Every profitable trader looks to maximize gains while cutting losses. It is a fairly common knowledge that trading in financial markets always involves some amount of risk. What if we told you that you can control risk and also be away from the trading terminal?

Yes! You heard that right!

Wouldn’t it be nice if you can automate all your trades? And not be glued to your screen like your grandma watching her favorite soaps on TV?

Yes? So let’s begin

What is a Bracket Order?

A Bracket Order is an advanced intraday order that is accompanied by a compulsory Target and Stop Loss Order. In simple words, this resembles a bracket which helps traders automate their trades. A Bracket Order offers high leverage and is available in Equity Cash, Equity F&O, Commodity F&O, and Currency F&O segments. It is a type of order where you can enter a new position along with a target/exit and a stop loss order. Hence, the order itself contains 3 orders embedded in it

- Limit Order

- Take Profit Limit Order

- Stop Loss Order or Trailing Stop Loss (optional)

This is used by traders to take advantage of high margin exposure while keeping complete control of the risks involved.

How does a Bracket Order work?

When a Bracket Order is placed, the system will first execute the Limit order. Until the Limit Order is triggered the ‘Take Profit Order’ and ‘Stop-Loss order’ does not get activated. Let’s consider a few scenarios to understand this better.

Scenario 1: Limit Order not executed

If the Limit Order is not executed by 3:15 pm, then the system will automatically cancel your order.

Scenario 2: Limit Order executed, Stop Loss and Take Profit to remain pending

When the Limit order is executed, the Stop Loss and Take Profit Orders to get activated. If the price does not reach the Stop Loss or Take Profit levels, they will remain pending. If these orders remain pending till 3:15 pm, then the system will automatically convert the Bracket Order to Buy/Sell order and close the trade at the current market price of 3:15 pm.

Scenario 3: Limit Order executed, Take Profit order executed

When the Limit Order is executed, the Stop Loss and Take Profit orders to get activated, If the price moves and hits the Take Profit level, the Take Profit order gets executed. When this happens, the position will automatically be squared off and you will book profits. In this case, the Stop Loss order gets canceled.

Scenario 4: Limit Order executed, Stop Loss order executed

When the Limit Order is executed, the Stop Loss and Take Profit orders to get activated. If the price moves towards the Stop Loss level and touches it, the Stop Loss order gets executed following which, the position will automatically be squared off and you will book losses. Consequently, in this case, the Take Profit order gets canceled.

Yes, we know how elaborate that was, but hey, we don’t mind explaining.

Time for a story!

Our budding trader wishes to buy TATA at Rs.1000 and wants to book profits at Rs.1050. However, he is a little skeptical that it might go down a lot if the price reaches below Rs.990. Under normal circumstances, he/she would have placed

- A buy Limit order at Rs.1000

- A Take Profit Order at Rs.1050

- A Stop Loss Order at Rs.990

After placing the above orders, our budding trader sits in front of his PC to monitor his trades to ensure that whenever any of the sell orders are triggered he cancels the other orders. Because if he does not, there is a possibility of all 3 orders getting executed, and that would be disastrous!

With a Bracket Order, our budding trader can place all the above orders at once and also without having the need to monitor the price. All he has to do is place a Bracket Order, with a Limit Order of Rs.1000, a target price of Rs.1050 and a Stop Loss Order of Rs.990 and sit back to watch the magic happen. Easy peasy!

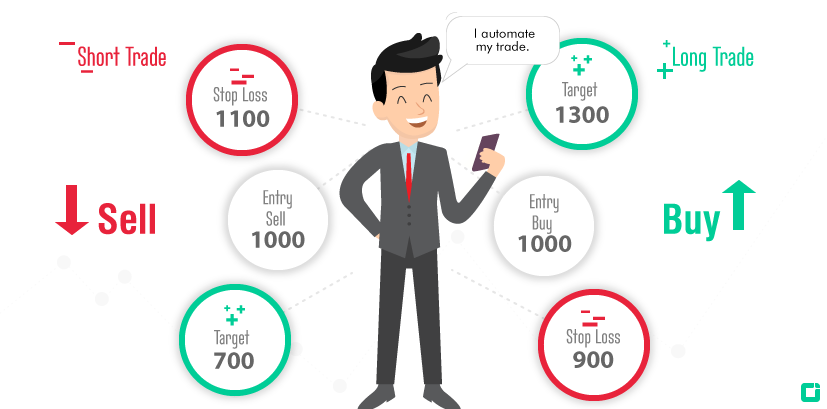

Bracket Orders can be either Buy (Long) or Sell (Short) orders.

