India is witnessing a transformative phase in its economic landscape, marked by a significant surge in consumption across both household and industrial sectors. This robust growth in consumption is not just a statistical uptick but a fundamental shift that is propelling the nation's economy to new heights and invigorating its equity markets. Understanding the nuances of this consumption boom reveals how deeply it is intertwined with India's economic prosperity and the implications it holds for the future.

A Dual Engine: Household and Industrial Consumption

The Indian economy's acceleration is powered by a dual engine of growth: household consumption and industrial demand. Both are experiencing unprecedented increases, fueling each other in a synergistic loop.

Household Consumption is The Rising Tide

Household consumption in India has been on an upward trajectory, driven by several interrelated factors that are reshaping the nation's economic landscape. A significant contributor to this trend is the rising income levels and the expansion of the middle class.

According to a report by the World Economic Forum, India's middle class is expected to reach 500 million people by 2025. This projection stems from consistent economic growth since the early 2000s, which has lifted millions out of poverty and increased disposable incomes. The burgeoning middle class, benefiting from improved education and employment opportunities, possesses greater spending power. This increase in disposable income leads to heightened demand for goods and services ranging from essential commodities to luxury items, thereby significantly boosting overall consumption.

Urbanization further amplifies this consumption growth. The United Nations projects that by 2030, 40% of India's population will reside in urban areas. This migration from rural to urban areas has been ongoing for decades but has accelerated in recent years due to better job prospects and living standards in cities.

Urban dwellers typically have higher income levels and greater access to a variety of consumer goods and services. The concentration of population in urban centers enhances overall consumption as city residents spend more on housing, transportation, entertainment, and other amenities. This urban influx also spurs infrastructural development, stimulating economic activity and reinforcing the consumption cycle.

Changing consumer preferences are also playing a pivotal role in driving consumption. Over the past decade, there has been a noticeable shift towards premiumization, with consumers opting for higher-quality products and experiences. The Boston Consulting Group reported in 2017 that Indian consumers are increasingly brand-conscious and willing to pay more for quality, especially in sectors like electronics, fashion, and personal care. This trend is fueled by greater exposure to global lifestyles through media and travel, as well as the desire for social mobility. As a result, companies are innovating and expanding their premium product lines to capture this emerging market segment, further stimulating consumption growth.

The digital revolution has significantly transformed shopping habits in India, contributing to the surge in consumption. The proliferation of smartphones and affordable internet connectivity, particularly after the launch of Reliance Jio in 2016, has made online shopping more accessible to a broader population. E-commerce platforms like Flipkart and Amazon India have capitalized on this trend by offering a convenient and diverse shopping experience.

Collectively, these factors—rising incomes, urbanization, evolving consumer preferences, and digital adoption—create a synergistic effect propelling household consumption to new heights in India. The consistent economic growth since the early 2000s has set the stage for this transformation, with each element reinforcing the others. The expansion of the middle class increases purchasing power, urbanization brings consumers closer to markets and opportunities, changing preferences drive demand for better products, and the digital revolution removes barriers to access. This robust growth in household consumption not only fuels economic expansion but also attracts investment, stimulates innovation, and enhances India's position in the global economy.

Industrial Consumption: Building the Backbone

Industrial consumption is equally pivotal in driving India's economic growth, with several key sectors contributing significantly to this surge. A primary driver is infrastructure development, which has been a focal point of the government in recent years. The launch of the National Infrastructure Pipeline (NIP), announced in 2019, outlines a comprehensive plan to invest over INR 111 lakh crore (approximately USD 1.5 trillion) in infrastructure projects by 2025. This ambitious initiative aims to enhance the country's transportation networks, energy systems, and urban development, leading to increased demand for construction materials like steel and cement.

According to a report by ICRA Limited, India's steel consumption is projected to grow by 9-10% in the fiscal year 2024-25, reaching 106 million tonnes from 97 million tonnes in FY24. This surge is attributed to substantial investments in roads, bridges, and urban development projects, which are integral components of the NIP.

The revival of the automotive sector also plays a crucial role in boosting industrial consumption. After a period of slowdown exacerbated by the COVID-19 pandemic, the automotive industry is experiencing a rebound.

The Society of Indian Automobile Manufacturers (SIAM) reported an upswing in vehicle sales last year in 2023, reflecting renewed consumer confidence and pent-up demand. This resurgence stimulates industrial production as it drives the need for metals like steel and aluminum, as well as components such as engines, transmissions, and electronic systems. The automotive sector's growth not only contributes directly to industrial consumption but also has a multiplier effect on ancillary industries, including tire manufacturing, glass production, and the petrochemical industry for plastics and rubber components.

