In the high-stakes world of Indian e-commerce, Flipkart has raised the bar by entering the quick commerce market with its new platform, 'Flipkart Minutes.' Launched last month in select areas of Bengaluru, Mumbai, and Delhi, the service promises deliveries in just 8 to 16 minutes, aimed at enhancing speed and convenience in the online shopping experience. Let’s crunch some numbers.

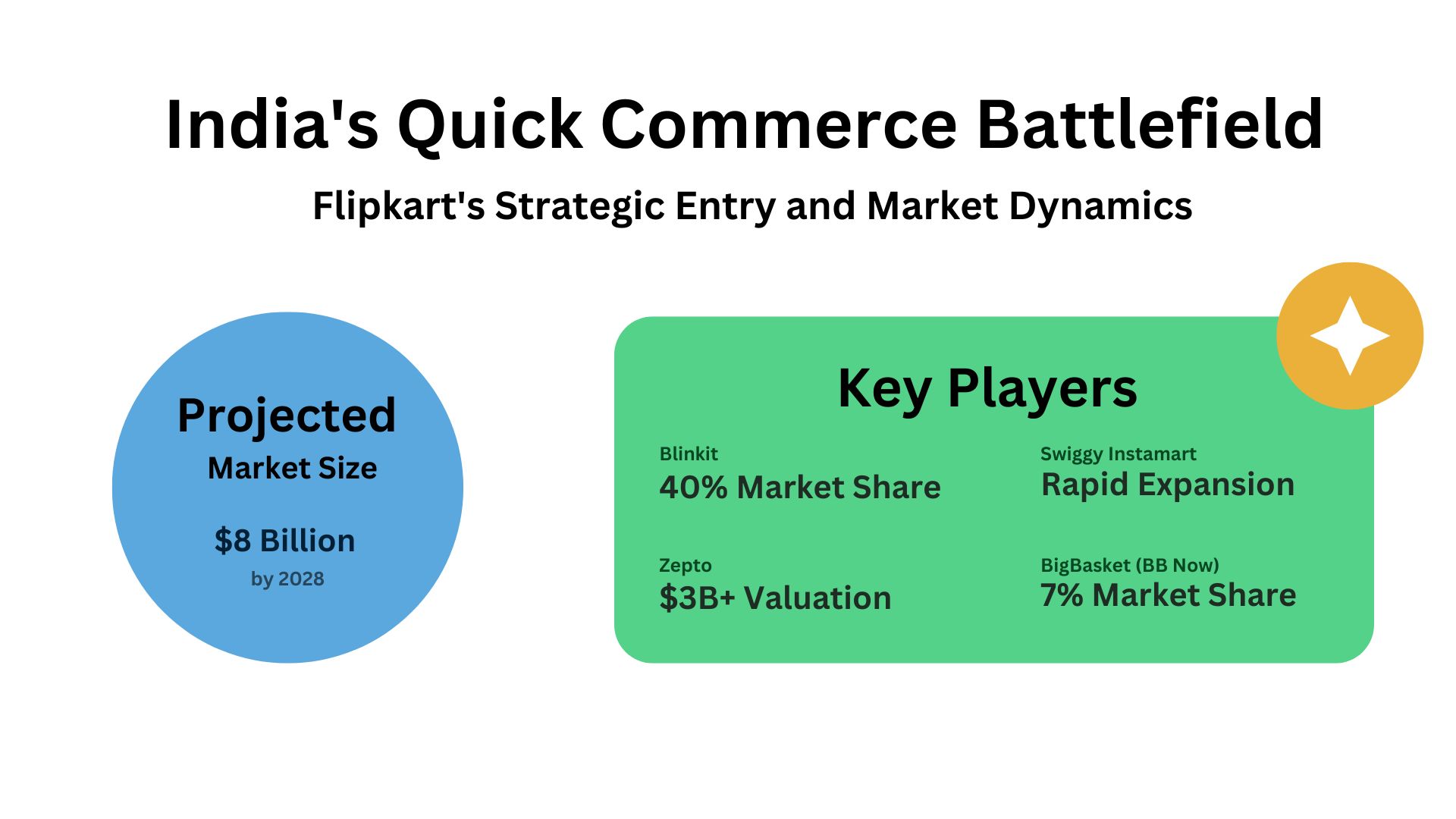

The quick commerce market in India is projected to hit $8 billion by 2028, growing at a compound annual growth rate (CAGR) of 50%. This rapid growth attracts significant investor interest, but here's the kicker: not a single player in this space is profitable yet.