A Long Bracket Order is placed when you want to benefit from the upward movement in price, in other words, when you want to buy low and sell high. In a scenario like this, the Stop Loss Order will be lower than your Limit Order. This is done to protect yourself from any unexpected downward movement. For example, if your Limit Order is placed at Rs.1000, your Stop Loss Sell Order will be at around Rs.900 or less. Whereas, your Take Profit order will be around Rs.1300 or higher

A Short Bracket Order is placed when you want to benefit from the downward movement in price, in other words, when you want to sell high and buy low. In such a scenario, the Stop Loss Order will be higher than your Limit Order. This is done to protect yourself from any unexpected upward movement since your trade places against price appreciation. For example, if your Limit Order is placed at Rs.1000, your Stop Loss Buy Order will be at around Rs.1100 or more, while your Take Profit order will stand at around Rs.700 or lesser.

Trailing Stop Loss Feature

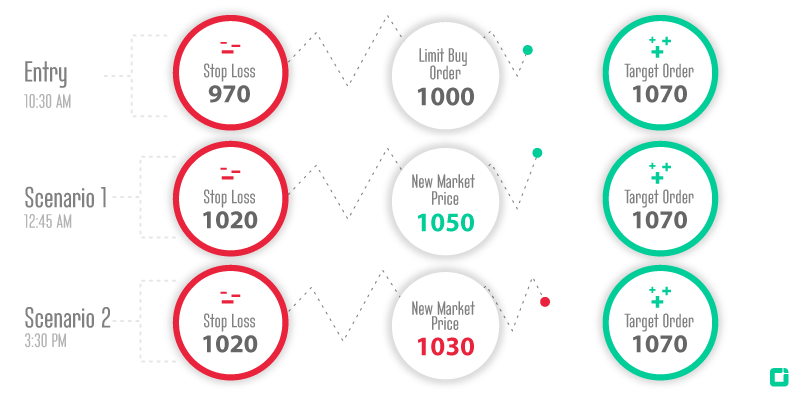

A Bracket Order also includes an optional Trailing Stop Loss feature. In this feature, your Stop loss trails favorable current market price to protect you further from potential losses.

Referring the example above, for a Buy order, if the price moves up by Rs.50, to Rs.1050, then the new Stop Loss would be adjusted to Rs.1020 (990 + 50) since this stop-loss price trails favorable market price and gets adjusted accordingly. The adjusted price is calculated by adding the difference between the highest price post limit order execution (1050) – the initial limit order price (1000) = Rs.50. However, if the price moves down from Rs.1050, the Stop Loss level at Rs.1020 will remain the same. This is how Trailing Stop Loss benefits traders. That’s pretty cool, don’t you think?

Uses and features of Bracket Order

- Controlled Losses – Bracket Orders can literally be a life-saver for a lot of traders. A trader that places an order without a stop loss is at the risk of losing a substantial portion of his/her capital. Since a Bracket Order accompanies a compulsory stop loss order, you are less likely to lose track of your losses and while also controlling them.

- Automate your trade – Since Bracket orders are automated, trading in the markets becomes a lot more efficient. Your trades will automatically close once the profit or loss targets are met, with or without your presence in front of the trading terminal, saving you a lot of time and effort.

Margin Calculation for Bracket Orders

Bracket order positions generally carry lower margin requirement due to the Stop Loss Order placed simultaneously. So the required margin will depend on the Stop Loss price entered. As a rule of thumb, lower margins for lower stop loss, while higher margin for higher stop loss.

| Index | Price | Quantity | Contract Value | Exchange Specified Margin | Stop Loss Price | Margin Required |

|---|---|---|---|---|---|---|

| Nifty | 11560 | 75 | 8,67,000 | 69,550 | 11,510 | 12,720 |

| Nifty | 11560 | 75 | 8,67,000 | 69,550 | 11,485 | 14,959 |

Note: TradeJini offers up to 5x margin of the exchange provided margin for intraday orders. If a trader wants to carry the trade to the next day, he/she must fulfill the exchange provided margin.

How to Place the Bracket Order

Option 1 – From the Menu bar

Open Nest Trader → select “Order and Trades” tab → select “Bracket Order” → select either (Buy / Sell) order → enter details → click “Submit”.

Option 2 – Using Shortcut Keys

Open Nest Trader → Select “Script” from market watch

- Press the shortcut key “SHIFT + F3” for a buy Bracket order → Enter details → Click “Submit”.

- Press the shortcut key “SHIFT + F4” for a sell Bracket order → Enter details → Click “Submit”.

There are two ways you can set your target and stop-loss using bracket order. You can either enter absolute values or, you can also use ticks where, 1 Tick = 5 paise, so 20 ticks represent 5 x 20 = Rs.1.

