One of the first names that comes to our minds when we think about conglomerates is Aditya Birla. The group is among the Fortune 500 largest conglomerates in the world, operating out of India with its foothold in numerous sectors spread across over 40 countries. The group, with a legacy of over 150 years, has become synonymous with scale, innovation and excellence in the business landscape.

Building a conglomerate of this size is no simple task. It is the combined effort of generations in the Birla family. In this blog, let’s delve into the making of this conglomerate into the shape it is now.

History

The journey started in 1857 in the small town of Pilani, Rajasthan, by Seth Shiv Narayan Birla. While he engaged in the trade of cotton and jute, he capitalised on the then extremely profitable trade of opium with China, forming the foundation of the family’s wealth. After finding immense success in his ventures, Shiv Narayan Birla moved to Ahmedabad and later to Bombay.

His adopted son, Baldev Das Birla, expanded the business by setting up trading houses in Bombay to facilitate trade with merchant ships. He had 4 children, the most prominent amongst them being Ghanshyam Das Birla, the first of 3 generations of masterminds of business who transformed the entire scale and operations of the group, making it a powerhouse that we know today.

Ghanshyam Das Birla (1894-1983)

GD Birla was a visionary who played a pivotal role in laying the foundation of the group by vastly expanding the business by setting up several industries pre-independence. He also played a major role in representing the interests of the industrialists and traders community in several conferences and made notable contributions to the Indian freedom movement. Post-independence, he would go on to establish several factories and industries that supported the newly independent nation by processing, manufacturing, and supplying essential items such as fibres, textiles, sugar, aluminium, copper, cement and so on.

Some of the notable enterprises, amongst several, set up by GD Birla include:

- Hindustan Motors (1942), The makers of Ambassador.

- Hindalco (Hindustan Alum Company 1958)

- Grasim (Gwalior Rayon Silk Manufacturing, 1948)

- Hindustan Times (Newspaper publication, 1924)

- UCO Bank (1943)

- Birla Institute of Technology and Science (BITS Pilani, 1946)

GD Birla was awarded the Padma Vibhushan by the Government of India in 1957 for his significant contribution to India’s industrial growth and economy. His legacy is one of impactful leadership that played a key role in shaping the country's industrial landscape.

Also Learn: Calendar Spread Options Strategy Explained

Aditya Vikram Birla (1943-1995)

Being the grandson of GD Birla, AV Birla was a gifted visionary and industrialist who took the Birla group to greater heights, expanding the company overseas. He was born in Kolkata and earned a chemistry degree from Massachusetts Institute of Technology, USA. He oversaw the expansion of the group into oil and petrochemicals, textiles and telecommunications. Upon returning to India, AV Birla went on his own independent journey and set up Eastern Spinning Mills in Kolkata, which became a huge success.

Under AV Birla, the group first set foot into Thailand by setting up Indo Thai Synthetics in 1969 making the Birla Group - India’s first multi-national company. There was no stopping after this. Soon the business expanded throughout south-east Asia and beyond, producing pulp, fibre, metal, cement, chemicals and so on.

In 1988, Aditya Vikram Birla founded Birla Copper, which became the world's largest single-location copper smelter with integrated port facilities. Under his leadership, the Aditya Birla Group achieved global leadership in several industries, including viscose staple fibre production, palm oil refining, insulators, and carbon black. His legacy was unfortunately short-lived and he passed away in 1995 due to cancer. A scholarship program was started in his name and every year, over 40 scholars from IIMs, IITs, BITS receive the scholarship.

Kumar Mangalam Birla (1967-present )

Born in 1967, KM Birla was exposed to the large-scale business operations of the group at a young age. He is a Chartered Accountant and also holds an MBA degree from the London School of Business. At the age of 28, KM Birla was given the reins of the conglomerate due to the unfortunate passing of AV Birla. He is the current chairman of the Aditya Birla Group.

