This is precisely what has happened in the corporate world, where the July 2024 budget introduced a significant shift in taxation. The government has now shifted the responsibility of paying tax on buyback proceeds from companies to shareholders. While it might seem like a minor adjustment, this change has profound implications for corporate practices related to taxation and share buybacks.

The new tax rule, effective October 1, 2024, has sparked considerable discussion, with many companies hastening to complete their share buybacks before the deadline. This leads us to discuss share buybacks and how these rule changes affect all parties involved.

What are share buybacks?

In the world of corporate finance, shares are crucial components of a company’s capital and are offered to the public to raise funds for business activities. A share buyback, also known as a stock repurchase, occurs when a company buys back its shares from shareholders, typically at a premium over the current market price.

For instance, if Mr A bought 10 shares of XYZ Ltd. at ₹50 each 10 years ago, his total investment would be ₹500. Now, if XYZ Ltd.'s shares are trading at ₹290 each, and the company offers a buyback at ₹300 per share, Mr A could sell his 10 shares back for ₹3,000.

Why do companies conduct share buybacks?

Shareholders are essential to a company's growth and success, and companies often reward them with dividends, bonus shares, and stock splits. Share buybacks are another method to return value to shareholders while allowing companies to regain control over their equity holdings.

For shareholders, buybacks can provide immediate returns on their investments, often at a premium to the prevailing market price. Additionally, buybacks reduce the number of shares in circulation, potentially increasing key financial metrics like Earnings Per Share (EPS) and share prices, which further benefit shareholders.

Also Learn: Swing Trading vs. Intraday Trading: What’s the Difference?

Why have they changed the law?

The revised share buyback rules aim to simplify corporate taxation and encourage companies to utilize their surplus cash for share repurchases. By removing the buyback tax, the government intends to streamline the process, making it easier for businesses to engage in share buybacks.

Previously, the buyback tax was imposed to prevent companies, particularly unlisted ones, from using buybacks as a tax-avoidance strategy, bypassing the dividend distribution tax. The revised rules are designed to ensure fair tax practices and reduce opportunities for tax avoidance.

The Impact of Eliminating the Buyback Tax on the co

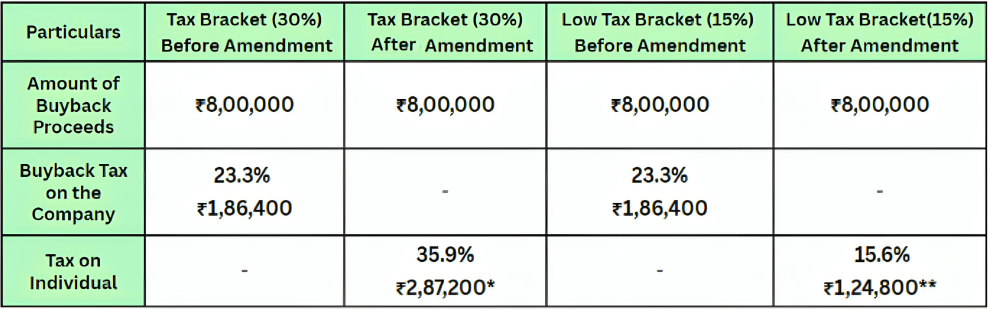

To fully understand the impact of the new tax laws, let's compare the old and new taxation systems with an example:

Imagine Mr. A bought shares in XYZ Ltd. at ₹5 lakhs. If XYZ Ltd. decides to buy back its shares for ₹8 lakhs and Mr A offers his shares, then-

Under the Old Tax Law:

The ₹3 lakhs capital gain that Mr A received would be exempt from taxation in his hand, whereas the company conducting the buyback would have to bear the tax burden. The tax was calculated at 23.3% of the Buyback Proceeds.

(23.3% of ₹800000 = ₹186400)

Under the New Tax Law:

The entire ₹8 lakhs that Mr. A receives from the buyback will be treated as dividend income and taxed according to his income tax slab (ranging from 5% to 30%). Mr. A’s original investment of ₹5 lakhs will now be considered a capital loss, which can be offset against capital gains and will be allowed to carry forward for the next 8 years.

Typically, capital gains are taxed, and there’s no clear indication in taxation laws about considering the original investment a capital loss. However, capital losses can be offset against gains.

*For those in the highest income bracket, earning over ₹15,00,000, the effective tax rate comes to around 35.9%. This includes the standard 30% tax, with the highest surcharge limited to 15%, plus an additional 4% for health and education cess.

**For those with an income between ₹10,00,000 and ₹12,00,000, the effective tax rate is roughly 15.6%, which covers the basic 15% tax and a 4% health and education cess.

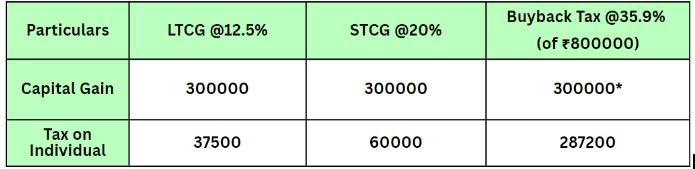

From the above table, we can see how the burden of tax fell on the individuals and the companies were exempt from it. Another point of concern would be the difference in tax treatment in case the gain was taxed under capital gains or under the buyback laws, which is shown in the table below-

*Despite the gains being 300000, the new law taxes the entire proceeds of 800000 at 35.9% (Assuming Mr. A falls under the 30% tax slab) and he ends up paying 95.7% of his actual gains.

Also Read: SEBI New Stock Market Rules to Take Effect From Oct 1, 2024

Is it more harmful than beneficial?

While the elimination of the buyback tax appears to benefit corporations, it places a heavier tax burden on shareholders, particularly those in higher tax brackets. Under the old system, shareholders like Mr. A enjoyed tax exemptions on buyback proceeds. Now, they may face higher taxes on the entire buyback amount, treated as dividend income. Although offsetting capital losses is possible, it feels more like a minor consolation than a significant benefit.

This shift may lead to the avoidance of buybacks by the companies. Shareholders may demand greater transparency and justification for buybacks during meetings, possibly advocating for other forms of capital return that are less tax-punitive. If companies persist with buybacks without addressing these concerns, investors may not offer their shares for the buyback.

Conclusion

With the removal of the 20% buyback tax, companies are rethinking their strategies. For shareholders, the benefits seem minimal, as the new rules increase their tax burden while offering limited advantages. Policymakers might have complicated the system rather than simplifying it, making tax calculations more challenging for shareholders.

To stay ahead, shareholders should remain updated about these changes, make well-informed decisions, and seek advice from financial or legal professionals to navigate this new landscape effectively.