Moreover, the expansion of renewable energy capacity is a significant factor spurring industrial consumption. India's commitment to increasing its renewable energy capacity to 450 gigawatts (GW) by 2030, as outlined by the Ministry of New and Renewable Energy (MNRE), represents a substantial shift towards sustainable energy sources. This ambitious goal necessitates large-scale production and installation of solar panels, wind turbines, and other renewable energy technologies.

The demand for industrial materials like zinc, copper, silicon, and rare earth elements is rising as these materials are essential components in renewable energy infrastructure. For instance, copper is widely used in electrical wiring and windings, while zinc is crucial for galvanization processes to prevent corrosion in solar and wind installations. The push towards renewable energy not only addresses environmental concerns but also invigorates industrial sectors involved in mining, material processing, and equipment manufacturing.

How growth in consumption can translate into economic growth?

The amplification of consumption across various sectors in India is translating into tangible economic benefits, significantly impacting the nation's economic growth. One of the most direct outcomes is the acceleration of Gross Domestic Product (GDP) growth. Increased consumption boosts production as industries strive to meet the rising demand for goods and services.

This heightened industrial activity contributes directly to GDP expansion. The Reserve Bank of India (RBI) projects that India's real GDP growth will reach 7.2% for the fiscal year 2024-25, underlining the strong performance of the economy. This optimistic projection reflects confidence in the sustained momentum of consumption-led growth and its capacity to drive overall economic prosperity.

Another critical benefit of rising consumption is employment generation. As demand increases, industries are compelled to expand their operations, which necessitates hiring additional workforce. This expansion leads to job creation across various sectors, including manufacturing, services, and retail.

The International Labour Organization notes that India's employment rates are positively impacted by growth in manufacturing and services sectors driven by consumption. Job creation not only reduces unemployment but also enhances household incomes, which in turn fuels further consumption—a virtuous cycle that reinforces economic growth.

Furthermore, the consumption boom is attracting significant investment opportunities, both from domestic and foreign investors. Sectors such as retail, e-commerce, and manufacturing are witnessing substantial capital inflows as investors seek to capitalize on India's expanding market. The Department for Promotion of Industry and Internal Trade (DPIIT) reports robust foreign direct investment (FDI) inflows, indicating strong global investor confidence in India's growth potential. This influx of capital facilitates business expansion, technological advancement, and the development of new products and services, all of which contribute to economic development.

Will the same energize the equity markets?

This positive trajectory in corporate earnings is mirrored in the stock market performance, particularly within indices that track consumer-oriented companies. The Nifty Consumer Durables Index, which comprises major consumer durable goods companies listed on the National Stock Exchange of India, has consistently outperformed broader market indices.

