The investment landscape in India is undergoing a remarkable transformation. Not too long ago, value stocks were the darlings of Indian investors, prized for their stability and steady returns. However, the tables have turned, and growth stocks are now stealing the spotlight.

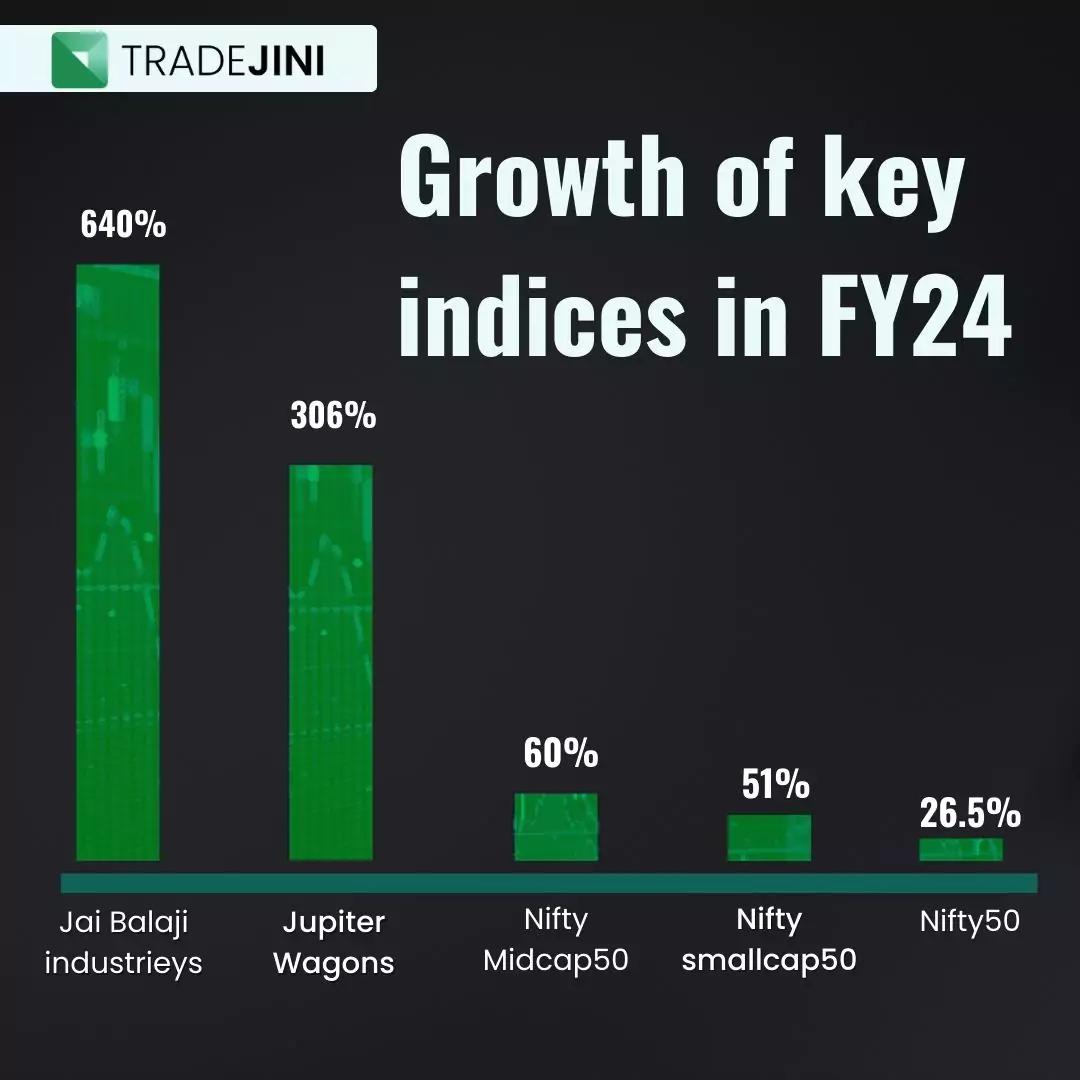

Over the past year, the Nifty Midcap 100 and Smallcap 100 indices have surged by an astonishing 51% and 60%, respectively. In comparison, the Nifty 50, a benchmark for large-cap stocks, rose by a more modest 26.5%. This sharp contrast in performance has caught the attention of many investors.