The Key Players

- Blinkit: Leading the market with a 40% share, Blinkit was acquired by Zomato for under $600 million in 2022. It has since seen its valuation rise, a classic turnaround story.

- Zepto: This fast-rising unicorn achieved its $3 billion valuation in just a year, making it the dark horse in the space.

- Swiggy Instamart: Backed by SoftBank, Swiggy is leveraging its existing food delivery infrastructure to scale quickly.

- BigBasket’s BB Now: A Tata-backed player with a 7% market share, BB Now has significant financial backing, making it a competitor to watch.

Enter Flipkart

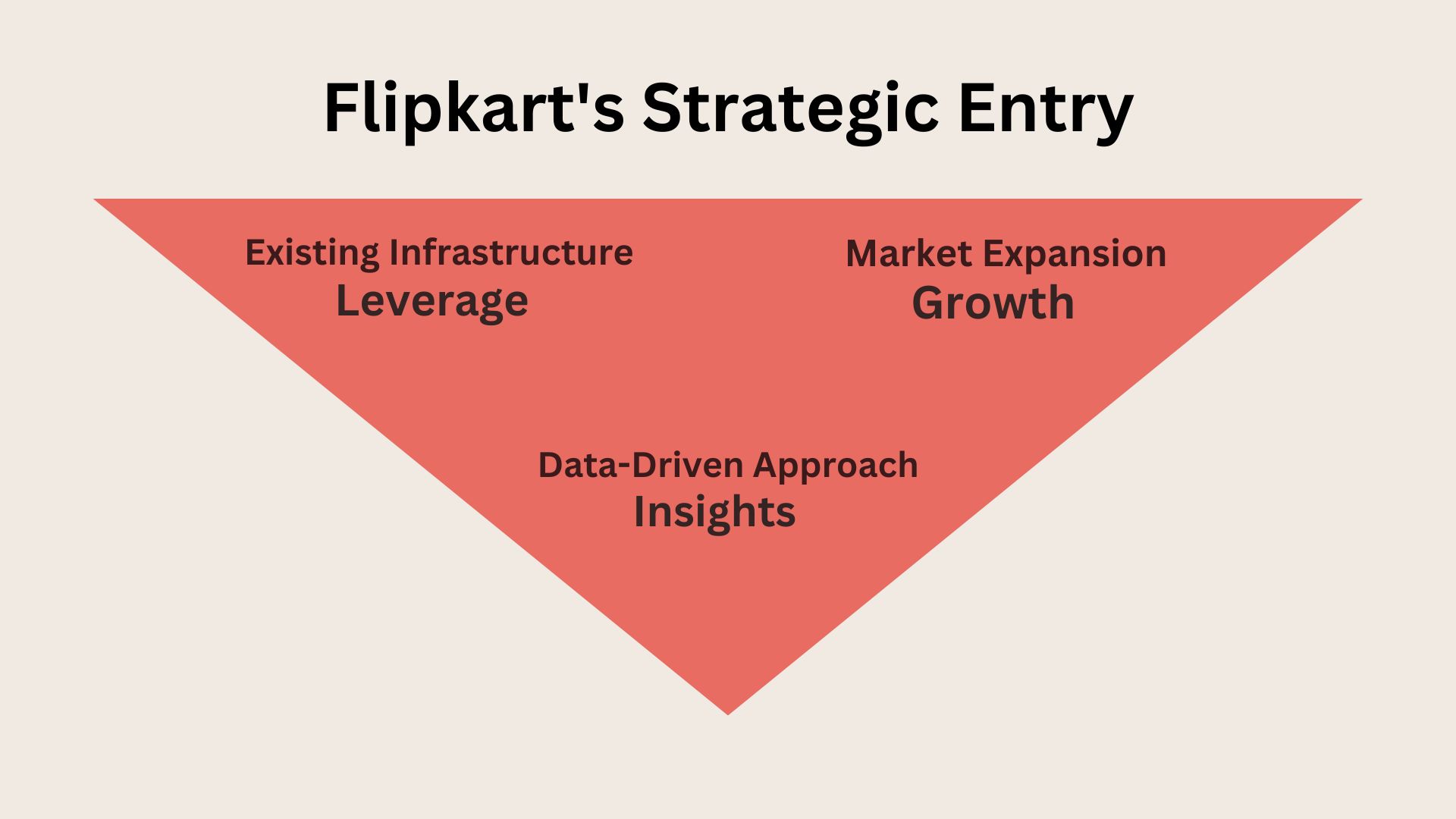

Why is Flipkart jumping into quick commerce now? The answer is simple: they’re playing the long game. As their core e-commerce business matures and growth slows, Flipkart needs a new engine for future growth, and quick commerce might be the solution.

Here’s why this move makes sense for them:

- Synergies: Flipkart has existing warehouses, a well-established logistics network, and millions of loyal customers—assets that put it ahead of newer players in the space.

- Data: Quick commerce is not just about delivering products quickly; it’s a goldmine for data. Flipkart can leverage this to predict customer needs and improve their services.

- Market Share Expansion: Quick commerce allows Flipkart to increase its total addressable market, tapping into a high-growth sector.

Also Learn: Is Trading Like Gambling? Exploring the Differences in Day Trading

The Challenge of Unit Economics

Quick commerce is known for its high burn rate. Blinkit, despite its leadership, loses money on every order. Zepto’s rapid growth has also come at a cost, while Swiggy Instamart is expanding aggressively but has yet to achieve profitability.

How can Flipkart succeed where others are struggling? The key metrics to watch are:

- Customer Acquisition Cost (CAC)

- Retention rates

- Order frequency

- Average order value

