Discover the power of Cover Orders in managing risk and safeguarding your trading investments. For traders seeking ways to minimize losses and protect against market volatility, Cover Orders offer a valuable solution. In this comprehensive guide, we delve into the fundamentals of Cover Orders, exploring their functionality, benefits, and application across various trading segments. Join us as we uncover the essential aspects of Cover Orders and how they can enhance your trading experience with Tradejini while controlling risks effectively.

What is a Cover Order?

A Cover Order is an advance intraday order that is accompanied by a compulsory Stop Loss Order. This helps traders minimize their losses by safeguarding themselves from unexpected market movements. A Cover Order offers high leverage and is available in Equity Cash, Equity F&O, Commodity F&O, and Currency F&O segments. It has 2 orders embedded in itself, they are

- Limit/Market Order

- Stop Loss Order

How does a Cover Order work?

A Cover Order can be placed either as a Market or a Limit Order. Although a Market Order executes the order at the current market price, a Limit Order is executed only when the price of the share hits the desired entry price. Let’s look at a few scenarios to understand this better.

Scenario 1: Limit Order not executed

In Cover Order, If the Limit Order does not get executed before market closing, the system will automatically cancel your trade by 3:15 pm, since Cover Orders are intraday orders.

Scenario 2: Limit Order executed, Stop-Loss not executed

When the Limit Order is executed, the Stop Loss Order gets activated, but if the price of the share does not hit the stop loss level before market closing, the system will automatically square off your position at the current market price of 3:15 pm. This happens because Cover Orders are intraday orders, and all pending intraday orders get squared off before market closing at 3:15 pm.

Scenario 3: Limit Order executed, Stop-Loss executed

When the Limit Order is executed, the Stop Loss order gets activated. Now if the price of the share hits the Stop Loss price, your position will automatically be squared and you will book losses.

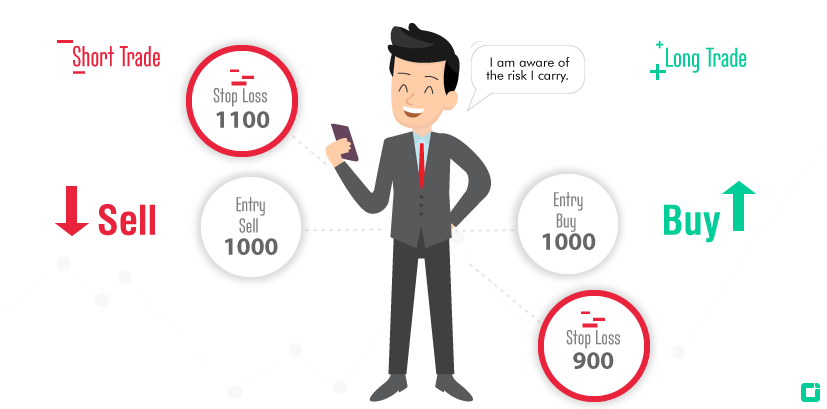

Cover Orders can be Buy (Long) or Sell (Short) orders

If our budding trader is looking to buy ITC at Rs.1000, he/she is going long on ITC, and hence places a Long Cover Order. In other words, our trader wishes to buy low and sell high. So naturally the stop loss price here will be lower than the entry price, hence our trader places a Stop Loss Order at around Rs.900.

If our budding trader is looking to sell ITC at Rs.1000, he/she is going short on ITC, and hence places a Short Cover Order. Here, our trader wishes to sell high and buy low. The stop-loss price will be higher than the entry price since our trader is expecting a depreciation in price and hence places a Stop Loss Order at say Rs.1100.

Features of Cover Orders

- Controlled Losses – Cover Orders can literally be a life-saver for a lot of traders. A trader that places an order without a stop loss is at the risk of losing a substantial portion of his/her capital. Since a Cover Order accompanies a compulsory stop loss order, you are less likely to lose track of your losses and while also controlling them.

- Higher Leverage – Since the compulsory Stop Loss feature reduces risk to a great extent, the leverage offered on Cover Orders is much higher when compared to naked intraday orders. Tradejini offers up to 30 times of contract value as leverage for Equity cash, and 5 times of exchange specified margin as leverage for all F&O segments.