But the real surprise? More than 120 stocks in the mid and small-cap categories have more than doubled in value during FY 2024. These numbers are hard to ignore and have sparked a significant shift in investor behavior. Indian investors, traditionally conservative and value-oriented, are now showing a growing preference for growth stocks. This shift begs the question: What’s driving this change?

Understanding Growth and Value Investing

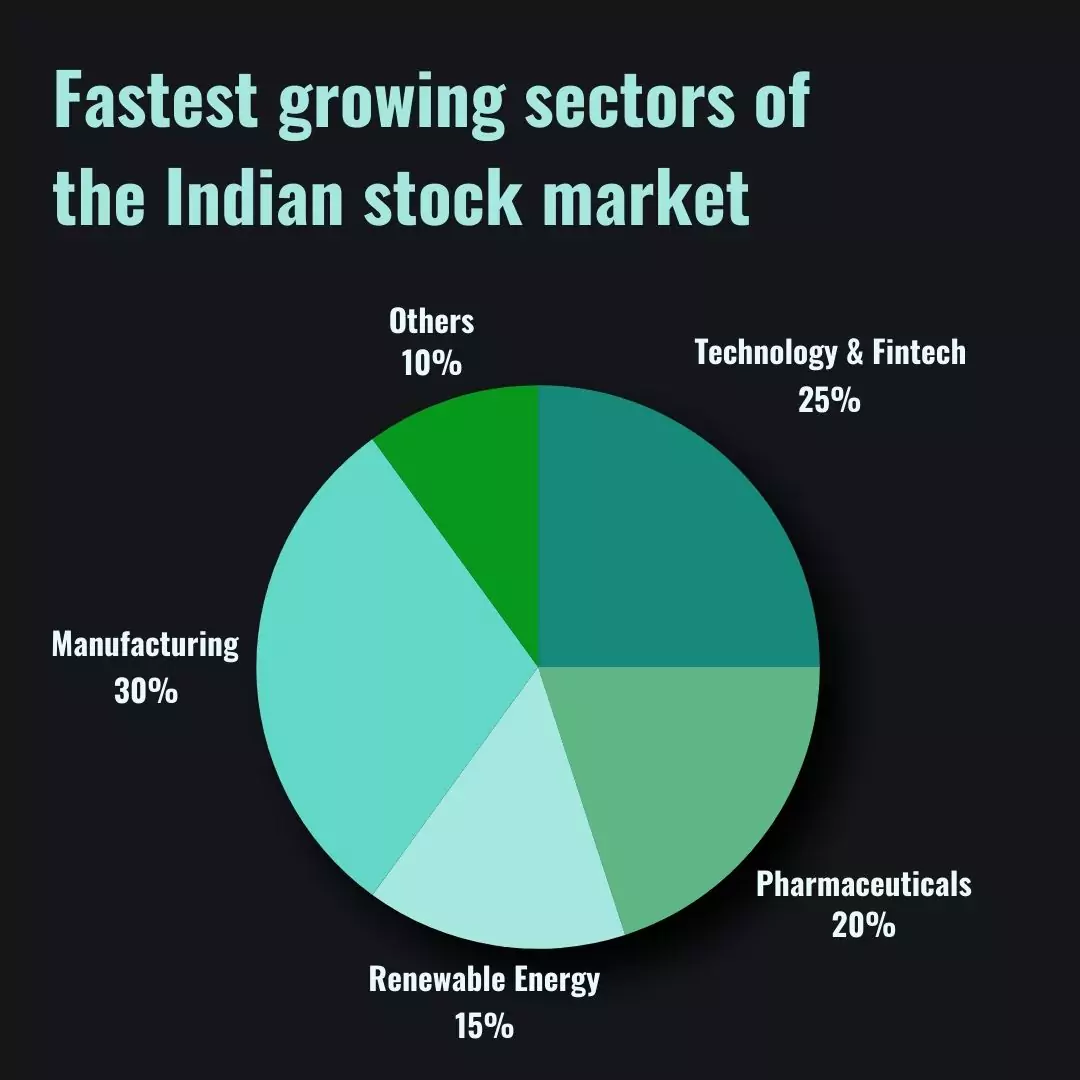

First, let’s get the basics out of the way. Growth stocks are those that are expected to grow at an above-average rate compared to other companies. They often belong to sectors like technology, pharmaceuticals, or renewable energy. These stocks typically have higher P/E (Price to Earnings) ratios, meaning they’re more expensive relative to their earnings.

On the other hand, value stocks are considered underpriced. They might not be growing rapidly, but they are stable and often pay dividends. Value stocks are usually found in more mature industries like utilities, banking, or consumer goods. Historically, these stocks were the go-to choice for many investors, especially those who preferred safety and steady returns.

But times have changed.

Also Learn: The Impact of the 2024 Iran-Israel War on India's Stock Market

Indian Economic Boom

India’s economy has been on a strong growth trajectory. In the fiscal year 2023-24, the country recorded an impressive GDP growth of 8.2%. That’s not a number to ignore. And it’s expected to continue growing, with forecasts predicting a growth rate of 7.0-7.2% for FY 2024-25.

This robust economic growth has played a significant role in shifting investor sentiment. As the economy expands, companies that are poised to grow rapidly, like those in the technology or renewable energy sectors, become more attractive. These sectors are where the growth stocks live. They promise higher returns, and in a booming economy, investors are more willing to take on the risks associated with these stocks.

Sectors Driving the Shift

Let’s talk about some of the key sectors that are driving this shift.

Technology and Fintech

India’s technology and fintech sectors are expanding at a rapid pace. The fintech market alone, which was valued at $50 billion in 2021, is expected to triple by 2025. With government support and a surge in digital adoption, tech stocks have become the darlings of the growth investing world.