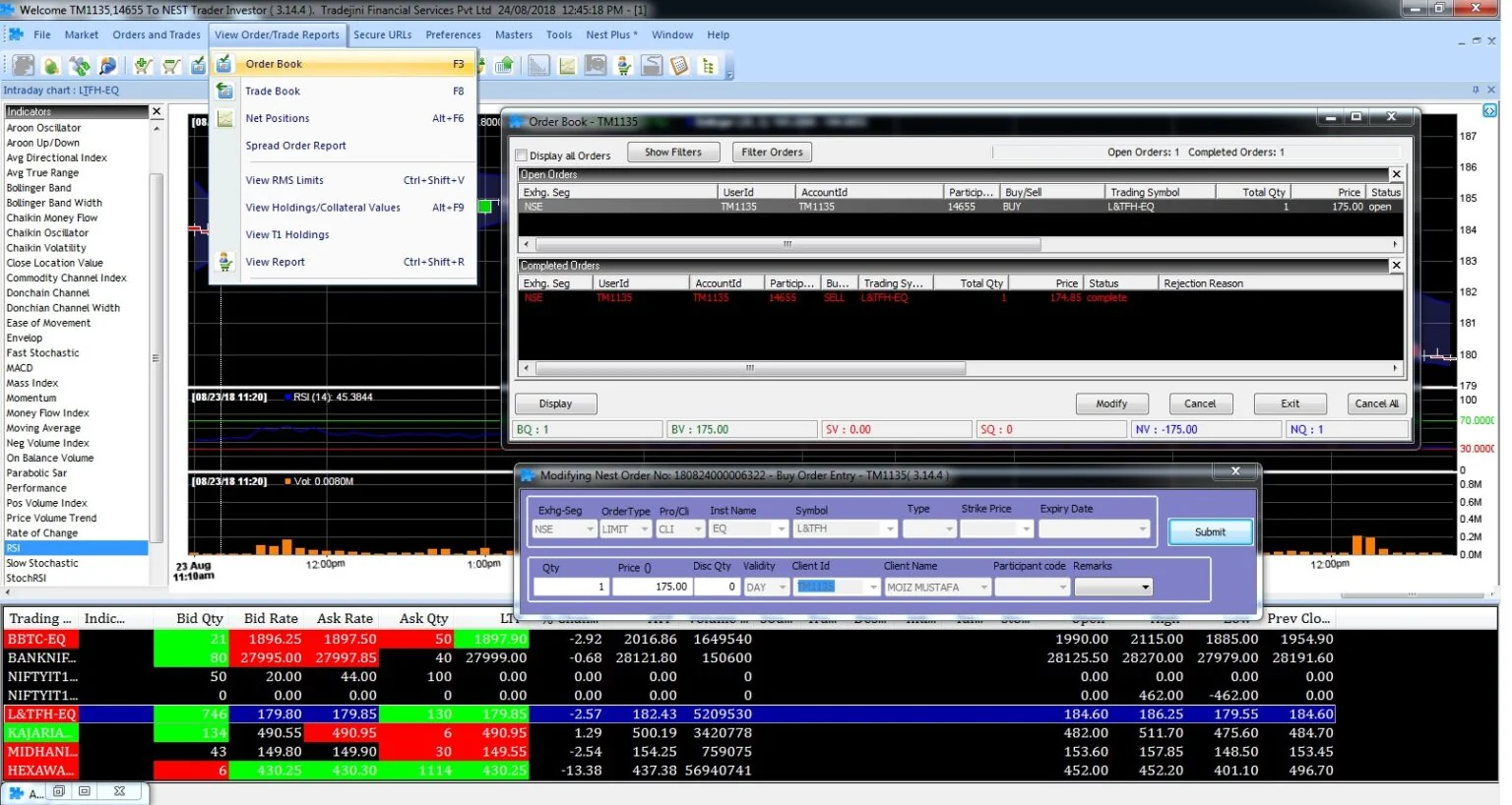

Modifying and Exiting a Bracket Order

For a Bracket Order that is pending (Limit Order not executed), you will be able to able to modify all 3 legs of the Bracket Order. This means, for a pending Bracket Order, you can modify Limit Order price, Stop Loss level and Take Profit level.

However, once the Bracket Order is executed (Limit Order being executed), you will not be able to modify the Limit Order price since it has already been triggered. But in this case, you will be able to modify Stop Loss and Take Profit levels.

If you wish to exit a Bracket Order, the system will square off the order at the current market price while also canceling the Take Profit and Stop Loss order.

To Modify or exit a Bracket Order, you can use either the shortcut key (F3) to open Order Book or click on “View Orders and Trades” button on the menu bar → Select “Order Book”.

Noteworthy points about Bracket Orders

- Since all Bracket Orders are Intraday orders by default, the orders will be squared off automatically at

- 3:15 pm for NSE Equity & NSE F&O

- 4:45 pm for NSE Currency

- 11:30 pm for MCX Commodity

- Bracket order is currently enabled for Equity Cash, Equity F&O, Commodity F&O, and Currency F&O segments.

- Bracket Order has an optional Trailing Stop Loss feature that dynamically adjusts your stop loss price according to market price movements.

- Bracket Orders are currently valid only for derivative-based scripts in Equity Cash.