Benefits of Cover Orders

Risk Management

Implementing Cover Orders in your trading strategy provides a crucial layer of risk management. By setting up a compulsory Stop Loss Order alongside your trade, you can limit potential losses and protect your capital from unexpected market movements. This risk mitigation feature ensures that you have a predefined exit point in case the trade goes against your expectations, allowing you to control and manage your risk exposure effectively.

Controlled Losses:

One of the key benefits of using Cover Orders is the ability to control and minimize losses. With the inclusion of a Stop Loss Order, traders can safeguard their investments by automatically exiting the trade if the price reaches a specified level. This helps prevent emotional decision-making during volatile market conditions and ensures that losses are kept within predefined parameters, enhancing overall trading discipline.

Higher Leverage Opportunities:

Cover Orders offer traders the advantage of higher leverage compared to traditional intraday orders. The compulsory Stop Loss feature reduces the risk associated with leveraged trading, allowing traders to access increased leverage ratios while maintaining risk control. This enhanced leverage capability can amplify trading opportunities and potential investment returns, making Cover Orders a valuable tool for maximizing trading efficiency.

Margin Efficiency:

Utilizing Cover Orders can lead to improved margin efficiency in trading. Since Cover Order positions typically require lower margin requirements compared to regular orders, traders can optimize their capital utilization while maintaining risk protection through the Stop Loss mechanism. By efficiently managing margin requirements based on the Stop Loss price entered, traders can enhance their trading capacity and capitalize on market opportunities effectively.

Margin Calculation for Cover Orders

Since Cover Order positions generally carry lower margin requirement when compared to a normal order, the required margin will depend on the Stop Loss price entered. As a rule of thumb, lower margin for lower stop loss, while higher margin for higher stop loss.

| Index | Price | Quantity | Contract Value | Exchange Specified Margin | Stop Loss Price | Margin Required |

|---|---|---|---|---|---|---|

| Nifty | 11560 | 75 | 8,67,000 | 69,550 | 11,510 | 12,720 |

| Nifty | 11560 | 75 | 8,67,000 | 69,550 | 11,485 | 14,959 |

Note: TradeJini offers up to 5x margin of the exchange provided margin for intraday orders. If a trader wants to carry the trade to the next day, he must fulfill the exchange provided margin.

How to Place a Cover Order?

Option 1: From the Menu Bar

Open Nest Trader → select “Order and Trades” tab → select “Cover Order” → select either (Buy / Sell) order → enter details → click “Submit”.

Option 2: Using Shortcut Keys

Open Nest Trader → select “Script” from market watch

- Press the shortcut key “SHIFT + F1” for a buy Cover Order → enter details → click “Submit”.

- Press the shortcut key “SHIFT + F2” for a sell Cover Order → enter details → click “Submit”.

There are two ways you can set your target and stop loss using Cover Order. You can either enter absolute values or, you can also use ticks. 1 Tick = 5 paise, so 20 ticks represents 5 x 20 = Rs.1.

Modifying and Exiting a Cover Order

Until the Cover Order is executed (Limit/Market Order being executed), you can modify both, Limit Order and the Stop Loss Order. But once the Cover Order is executed, only the Stop Loss Order can be modified. You can modify the Stop Loss Order provided you meet the margin requirements (since margin required varies with stop loss levels).

If you wish to exit a Cover Order, the system will first convert this order to a buy/sell order and square off the order at current market price automatically.

To Modify or exit a Cover Order, you can use either the shortcut key (F3) to open Order Book or click on “View Orders and Trades” button on the menu bar → Select “Order Book”.

Still doubtful about how to place a Cover Order? Watch the video below from TradeJini youtube channel.

Noteworthy Points about Cover Orders

- All Cover Orders are Intraday orders by default, these orders will be squared off automatically at

- 3:15 pm for NSE Equity & NSE F&O

- 4:45 pm for NSE Currency

- 11:30pm for MCX Commodity segment

- Cover Orders can be placed only during regular market hours and can be placed during the pre-market trades (9:00 am – 9:15 am) only for Equity Cash and post-market trades (3:40 pm – 4:00 pm) Equity Cash and F&O.

- Cover Orders are currently valid only for derivative-based scripts in Equity Cash.