During the 2008 global financial crisis, businesses around the world faced a tough situation. Rising costs and reduced consumer spending created enormous pressure, especially in industries like real estate and manufacturing. Borrowing money became more expensive, making it even harder for businesses to stay afloat. Companies struggled to grow, and as a result, stock markets plunged. Investors, fearing large losses, began pulling back their investments, causing further turmoil.

In such situations, central banks step in with a rate cut. For instance, the U.S. Federal Reserve and the Reserve Bank of India both implemented significant rate cuts during past crises, like the 2020 pandemic, to make borrowing cheaper. A rate cut lowers interest rates, allowing businesses and individuals to borrow at lower costs. This, in turn, encourages more spending and investment, helping the economy recover and regain momentum.

Why are global markets expecting interest rate cuts?

Global markets are increasingly focused on the possibility of interest rate cuts, especially as central banks like the U.S. Federal Reserve are expected to lower rates soon. There is speculation that the Fed may cut rates by 25 or even 50 basis points.

Global markets are eagerly anticipating rate cuts, and there are several reasons for this. First, rate cuts are often seen as a tool to boost economic growth. Take the recent U.S. jobs report, for example—it showed a rise in unemployment to 4.3%, which indicates a slowing economy. Lowering interest rates would make borrowing cheaper for businesses, encouraging them to invest and expand.

We saw a sharp sell-off in the S&P 500 in Mid July which left investors uneasy. However this recovered due to expectations of a rate cut. A rate cut can help calm these markets by making bonds more attractive compared to stock, which typically offer higher yields when interest rates fall.

Another area where rate cuts can help is with commodity prices. Crude oil, for instance, has seen a drop as fears of an economic slowdown. Meanwhile, gold prices usually rise as risk-averse investors seek safer assets during uncertain times.

Rate cuts also play a big role in helping emerging markets. High U.S. interest rates have historically made it tough for these markets to issue debt affordably. But with lower rates, we might see a revival in capital flows, as we did when countries like Ivory Coast returned to the bond market after the Fed’s easing in previous cycles.

Lastly, it’s not just the U.S. that’s considering cuts. Global coordination is a key factor here. Central banks around the world, including the European Central Bank, are expected to lower rates soon, signaling a broader effort to stimulate growth and ensure financial stability across regions.

How Rate Cuts Impact the Economy and Stock Market

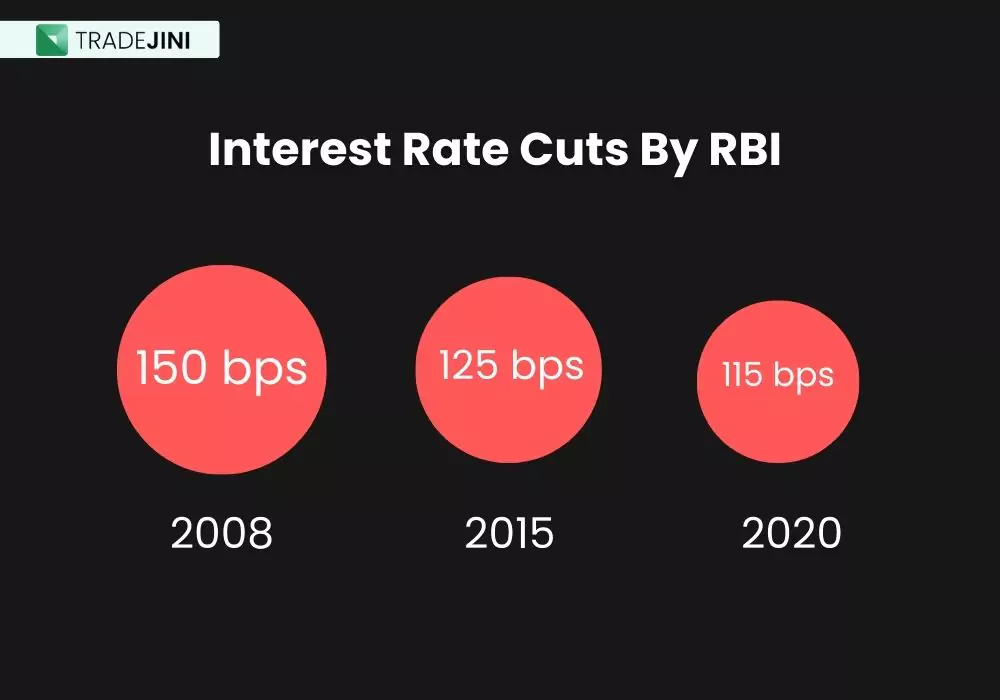

In 2020, the Reserve Bank of India (RBI) took aggressive measures to cut interest rates in response to the economic fallout from the COVID-19 pandemic. The RBI reduced the repo rate by 115 basis points, bringing it to a historic low of 4%. This move was aimed at stimulating the economy, which was experiencing a severe contraction due to lockdowns and reduced economic activity. Cheaper loans helped businesses and individuals manage cash flow challenges, and sectors like real estate and automotive saw increased demand. Additionally, the stock market reacted positively, with indices like the Sensex and Nifty rising as investors anticipated improved growth prospects due to easier credit.