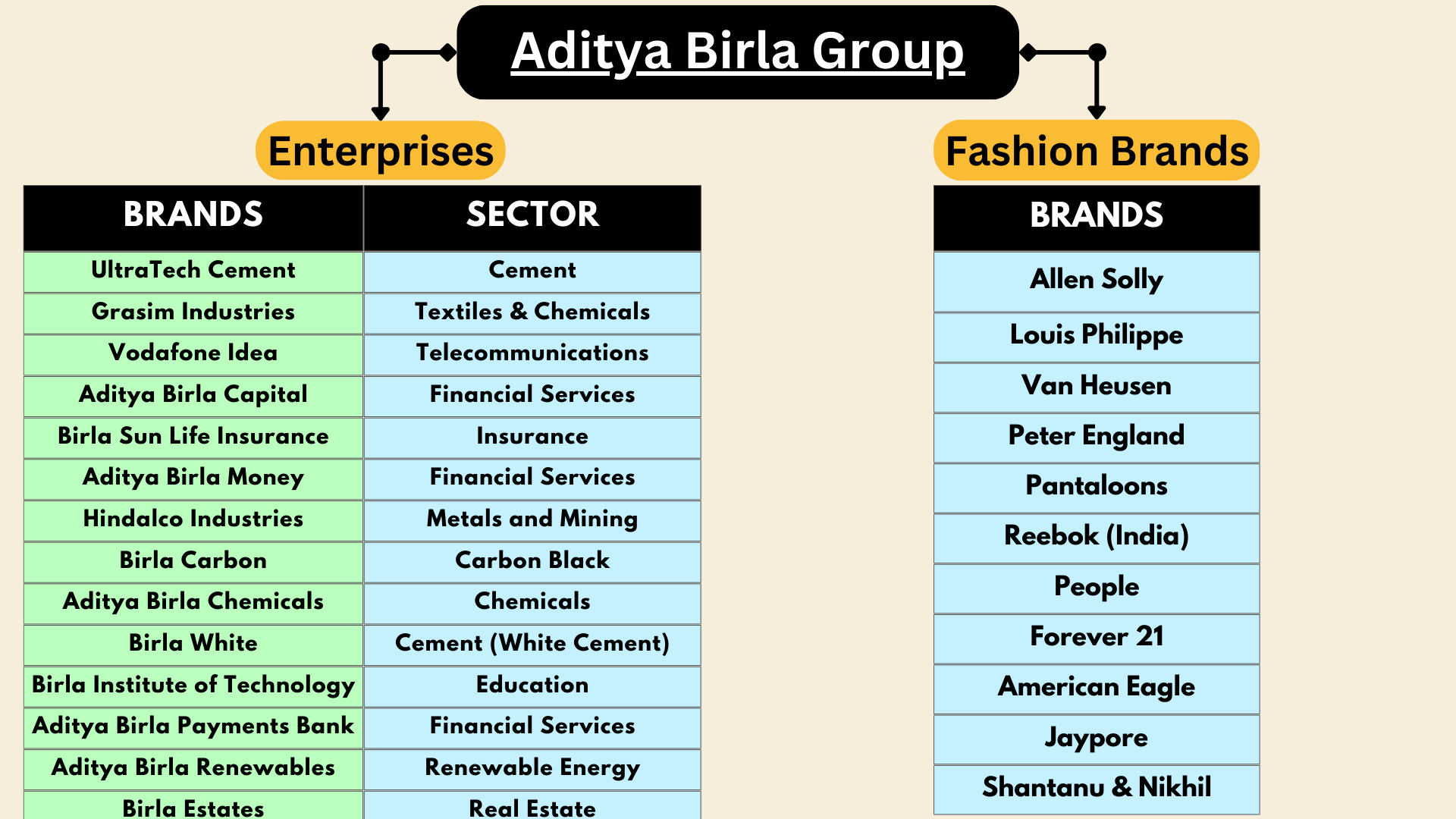

Under the direction of Kumar Mangalam Birla, the Aditya Birla Group has significantly expanded its presence across various sectors. The group has not only strengthened its position in cement, chemicals, metals, and financial services but has also made notable strides in fashion and telecommunications. Major fashion brands such as Louis Philippe, Peter England, Van Heusen, and Allen Solly now fall under the group's portfolio, and they have acquired a 26% stake in Vodafone Idea.