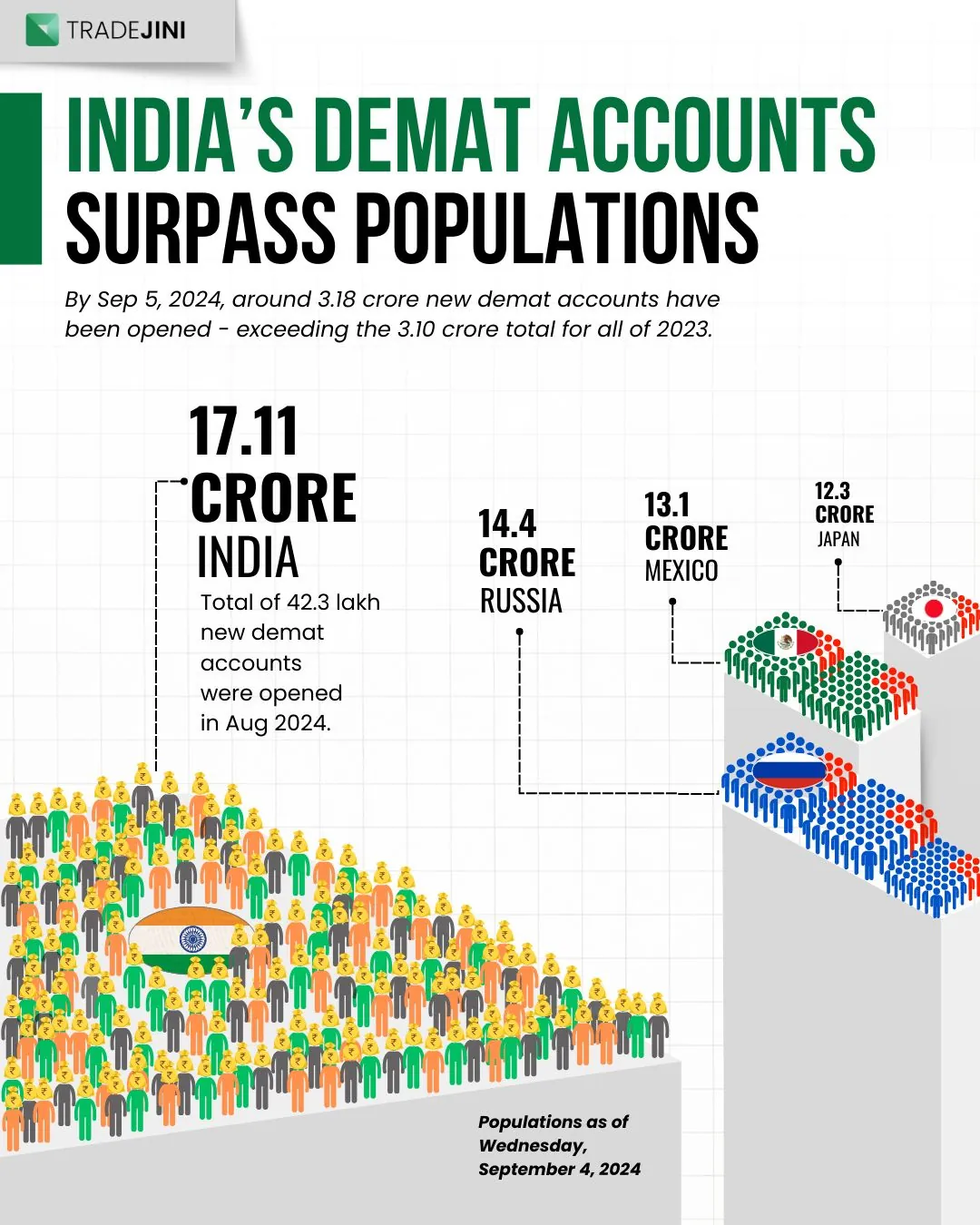

In addition to corporate earnings and stock performance, there has been a noticeable increase in market participation, particularly among retail investors. The Securities and Exchange Board of India (SEBI), which regulates the securities market in India, reports a significant surge in new demat (dematerialized) account openings over the past few years. Between April 2020 and March 2023, the number of demat accounts more than doubled, surpassing 100 million accounts. Now the tally is over 17 crores and increasing. This surge is partly attributed to increased interest in equity investments linked to consumption trends, as retail investors seek to participate in the growth of consumer-focused companies.

The proliferation of online trading platforms and mobile applications has made investing more accessible, while greater financial literacy initiatives have educated potential investors about the benefits of equity participation. The heightened involvement of retail investors adds depth and liquidity to the equity markets, further amplifying the positive effects of consumption-driven growth.

Also Learn: Aditya Birla Group Legacy and Expansion in the Global Arena

Digital Adoption and E-commerce

The digital landscape in India is profoundly reshaping consumption patterns, with technology playing a pivotal role in how consumers engage with markets and make purchasing decisions. One of the most significant developments is the rapid expansion of e-commerce.

According to the Internet and Mobile Association of India (IAMAI), the e-commerce sector has been experiencing a compound annual growth rate (CAGR) of approximately 27% over recent years. This impressive growth is propelled by increasing internet penetration, affordable smartphones, and the convenience that online shopping offers. E-commerce platforms like Flipkart and Amazon India have capitalized on this trend by providing a vast array of products, competitive pricing, and user-friendly interfaces, making online shopping more accessible to a broader population.

Fintech innovations have further accelerated this digital transformation by revolutionizing payment methods and enhancing the overall consumer experience. Digital payment platforms such as Paytm and Google Pay have simplified transactions, offering seamless and secure payment solutions that encourage more online purchases.

These platforms have built consumer trust by ensuring transaction security and convenience, reducing the friction often associated with traditional payment methods. The widespread adoption of digital wallets and Unified Payments Interface (UPI) systems has not only facilitated instant payments but also integrated various financial services into a single platform. This integration has made it easier for consumers to shop online, pay bills, and manage finances, thereby significantly boosting consumption.

Government Policies Fueling Consumption

Government initiatives are playing a crucial role in sustaining and accelerating consumption growth in India by creating a conducive environment for both producers and consumers. One significant area of focus is infrastructure investment, which directly impacts connectivity and accessibility of goods.

Massive investments under programs like Bharatmala Pariyojana, launched in 2017, aim to develop about 83,677 kilometers of highways by 2022. This ambitious project is designed to improve road connectivity across the country, enhancing the efficiency of the logistics network. Improved infrastructure reduces transportation costs and delivery times, making goods more accessible and affordable to consumers nationwide. By facilitating smoother movement of goods, these investments stimulate trade, encourage market expansion, and ultimately boost consumption by ensuring that products reach even the most remote areas.

Overall, this period of transformation offers immense opportunities for businesses, investors, and consumers. By harnessing this momentum and addressing challenges proactively, India can ensure that this growth is inclusive and sustainable, solidifying its status as an economic powerhouse on the global stage.

Also Read: RBI Keeps Repo Rate Unchanged at 6.5% for the Tenth Time: What It Means for Inflation and Growth