Pharmaceuticals

Besides tech, India has been a global leader in pharmaceuticals, ranking third in the world by production volume. The industry is expected to grow at an annual rate of 11-12%, reaching $65 billion by 2024. Investors are drawn to the potential for significant returns in this sector, particularly in a world where health and medicine are increasingly in focus.

Renewable Energy

The push towards renewable energy is another major factor. India has set ambitious goals, like reaching 500 GW of non-fossil fuel capacity by 2030. As the world moves towards greener energy, companies in this sector are expected to see substantial growth. This has made renewable energy stocks particularly attractive to investors looking for long-term growth.

But it’s not just these sectors that are growing. The manufacturing sector is also on the rise. With strong sales in electrical machinery, automobiles, and non-ferrous metals, this sector has caught the attention of growth-focused investors.

Rise of Retail Investors

Another significant factor behind this shift is the rise of retail investors. Over the past few years, there has been a massive increase in the number of retail investors entering the stock market. The number of Demat accounts (which are required to trade stocks in India) has skyrocketed from around 4 crores (40 million) in early 2020 to over 15 crores (150 million) by mid-2024.

These new investors tend to be younger and more willing to take risks. They are attracted to the high potential returns that growth stocks offer. This new breed of investors is not just investing directly in stocks, but also pouring money into mutual funds, particularly those that focus on growth stocks.

Systematic Investment Plans (SIPs) have also played a crucial role. SIPs allow investors to regularly invest small amounts of money into mutual funds. As more money flows into these funds, fund managers are compelled to buy more stocks, including growth stocks, further driving up their prices.

Performance of Mid and Small-Cap Stocks

The performance of mid and small-cap stocks is another major factor behind the preference for growth stocks. Over the past year, the Nifty Midcap 100 and Smallcap 100 indices have soared by 51% and 60%, respectively. These numbers are staggering, especially when compared to the 26.5% increase in the Nifty 50 index during the same period.