Beyond the business realm, Mr. Kumar Mangalam Birla has been active in various regulatory and professional boards, including the Reserve Bank of India and the Securities and Exchange Board of India (SEBI). His contributions to corporate governance and policy-making have influenced Indian business practices and legal reforms.

He is also known for his philanthropic efforts. He is the fourth most philanthropic person in India and has contributed over 500 crores to the PM Cares fund during COVID-19 pandemic. He fully sponsors the fees of 10 MBA aspirants in the London Business School every year with a £15 million scholarship fund.

Timeline of the Aditya Birla Group

1857: Seth Shiv Narayan Birla founded a small trading business in Pilani, laying the foundation for what would become the Aditya Birla Group.

1901: Ghanshyam Das Birla, the adopted son of Seth Shiv Narayan Birla, expanded the business by establishing a cotton mill in India, marking the group’s entry into the textile industry.

1920: Under GD Birla’s leadership, the Aditya Birla Group expanded into the cement industry with the establishment of the Cement Manufacturing Company (now UltraTech Cement).

1947: Post-independence, the group diversified into the aluminium sector with the establishment of Hindalco Industries, which would become a leading player in the metal industry.

1951: Aditya Vikram Birla, the son of GD Birla, launched the Birla group’s foray into the financial services sector by founding Aditya Birla Capital Limited.

1969: The group ventured into telecommunications with the launch of Birla Communications, which later became part of Idea Cellular.

1986: Aditya Vikram Birla’s leadership saw further diversification into retail, with the establishment of Aditya Birla Retail Limited, focusing on supermarket and hypermarket formats.

1997: The group acquired the British textile company, The British Silk Company, strengthening its presence in the global textile market.

2000: The acquisition of several brands, including Pantaloons, marked the group’s expansion into the retail sector under Aditya Vikram Birla’s leadership.

2004: The group entered the insurance sector with the launch of Aditya Birla Insurance Brokers Ltd.

2011: Kumar Mangalam Birla, the son of Aditya Vikram Birla, led the group’s acquisition of well-known fashion brands including Louis Philippe, Van Heusen, and Allen Solly, consolidating its position in the apparel sector.

2012: The group acquired a significant stake in Vodafone Idea, reinforcing its presence in the telecommunications industry.

2014: The launch of Aditya Birla Health Insurance Company marked the group's expansion into the health insurance sector under Kumar Mangalam Birla’s leadership.

2018: The Aditya Birla Group acquired the American fashion brand Forever 21, expanding its international retail footprint.

2020: The group announced a strategic partnership to drive innovation and growth in digital services and technology.

2024: The Aditya Birla Group undertook a strategic restructuring, resulting in the formation of independent entities to enhance focus and drive growth in their respective sectors.

Aditya Birla Group: A Diversified Conglomerate

Listed companies

Currently, the group has 8 companies listed on the stock market as of August 2024. Here is a list-

| Company Name | Market Capitalization* | Year

Listed |

| Aditya Birla Capital Ltd (ABCAPITAL) | 57053.1 | 2017 |

| Aditya Birla Fashion & Retail Ltd (ABFRL) | 32464.86 | 2016 |

| Aditya Birla Sun Life AMC Ltd (ABSLAMC) | 21412.19 | 2021 |

| Aditya Birla Money Ltd (BIRLAMONEY) | 907.42 | 2008 |

| Grasim Industries Ltd (GRASIM) | 184936.75 | 1995 |

| Hindalco Industries Ltd (HINDALCO) | 153956.8 | 1997 |

| Vodafone Idea Ltd (IDEA) | 107384.39 | 2007 |

| UltraTech Cement Ltd (ULTRACEMCO) | 327434.72 | 2004 |

*Data as on 27th August 2024, Market capitalization in INR Crores.

Key Statistics

Here are some key statistics of Aditya Birla Group’s major enterprises:

UltraTech Cement - India’s largest cement manufacturer.

Hindalco Industries - World’s largest aluminium rolling company

Aditya Birla Capital - Among India’s largest financial services firms.

