If you are new to the whole system of buying and selling futures and options, understanding the concept of lot size is crucial as it plays an important role in determining the number of contracts to trade and risk management for the same.

This blog aims to provide a comprehensive overview of what lot size signifies in options trading, specifically focusing on the lot size of futures and options (F&O) stocks. Let's delve into the details to demystify the significance of lot size in the trading landscape.

What is Lot Size in Options Trading?

Before we get into the definition of lot size, let us first understand it in simple terms, with the help of an example, shall we?

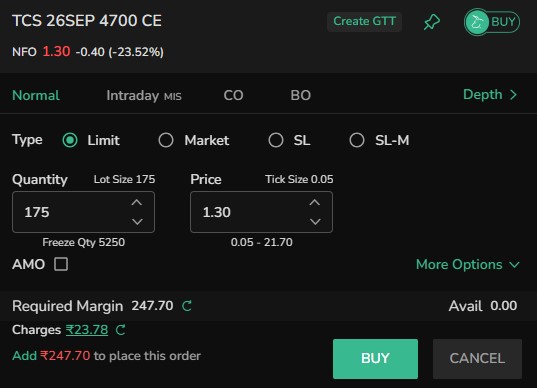

Company: Tata Consultancy Services (TCS)

The TCS stock option on the National Stock Exchange of India (NSE) has a lot size of 175 shares per contract. This means that one option contract for TCS covers 175 shares of the company's stock.

Definition of Lot Size:

As mentioned in the example, lot size in options trading refers to the standardised quantity of shares that can be traded. Lot size provides clarity on the minimum number of shares that can be bought or sold. Understanding lot size is essential for investors to effectively manage their trading positions and capital allocation.

The lot size for a security is set by the regulatory body to maintain uniformity and efficiency in trading activities, particularly in the derivatives market. If the regulator perceives that a retail investor should not participate in a particular security, they will fix a higher lot size for such securities as it will require a higher investment amount.

Also Learn: Rollover Futures Contracts: Steps, Risks, and Market Impact

Significance of Lot Size in F&O Stocks

- Standardisation: Lot size is essential because it puts a standard quantity to trading units for F&O stocks so that there is uniformity and consistency in the derivatives market. This way, the whole system of the stock exchange maintains fair trading practices for the market participants.

- Risk Management: One of the key reasons why the system of lot size exists is to mitigate and manage risks for investors who are trading stocks. Due to the standardised practices, one can keep a check on market fluctuations and avoid potential losses.

- Capital Efficiency: Lot size helps traders optimise their capital allocation by specifying the number of contracts required to establish a position. This enables traders to manage their funds effectively and make informed decisions based on the lot size available for trading.

Understanding Lot Size of F&O Stocks

The lot size of futures and options (F&O) stocks varies depending on the underlying security and the rules set by the stock exchange. Typically, the lot size for a stock is determined based on factors such as the price of the stock, market liquidity, and trading volume. For instance, a stock with a higher price may have a smaller lot size to accommodate larger contract values.

Conclusion

Lot size is a fundamental aspect of options trading that defines the number of contracts or shares involved in a single trade. Understanding the meaning and significance of lot size, especially in futures and options (F&O) stocks, is essential for investors to navigate the derivatives market effectively. By adhering to lot size regulations, traders can enhance their risk management practices, optimise capital allocation, and make informed decisions when engaging in options trading. Stay informed about the lot sizes of F&O stocks on TradeJini to enhance your trading knowledge and proficiency in the dynamic world of financial markets.

Also Read: Gap Trading Strategy: Understanding Gap Up and Gap Down