Hey there, fellow investors and market enthusiasts! Today, we're diving into the exciting world of sector analysis, where we'll help you uncover some hidden gems and potential opportunities. Whether you're a seasoned trader or just dipping your toes into the stock market, this article will be your guide to understanding which sectors are outperforming or underperforming the Nifty 50 Index.

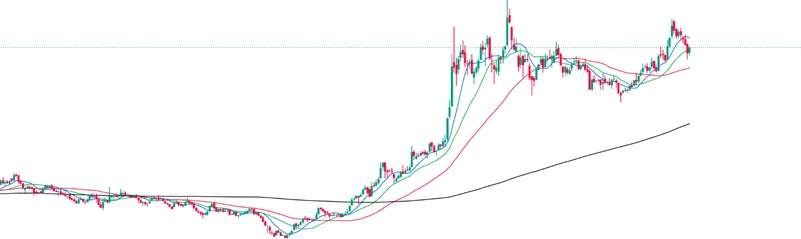

In our pursuit of understanding the stock market's dynamics, we've employed Relative Strength (RS) with Weekly Time Frame, and the Moving Average Ribbon (comprising the 9, 20, 50, and 200 periods) to provide a comprehensive sectoral analysis. By combining these tools, we've successfully found stocks in various sectors displaying distinct trends - be it an upward trajectory, a sideways movement, or a downward trend.

Important Note:

Before we share our findings, it's important to know that our analysis is only for learning purposes. The stocks we talk about are just examples and not suggestions for you to invest in. Remember, “Investing in stocks is risky, and you should do more research or talk to experts before making any investment choices.”

1.Finding the Stars: Sectors Beating the Nifty 50 Index

Ever wondered which sectors are leaving the Nifty 50 Index in the dust? We did the legwork and found the top-performing sectors that are shining brighter than the rest. Auto and Energy Sectors are out performing Nifty 50 index.

The Outperformers within the Outperformers

“The securities are quoted as an example and not as a recommendation”

Within the Auto and Energy sectors, there are stocks that are making even more noise. We'll try to reveal which stocks within those sectors are outperforming their very own sector index.

Auto Sector:

“The securities are quoted as an example and not as a recommendation”

The Auto Index has been doing better than the Nifty 50 Index since June 2022. It's pretty clear that the trend of the Auto Index is very positive, with a pattern of making higher highs and higher lows. The prices are finding support at the 9-day Simple Moving Average (SMA), and all the moving averages are pointing upwards. This suggests that the stocks in this index are in a strong upward trend on a weekly basis.

1. TVS Motor:

Energy Sector:

“The securities are quoted as an example and not as a recommendation”

The Energy Index has been doing better than the Nifty 50 Index since October 2023. We notice that the Price has broken out of the 200 Simple Moving Average (SMA), and all the moving averages are below the price, which can act as a support.

Now, let's take a closer look at the stocks that are performing well and those that aren't within the Energy Index.

1. TATAPOWER:

2. NTPC:

3. ONGC:

2.The Underperformers within the Outperformers

“The securities are quoted as an example and not as a recommendation”

But wait, there's more! Even in the sectors that are beating the Nifty 50 Index, there are stocks that are not keeping pace with their sector index. We'll identify these underperformers so you can make informed decisions.

Underperforming stocks in the Sector Auto Industry

“The securities are quoted as an example and not as a recommendation”

1. Bosch:

2. Ashokley:

3. Eichermoter:

Energy Industry:

“The securities are quoted as an example and not as a recommendation”

1. ADANI GREEN:

2. BPCL:

3. HINDPETRO:

3. Unearthing Potential in Underperforming Sectors

Now, let's turn the spotlight on the underperforming sectors IT and Finance. You might be surprised by what lies ahead! We'll show you which stocks in these underperforming sectors are bucking the trend and outperforming their sector index.

