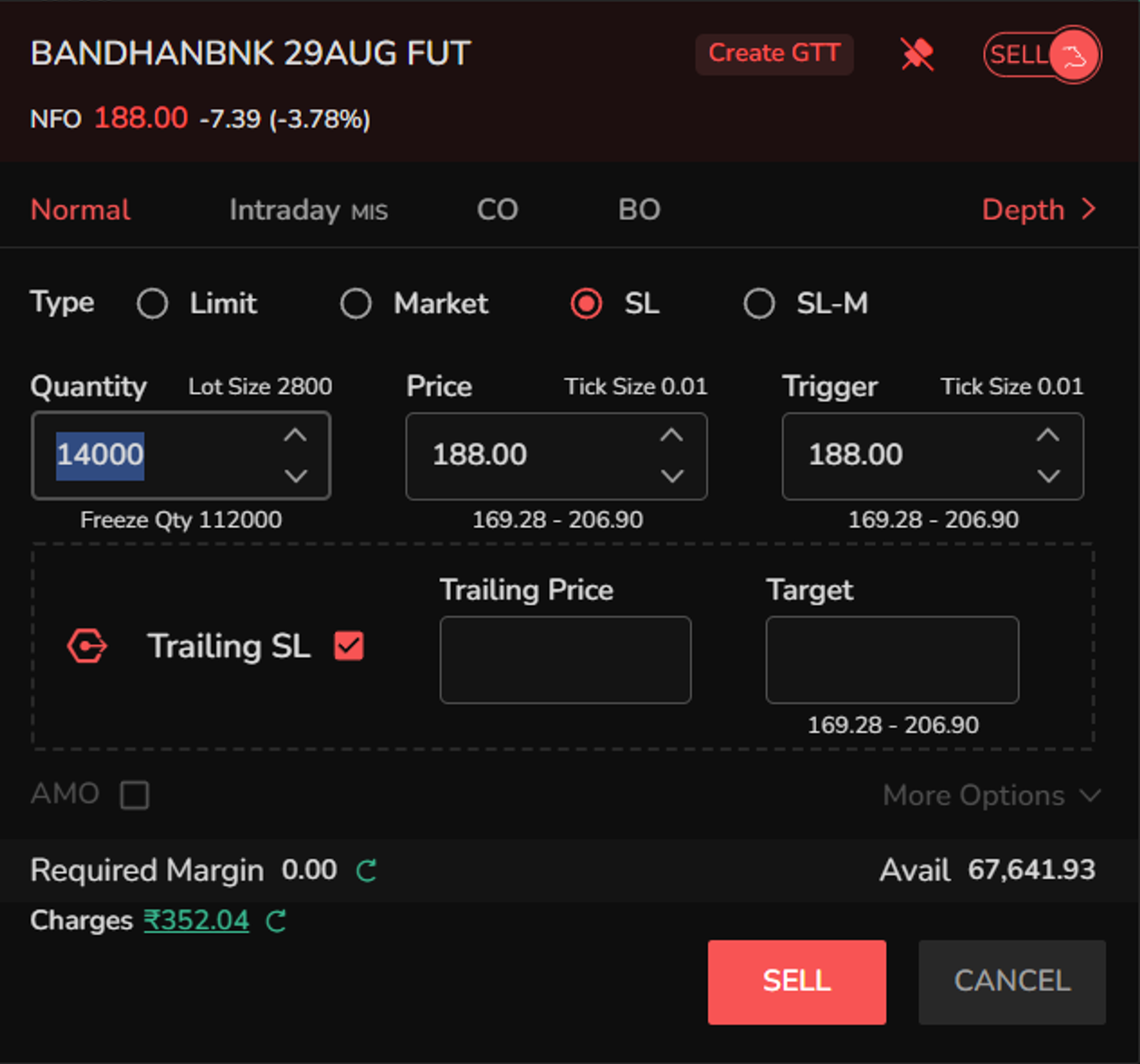

Key Components of Trailing Stop-Loss Orders

- Price: The current market price of the security. This is the baseline from which the trailing stop-loss is calculated. For example, if a stock is trading at ₹100, this is the price used to determine the trailing stop price.

- Trailing Price: This is the stop price that trails the market price by a fixed amount of points. For instance, if the trailing price is set to trail by 2 points, and the stock is currently at ₹100, the trailing price will be ₹98. As the stock price increases, the trailing price adjusts upward by maintaining the 2-point distance.

- Target: This is the price level at which you aim to sell the security for profit. While not directly related to the trailing stop-loss, setting a target helps in planning your exit strategy. For example, if you bought a stock at ₹100 and set a target of ₹120, you're planning to sell when the stock reaches ₹120.

- Trigger Price: This is the specific price point that activates the trailing stop-loss order. In the case of a trailing stop-loss, the trigger price is dynamically set based on the trailing points. For example, if the stock price reaches ₹110 and your trailing stop-loss is set at 2 points, the trigger price will be ₹108. If the stock falls to this trigger price, the stop-loss order is executed.

Also Read: Long and Short Positions in Trading - Definition, Risks & Advantages