Go First filed a voluntary application for Corporate Insolvency under the Insolvency and Bankruptcy Code 2016 (IBC) on 2nd May 2023.

One of the main components of filing this voluntary insolvency petition would be a moratorium put on its lenders who wished to repossess its assets.

For all Indian airlines, a significant portion of their operating cashflows go towards payment of these leases and it is their biggest expenditure.

The Moratorium kept all the lessors looking to repossess Go First’s aircrafts and aircraft engines at bay and started a set of legal battles in High Court and tribunals.

Indian laws have been considered unfavourable to lessors despite the country being a signatory to the Cape Town Convention Bill which protects lessor’s rights to leased aircrafts.

The Aviation Working Group (AWG) i.e., the global watchdog representing aircraft makers and leasing firms downgraded India’s ratings, put it on the negative watchlist and it was said that lease costs could rise by 25%.

Indian aviation has been a cutthroat business of poor profits with high lease costs. This would have further crippled the industry.

So, the MCA in a notification, declared that the provisions of Section 14(1) of IBC, which imposes a moratorium upon the admission of an insolvency plea, shall not apply to transactions, arrangements, or agreements related to aircraft, aircraft engines, airframes, and helicopters.

This immediately had the AWG put a positive watchlist notice for India’s score.

The Ministry said that this could save over $1.2 Billion for the Indian airline companies.

Let us understand how this impacts the listed companies currently having an exposure to the commercial aviation space.

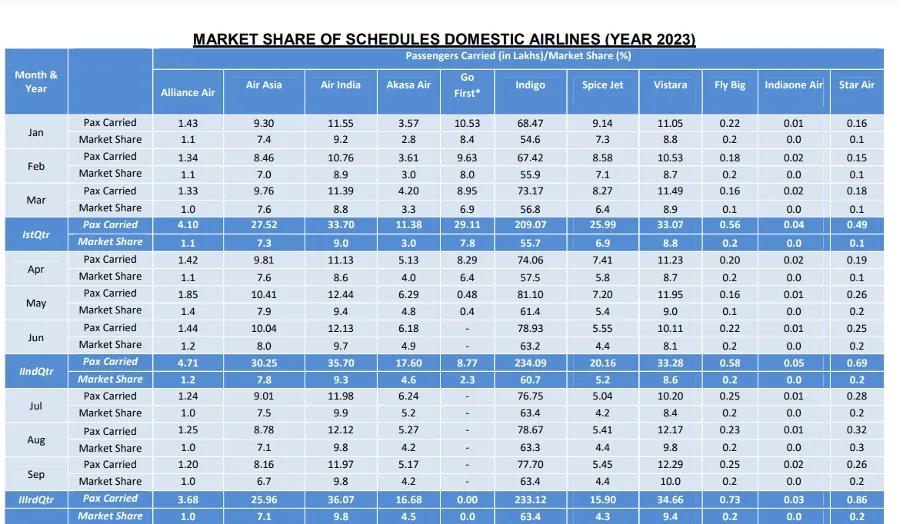

If we look at the market share of Indian Airlines by Domestic Air Traffic.

Three have exposure to the public markets. IndiGo, Spicejet and Go First through its associate (Bombay Burmah Trading Company).

Air India, Air Asia and Vistara’s parent Tata Sons is private and Akasa Air is privately owned.

IndiGo (Interglobe Aviation Ltd)

IndiGo is likely to be the largest listed beneficiary of the law being passed.

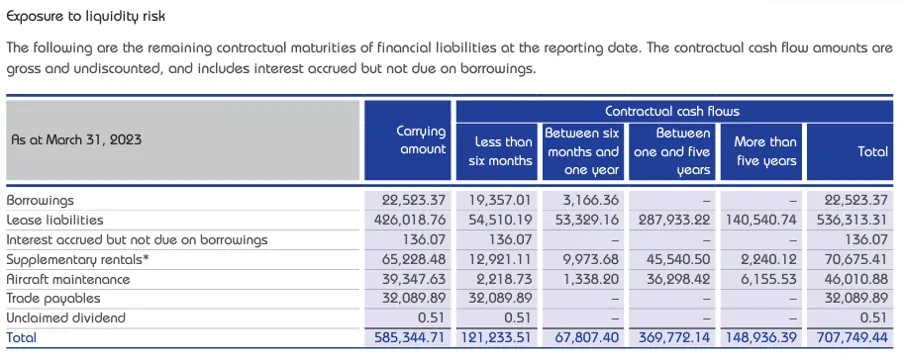

As of 31st March 2023, IndiGo had $6.5 Billion of lease liabilities outstanding or INR 53,600 Crs payable (full undiscounted value). Of which $4.8 Billion will be due within the next 5 years. Lease liabilities would represent 96% of the debt of the airline.

They also have supplementary rentals of INR 7067 Crs, payable relating to lease of engines which are costs based on the utilisation of the aircrafts.

The total expenditure in the P&L related to aircraft and engine rentals represent 28% of the costs of the airline this year and 40% in the previous year and 53% of their cash flow from operations. The second most important item after fuel expenses.

Any savings will have a major impact on profitability. IndiGo also has made an order with Airbus for 500 planes and has a total order book of over 1,000 airplanes over the next decade.

It is estimated that India has 800 commercial aircrafts with 80% of those leased.

IndiGo having 300 out of 316 aircrafts leased or approx. 47% of the total in the country. A major part of the savings that the government estimates will likely accrue to IndiGo considering Air India will grow.

Spicejet Limited

Spicejet is the other airline that will be impacted by the law albeit in quite a different way than IndiGo.

Spicejet has cases filed by 4 lessors in the National Company Law Tribunal pending.

It has told the court that it is in the advanced stage of settlement with Celestial Aviation one of the lessors.

In the previous month it had issued 48.1 million shares to clear dues of 231 crores to 9 lessors.

This law being passed will strengthen the position of the lessors of the loss-making airline.

They no longer have to worry about the possibility of bankruptcy and being required to take a significant haircut on the loan post a long moratorium.

It has over ₹6,700 Crs in lease liabilities sitting on its balance sheet and spent ₹628 Crs in the previous year to repay them.

However, the airline made a loss of ₹1,513 Crs in FY 23 so is in a difficult position despite promoter Ajay Singh investing ₹500 Crs.

Go First

Go First’s exposure to the public markets stems through the Wadia Holding Company Bombay Burmah Trading Company (BBTC).

This airline will be the most significantly hit by the provision with its lessors now not having the overhang of the Insolvency and Bankruptcy Code.

They will now be able to repossess all the aircrafts of Go Air. The airline has received one expression of interest from Jindal Power Ltd so far in its insolvency process.

It had invested 944 crores in Go Air through a subsidiary. As of 31st March 2023, it has impaired the investment in the subsidiary and has 90 crores outstanding which it impaired last year along with the investment. Considering that a related party does not have a right to sit on the committee of creditors during insolvency, BBTC has impaired all exposure to Go First.

Special mention to Jet Airways who are also listed, but as of 30th June 2023 has not been in operations for 4 years and earns most of its revenue from leasing the aircrafts owned by it.

This law strengthens the leaders in the aviation space and further pushes for consolidation of the sector, making sure that the financially unsound airlines will not have much recourse.