In the dynamic landscape of corporate restructuring, the demerger process has emerged as a significant trend, reshaping businesses to enhance efficiency and focus. Let’s explore what a demerger entails, the various types, the motivations behind this strategic move, and its implications for shareholders.

What is demerger?

A demerger is a corporate restructuring process in which a company separates a part of its business operations into a new, independent entity. The aim is to allow each entity to focus on its core activities, improve operational efficiency, and potentially unlock greater value for shareholders.

Why Companies choose Demergers

- Focus on Core Operations: Shedding non-core units allows companies to concentrate on their main areas of expertise.

- Enhancing Shareholder Value: Each entity can pursue its growth strategy, potentially increasing shareholder value.

- Streamlining Operations: Simplifies structures and improves efficiency within each new entity.

- Raising Capital: Divesting underperforming units can free up funds for more promising projects.

- Regulatory Compliance: Demerger may be necessary to address regulatory pressures or antitrust concerns, allowing companies to comply with legal requirements.

| Pros of Demergers | Cons of Demergers |

| Allows companies to focus on core operations. | The separation process can lead to temporary operational challenges. |

| Shareholders often receive shares in the new entities. | Demergers can be costly due to legal, financial, and restructuring expenses. |

| Improved management accountability boosts performance focus. | Shareholders may face tax liabilities on shares received in the new companies. |

| Separate entities may achieve higher valuations than when combined. | The success of a demerger is uncertain and may not always lead to increased shareholder value. |

| New entities can pursue unique market opportunities tailored to their strengths. | The restructuring process may lead to layoffs as companies streamline operations. |

| Each entity can have its own board focused on specific goals and challenges. | The market's response during and after a demerger can be unpredictable, impacting stock prices. |

| The financials of each entity become more transparent, aiding investor decisions. | New management structures might cause job role instability. |

Key Challenges Companies Face During the Demerger Process

When companies decide to go through a demerger, they often face a series of challenges that can make the process complex and demanding. Here are some of the key hurdles companies need to watch out for:

Dividing Assets and Liabilities: One of the trickiest parts of a demerger is figuring out how to split assets and liabilities fairly. Getting this right is crucial to set up both entities for financial success and avoid disputes down the line.

Managing Employee Transitions: Workforce changes can be disruptive. Companies need to ensure smooth transitions, keeping employees motivated and productivity high as they adjust to new structures.

Establishing New Governance Structures: Each newly formed entity requires a governance framework. This can lead to challenges in aligning leadership and preventing power struggles or overlaps in authority.

Maintaining Customer and Supplier Relationships: During the split, maintaining strong ties with customers and suppliers is essential to keep the business running smoothly. Any disruption can impact service, supply chain reliability, and customer loyalty.

Navigating Operational Complexity: The logistics of physically and legally separating a company can be daunting. This can include splitting IT systems, facilities, and other operational resources in a way that ensures both companies can function independently.

Meeting Regulatory Requirements: Demergers often have to meet a set of legal standards and industry regulations, which can add significant complexity and delay to the process.

Integration and Synergy Realization: After the merger or demerger, integrating the operations, systems, and cultures of the companies involved can be a complex process. It is important to have a well thought-out integration plan to ensure a smooth transition and realize the expected synergies.

Handling Financial Costs: Finally, demergers come with a hefty price tag. Whether it's legal fees, restructuring costs, or investing in new infrastructure, these expenses need to be carefully managed to avoid financial strain.

Also Read: https://tradejini.com/company-demergers-impact-on-investors/

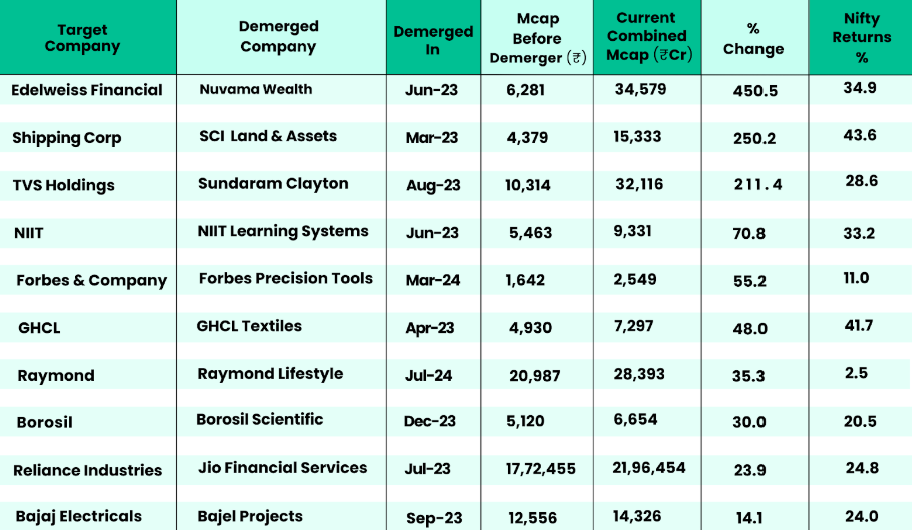

Recent Demergers in India

Reliance Industries Limited made a significant move on October 13, 2023, by demerging its financial services arm, Jio Financial Services (JFS). Shareholders received one JFS share for each Reliance share they held. At the time, Reliance was trading at around ₹2,350, while JFS debuted at ₹262. By December 2024, both companies have shown solid growth, with Reliance shares rising to ₹2,500 and JFS up to ₹363.45, marking a 36% increase. This demerger has unlocked substantial value for shareholders and positioned both companies for sector-specific growth.

Post-Demerger: Percentage Returns in Market Value

Conclusion

Demergers provide companies with the opportunity to sharpen their focus, improve operational efficiency, and unlock hidden value for shareholders. By separating into specialized entities, businesses can respond more effectively to changing market conditions, drive innovation, and enhance growth potential. For investors, these transformations open new avenues for strategic investments, making demergers a trend worth following closely.

Explore how CubePlus can streamline your financial services and support strategic growth: Discover CubePlus