This kind of performance is hard to ignore. Investors who might have previously focused on large-cap value stocks are now looking at mid and small-cap growth stocks for better returns. It’s worth noting that some of these stocks have delivered extraordinary returns. For instance, Jai Balaji Industries saw its stock price increase by 640% in FY 2024.

These returns have further fueled the appetite for growth stocks among Indian investors.

Changing Consumer Behavior

There’s also a shift happening in how consumers spend their money. Both rural and urban consumers are moving away from just buying essentials and are starting to spend more on discretionary goods and services. This shift is a reflection of changing lifestyles, with people buying more cars, electronics, and luxury goods.

As consumer behavior changes, companies that cater to these new demands are likely to grow faster. Investors, recognizing this trend, are turning to growth stocks in these sectors, betting on the continued rise in consumer spending.

Risks of Growth Investing

Of course, it’s not all smooth sailing. Growth stocks come with their own set of risks. One of the biggest concerns right now is the high valuations of these stocks. Many growth stocks, particularly in the mid and small-cap segments, are trading at premium valuations.

These high valuations mean that the stocks are more expensive compared to their earnings. This could lead to volatility, especially if the companies fail to meet their growth expectations. There’s also the risk of a market correction, where the prices of these overvalued stocks could drop significantly.

Investors need to be cautious. While the potential for high returns is attractive, the risks are equally high.

Growth vs. Value Debate

Now, let’s shift our focus to a debate that has been at the heart of investing for decades: growth versus value investing. With the surge in growth stocks, many investors might wonder if value investing still holds its ground.

Historically, value investing was the go-to strategy for conservative investors. Value stocks are often seen as less risky because they represent companies that are stable and well-established. They might not grow rapidly, but they offer steady returns and dividends. This made them appealing, especially in uncertain economic times.

However, the appeal of growth stocks lies in their potential. Growth stocks represent companies that are expected to increase their earnings at a faster rate than the market average. They may not pay dividends, but the appreciation in their stock prices can be significant. In a booming economy like India’s, where certain sectors are expected to grow rapidly, investors are willing to take on the higher risk associated with growth stocks.

But does this mean value investing is obsolete? Not necessarily.

Balancing Growth and Value

It’s important to recognize that the best investment strategy might not be about choosing one over the other. Instead, it could be about finding a balance that suits your risk tolerance and investment goals.

Value stocks can still play a crucial role in an investment portfolio. They offer stability, especially during market downturns. While growth stocks can provide high returns, they also come with higher volatility. In contrast, value stocks tend to be less volatile and provide a safety net during turbulent times.

Some seasoned investors recommend a diversified approach. This involves holding a mix of both growth and value stocks. By doing so, you can take advantage of the high returns from growth stocks while also enjoying the stability and income provided by value stocks.

Learn About: Can Government Employees Do Trading in the Stock Market?

Expert Opinions on the Trend

Market experts have mixed views on the current trend towards growth investing. Some believe that the high valuations of growth stocks, especially in the mid and small-cap segments, are unsustainable. They caution that these stocks are vulnerable to sharp corrections if economic conditions change or if the companies fail to meet their growth expectations.

On the other hand, there are those who argue that India’s economic fundamentals remain strong, and as long as the economy continues to grow, so will the companies that drive this growth. They point to the ongoing investments in infrastructure, technology, and renewable energy as signs that growth stocks still have plenty of room to run.

What’s the Future of Investing in India?

So, what does the future hold for Indian investors?

The trend towards growth investing is likely to continue, at least in the near term. As long as India’s economy remains on a strong growth path, sectors like technology, pharmaceuticals, and renewable energy will continue to attract investor interest.

However, it’s essential to keep an eye on the risks. High valuations, market corrections, and economic uncertainties could all impact the performance of growth stocks. Investors who are heavily invested in these stocks should be prepared for potential volatility.

At the same time, value investing will likely see a resurgence, especially if the market experiences a downturn. During such times, the stability and income provided by value stocks become more appealing. Therefore, a balanced investment strategy that includes both growth and value stocks might be the most prudent approach.

Also Read: Stockbrokers Explained: Meaning, Types, and Additional Insights