Grasim Industries - World’s largest producer of viscose staple fibre.

Aditya Birla Fashion and Retail - India’s largest fashion and lifestyle company.

Aditya Birla Insulators - India’s largest manufacturer of electrical insulators.

Also Learn: Mergers Explained: Types, Effects, and Impact on Your Stocks 🤔

How Aditya Birla Fashion and Retail stays 2 steps ahead

When you ask someone to name a few famous clothing and fashion brands, there is a good chance that you’ll hear names like Louis Philippe, Van Heusen, or Peter England. But little do they know that all the brands they name fall under the wide net cast by the Aditya Birla Group in the clothing and fashion sector.

The subsidiary Aditya Birla Fashion and Retail Limited (ABFRL) is a billion-dollar powerhouse that drives the entire fashion sector of India. This has been possible thanks to strategic mergers, acquisitions and partnerships between ABFRL and other brands. One of the biggest plus points of Aditya Birla Group as a whole is their ability to adapt to changes and being ahead of the curve when it comes to capitalizing on new trends and market dynamics.

Madura Garments, a division of Madura Coats, was a well established British textile and garments manufacturer who owned several brands, such as Louis Philippe, Van Heusen, and Allen Solly, among others. They were acquired by Aditya Birla Group in 1999 and subsequently fell under ABFRL. This gave the group access to well established fashion brands, giving them a good foothold in the fashion sector.

What followed were a series of strategic and well-timed decisions aimed towards the growth and expansion of ABFRL in the Indian fashion sector. This included aligning the products to match the ever-changing consumer demand, maintaining high production quality, tapping into untapped segments and creating a loyal customer base.

Some major strides towards these goals are as follows-

- Acquisition of Louis Philippe, Van Heusen, Allen Solly, and Peter England (1999): ABFRL’s acquisition of these iconic brands quickly established its dominance in the Indian fashion market. Louis Philippe and Van Heusen catered to premium and luxury segments, while Allen Solly and Peter England offered quality, affordable options, making them household names.

- Acquisition of Pantaloons (2012): Acquiring Pantaloons provided ABFRL with access to a well-established retail network and a broad customer base, significantly boosting its presence in the Indian fashion landscape.

- Acquisition of Forever 21 (2016): Securing the Indian rights to Forever 21 allowed ABFRL to enter the fast-fashion market, appealing to the youth with trendy, affordable clothing and enhancing its appeal across diverse style preferences.

- Acquisition of Jaypore (2019): The acquisition of Jaypore marked ABFRL's entry into the e-commerce space, expanding its portfolio with premium ethnic wear and addressing both domestic and international markets.

- Acquisition of Shantanu & Nikhil (2019): Investing in Shantanu & Nikhil added a touch of luxury to ABFRL's portfolio with contemporary ethnic designs, strengthening its position in the high-end fashion sector.

- Acquisition of Reebok India (2021): Acquiring Reebok India expanded ABFRL’s reach into the sports and activewear segment, enhancing its portfolio with globally recognized fitness apparel and meeting the growing demand for stylish, high-performance sportswear.

SWOT analysis

Conclusion

With a legacy of over 150 years, the Aditya Birla empire stands as a testament to visionary leadership over generations, expanding globally and maintaining a strong foothold in several sectors. The group has stood the test of time and for a traditional company to survive decades of changes, it takes an exceptional blend of strong leadership, adaptability, innovation and a strong driving force of customer satisfaction.

The group has a consolidated market capitalization of $133 billion, employs over 1,87,000 people and operates in over 40 countries. It seeks to achieve net zero carbon emissions by 2050 in its drive towards sustainability. This resilience and forward-thinking approach have enabled the Aditya Birla Group to thrive through generations and emerge as a global powerhouse.

(Disclaimer: This article provides info on Aditya Birla Group and is for educational purposes only. It's not financial advice, nor does it endorse Aditya Birla Group or motivate buying shares. Please conduct your own research before making any investment decisions)

Also Read: Exploring Investor Types in the Stock Market: Retail vs. Institutional