These will determine whether Flipkart is building a sustainable business or merely buying market share.

Dark Stores: The Backbone of Quick Commerce

Dark stores—small, strategically located warehouses designed for fast deliveries—are critical to success in this space. Flipkart plans to launch 100 dark stores by 2024. The pace is expected to accelerate over the next few weeks, and Flipkart may launch as many as 60 more dark stores in the coming 20 days, as reported.

This puts them on track to compete with Blinkit and Zepto, both of which have a head start. Blinkit already operates 500+ dark stores and plans to scale up to 1,000, while Zepto has 350+ dark stores.

| Company | Number of Dark Stores | Expansion Plans | Sources |

| Flipkart Minutes | 100 (planned by 2024) | Launching ahead of Big Billion Days to compete with Blinkit and Zepto | Outlook Business, Office Chai |

| Blinkit | 500+ | Aiming for 1,000 dark stores by year-end, stores located within 2 km of customers | Office Chai |

| Zepto | 350+ | Rapidly scaling across urban India | Outlook Business, Office Chai |

Outlook: High Risk, High Reward

Flipkart's quick commerce gamble is bold. It could be a masterstroke or a costly misstep, depending on execution. For investors, this adds a new layer of complexity to Flipkart’s valuation. It’s no longer just an e-commerce play; it’s a bet on the future of retail in India.

With the quick commerce sector estimated to have burned through $800 million in 2022 alone, Flipkart's entry raises the stakes. The question remains: Will Flipkart's strategy pay off? Can they outmaneuver Blinkit, outgrow Zepto, and outpace Swiggy Instamart? Only time will tell.

One thing is certain—the Indian retail landscape is about to change, and Flipkart’s move into quick commerce will be closely watched by investors and competitors alike.

Also Read: Explore evolution of Zomato and Swiggy as they transformed from food delivery