Introduction to fundamental and technical analysis of stock buying or selling stock should always be preceded by at least some or other form of rational analysis that is backed by data. This ensures that the investor or trader has done some groundwork before taking the buy/sell decision and is not just throwing darts in the dark.

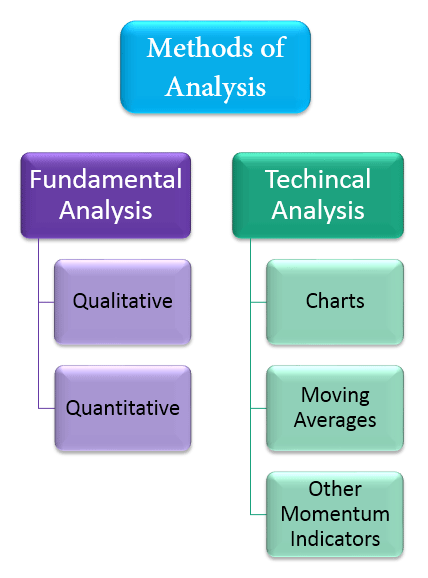

At a very broad level, there are two disciplines of doing the stock analysis:

- Fundamental Analysis of stock

- Technical Analysis of stock

Both are very different from each other and attract market participants of different financial profiles and time horizons.

Fundamental Analysis of stock-

This analysis requires an evaluation of a company’s business by analyzing its qualitative and quantitative parameters.

- Qualitative parameters involve rational analysis and earnings projection by analyzing key financial indicators. For this, analysts delve deep into a company’s past years balance sheets, income statement, cash flow statements, and disclosures.

- Quantitative parameters, on the other hand, require analyzing other non-financial aspects of the company like management quality, corporate governance, treatment of minority shareholders, general business practices and competitive strategy, etc.

Within fundamental analysis, investors can choose to adopt either of the following two styles:

- Top-down Approach – Starts with an analysis of broader economic levels. It then identifies key sectors that will benefit in the current economic and business environment. This is followed by the identification of the best companies within the sector for actual investment.

- Bottom-up Approach – This approach follows a reverse path where analysts start with a company and analyze qualitatively and quantitatively factors, before moving up to analyze broader variables like industry and economy.

Technical Analysis of stock

Followers of technical analysis believe that the price of stock contains all the required information and hence, there is no need to do a deeper fundamental analysis of the company’s business. This way of analysis is based on the concept that market action discounts everything.

According to technical analysis, the trends in price and volume of shares tend to repeat over time, as investors as a group respond in similar behavior patterns. So by looking at the price and volume trends, traders through technical analysis try to figure out – how the stock’s prices will move in future.

For this kind of analysis, technical analysts make use of

- Charts (depicting price and volume trends),

- Moving averages (simple or exponential) and

- Other momentum indicators (used to support/vet the conclusions made using charts, moving averages, etc.).

Extensive backtesting of historical price and volume data is carried out to test investment strategies based on technical parameters.

Technical analysis is generally short-term in nature. It is usually practiced by traders and is used on very small periods ranging from hours to even weeks. This is in stark contrast to fundamental analysis that uses data spanning several years to arrive at conclusions.

So now if your question is that which the better approach is, then there is no clear answer here. The primary goals of both are same – earn higher returns. But both approaches take very different routes to achieve the same. Individuals opting for fundamental analysis don’t give much weight to technical indicators and those of technical analysis don’t have much interest in fundamental factors.

Check out: How To Use ADX Indicator For Day Trading on our blog.

So, at the end of the day, the choice of method depends a lot on the available time horizon, investor or trader’s own interest area and several other factors. It is not wise to write-off one method for the sake of others.