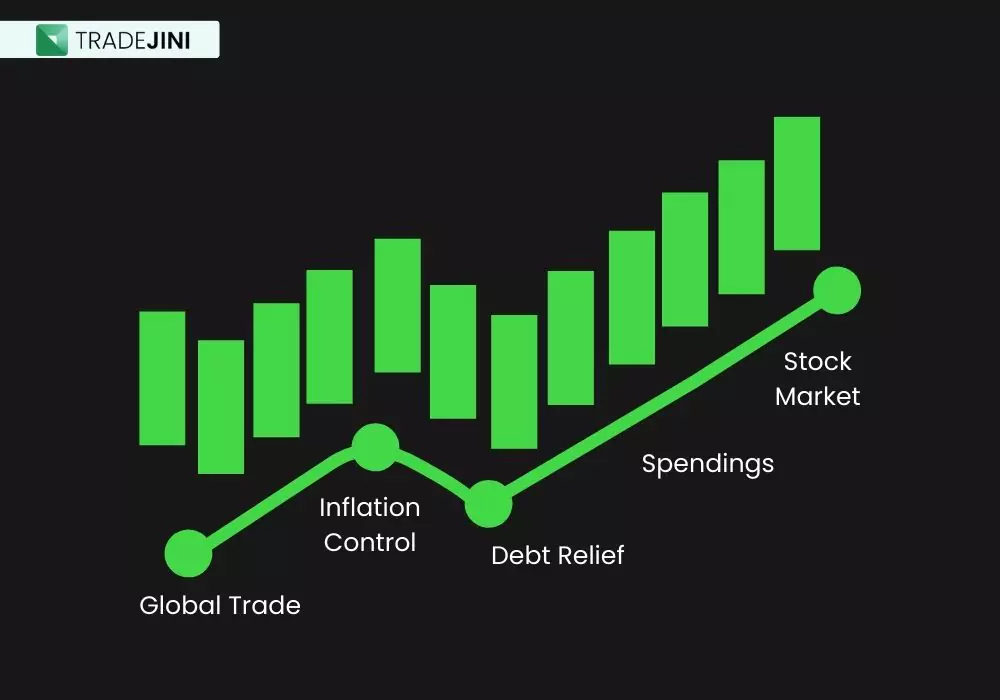

When interest rates go down, it becomes cheaper to borrow money, which has a significant impact on both consumers and businesses. Lower borrowing costs encourage individuals to take out loans for homes or cars, while businesses are more likely to invest in expansion.

This rise in spending results in more money circulating in the economy, contributing to its overall growth. Additionally, rate cuts often trigger a stock market rally. With lower bond yields, investors shift towards equities in search of better returns. This move into the stock market typically boosts stock prices and enhances market confidence, as seen in previous rate cut cycles.

However, rate cuts also tend to weaken the national currency. While this might seem concerning, it benefits a country’s exports by making them more affordable for foreign buyers, boosting trade and contributing to economic growth. Lastly, debt relief is a crucial outcome of lower interest rates. Governments and corporations can refinance their existing debt at lower rates, freeing up resources for growth or other initiatives.

How Have Rate Cuts Helped the Indian Economy in the Past?

The Reserve Bank of India (RBI) has implemented significant rate cuts during times of economic uncertainty, such as in 2008, 2015, 2020. These cuts helped boost liquidity, stimulate consumer spending, and revive economic growth during periods of financial distress.

Back in 2008, during the global financial meltdown, the Reserve Bank of India (RBI) acted quickly by slashing interest rates by a massive 350 basis points. This move brought the repo rate down from 9% to 5.5%. The goal was to inject liquidity into the economy and provide relief to businesses and consumers. It worked—consumer spending picked up, especially in sectors like housing, and investor confidence returned, helping the stock market recover.

In 2015, the RBI cut interest rates three times, reducing the repo rate by a total of 75 basis points. The first cut came in January when the repo rate dropped by 0.25%. By September, the bank rate was slashed by another 50 basis points, from 8.25% to 7.75%. These cuts were designed to boost growth as inflation had eased. The result? Increased consumer demand and investment activity, particularly in sectors like real estate and consumer durables. Lower borrowing costs helped revive economic activity at a crucial time.

Sectors That May Gain Due to Rate Cuts

Several sectors in India are expected to benefit from the recent and anticipated rate cuts by the RBI. Lower borrowing costs can provide a much-needed boost to certain industries, while others may experience slower growth. Here are the key sectors likely to see gains:

| Sector | Impact of Rate Cuts |

| Non-Banking Financial Companies (NBFCs) | Rate cuts reduce capital costs for NBFCs, making loans more affordable. This boosts loan disbursement volumes. |

| Automobile and Auto Ancillaries | Cheaper loans encourage vehicle purchases, reviving demand in the auto sector. Auto ancillaries benefit from rising demand. |

| Industrials and New Economy Companies | Industrial and new tech companies benefit from reduced loan interest, encouraging investment and expansion. |

| FMCG and Telecom Sectors | Increased consumer spending due to lower rates boosts FMCG, while telecoms benefit from reduced capital expenditure costs. |

| Real Estate | Lower home loan interest rates increase housing demand, though the sector may have already absorbed some of the benefits. |

| Banking Sector | Rate cuts support lending but may pressure profit margins due to reduced interest income. |

Global markets are eager for rate cuts due to their ability to stimulate economic activity, improve liquidity, and revive consumer and business confidence. Central banks, including the RBI, have used rate cuts in the past to navigate crises like the global financial meltdown of 2008 and the COVID-19 pandemic. As demonstrated, sectors such as NBFCs, automobiles, industrials, and FMCG stand to benefit the most from these reductions, while others may face headwinds. While rate cuts can provide a boost to the economy, they must be used carefully to balance inflation and growth over the long term.