IT Sector:

The securities are quoted as an example and not as a recommendation”

The IT Index has not been performing as well as the Nifty 50 Index since August 2022. You can observe that the price has fallen below the 200-day Simple Moving Average (SMA), and all the other moving averages are jumbled up below the 200-day SMA. This suggests that the price trend is either bearish or moving sideways in a bearish manner.

1. Persistent:

2. HCL:

3. COFORGE:

Finance Sector:

“The securities are quoted as an example and not as a recommendation”

The Finance Index has not been doing as well as the Nifty 50 Index since November 2021. We can observe that the price has fallen below the 200-day Simple Moving Average (SMA), and all the other moving averages are positioned above the price but below the 200-day SMA. This indicates that the price is facing a lot of resistance when trying to go up.

1. RECLTD:

2. PFC:

3. CHOLAFIN:

4. Identifying the Laggards in Underperforming Sectors

Not all is lost in underperforming sectors, and not all stocks are winners. We'll pinpoint those stocks that are underperforming even within these underperforming sectors.

IT Sector:

“The securities are quoted as an example and not as a recommendation”

1. TechM:

2. WIPRO:

3. INFY:

Finance Sector:

“The securities are quoted as an example and not as a recommendation”

1. PEL:

2. ICICIPRULI:

3. SBICARD:

6. Putting it All Together

This analysis gives you a good idea of what's happening in the market right now. It can help you start looking at specific stocks in your chosen sectors. We suggest doing your research and talking to experts before you decide to invest.

Using RS, the weekly timeframe, and Moving Averages with different numbers can help you understand the stock market trends better. We hope this information makes it easier for you to learn about the financial markets.

By the end of this article, you'll have a clear picture of which sectors are soaring, which stocks within those sectors are the real champions, and which sectors may have hidden potential.

So, if you're looking forward to reading more such content, stay tuned for our upcoming articles where we'll delve into each of these sectors, providing you with insights and easy-to-understand analysis.

Remember, successful investing doesn't require fancy words or complicated jargon. It's all about understanding the basics, doing your research, and having the right tools at your disposal.

Stay tuned for more sector analysis insights, and happy investing! 🚀 #StockMarket #SectorAnalysis #Investing #Nifty50 #Stocks #InvestmentStrategy

“The securities are quoted as an example and not as a recommendation”

FAQ

A. Automobile Sector:

1. What is the Sector Index?

Nifty Sector Index is an index that represents companies from the automobile sector in India, including the ones that are engaged in the manufacturing and distribution of automobiles and related components.

2. How are stocks chosen for the Nifty Auto index?

- Stocks for Nifty Auto are selected based on various factors like market cap, liquidity, and sector representation, thereby including several publicly traded companies operating in the automotive industry.

3. How is the Nifty Auto index calculated?

- The value of the Nifty Auto index is calculated by multiplying stock prices and the number of shares available for trading. This is known as the free float market cap-weighted method.

4. What factors can impact performance of the Nifty Auto index?

- Automobile and related component sales depend on a variety of factors like consumer demand, input costs, raw material prices, regulatory changes, and economic indicators.

B. Energy Sector

1. What is the Nifty Energy index?

- Nifty Energy is an index that represents Indian companies involved in oil exploration, refining, marketing, and other energy-related domains.

2. How are stocks chosen for the Nifty Energy index?

- Nifty Energy stocks are based on sector fit, market capitalization, and liquidity, thereby consisting of several companies operating in the Indian energy industry.

3. How is the Nifty Energy index calculated?

- NSE calculates the value of the Nifty Energy index based on the free float market cap weighted method. The method involves multiplying the stock prices and the number of shares available for trading.

4. How to use the Nifty Energy index for investing purposes?

- Tracking the Nifty Energy index can help you as an investor to monitor the energy sector, monitor oil prices, and assess investment opportunities within this industry.

5. What factors can impact performance of the Nifty Energy index?

- The energy sector and the companies in the Nifty Energy index have been known to be affected by crude oil prices, geopolitical events, government policies, energy consumption patterns, and global energy trends.