Many individuals enter the stock market with high hopes of making substantial gains and sky-high ambition, where they earn profits in crores, but often end up facing significant losses. The primary reason for this is a lack of knowledge and guidance. Choosing the right mutual fund in India can be transformative for these investors, as it provides access to extensive stock market expertise and guidance for a reasonable fee. With a vast array of mutual fund options available, each claiming high returns and various advantages, the decision-making process can be overwhelming. However, by understanding the critical factors that affect mutual fund performance and aligning them with your financial objectives, the process becomes more manageable. This comprehensive guide aims to demystify mutual funds in India, offering expert advice and insights to help you make well-informed investment choices. Whether you're an experienced investor or just starting out, this article will arm you with the knowledge needed to navigate the mutual fund landscape and build a strong, diversified portfolio.

A mutual fund (MF) is an investment vehicle where multiple investors pool their money together. The combined assets are then used to invest in a variety of securities to achieve the fund's investment objectives. There are many different kinds of mutual funds to choose from, which can be daunting for some investors given the sheer number of options available.

Why invest in mutual funds?

MFs are a great way to make money from the capital market when the investor does not or cannot spend all day long in front of the screen analysing the market. The cost-effectiveness and ease of access are what attract many to the professional risk management services that come complimentary to investing in MFs. Additionally, the government provides tax benefits for investing in Equity Linked Saving Schemes(ELSS) and the minimum amount required to start a Systematic Investment Plan (SIP) is reduced to ₹500 from ₹1000, and just ₹100 for Lump-sum making it more welcoming to new investors.

Types of MF

Equity Funds: These funds are invested primarily in company stocks, which is suitable for investors with a higher risk-taking appetite. This can be put into large-cap, mid-cap, small-cap, multi-cap, sectorial, index, etc.

Debt Funds: Here the aim is to provide regular income and capital preservation by investing in bonds, treasury bills, corporate debentures, etc. Here, the investment horizon is shorter and is suitable for investors with a low to moderate risk appetite.

Hybrid Funds: A mix of equity and debt securities makes a hybrid fund, this balances the growth and income of the MFs, which brings a moderate level of risk along with a medium to long-term horizon.

History

It is thought that the Dutch invented mutual funds in 1774 with the intention of luring investors in with diversified investments using little initial capital. The first Indian Mutual Fund was an initiative by the Government of India under the banner of the Unit Trust of India and the Reserve Bank of India to encourage saving, investment, and participation in the profits and gains accruing to the Corporation from the acquisition, holding, management and disposal of securities.

INTERESTING FACTS: A man by the name of Van Ketwich founded the first mutual fund scheme, Eendragt Maakt Magt, which means ‘unity creates strength.’

Now, let's talk about how to select mutual funds

Factors to consider a category

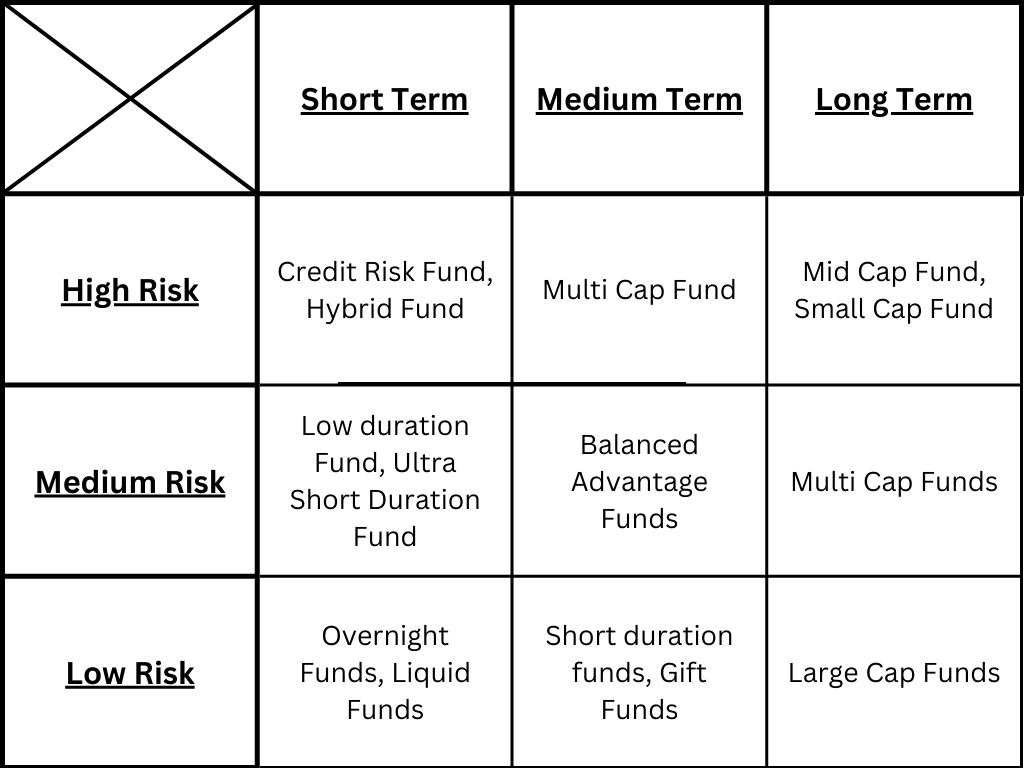

- Investment Goal: The first step in investing is to identify your financial objectives. As soon as you realize how much risk you can tolerate, an individual who finds it difficult to deal with market volatility should invest in bonds; those who are willing to take on more risk should put their money into aggressive hybrid funds or equity funds, which also yield high returns.

- Time Horizon- Investment goals and time horizon go hand in hand. This implies that you must choose the appropriate mutual fund (MF) for your needs to determine the duration of your market investment. For instance, an investment made for a significant purchase, such as a car, after a year should ensure that your money market matures at that point and is liquid when needed.

- Risk Tolerance: An investor's ability to tolerate risk is based on their capital and level of risk appetite. It is critical to determine your bear market volatility tolerance to select the appropriate funds. For example, a person with a higher risk tolerance would invest in small and mid-cap stocks; if your tolerance is lower, you should go with large-cap stocks.

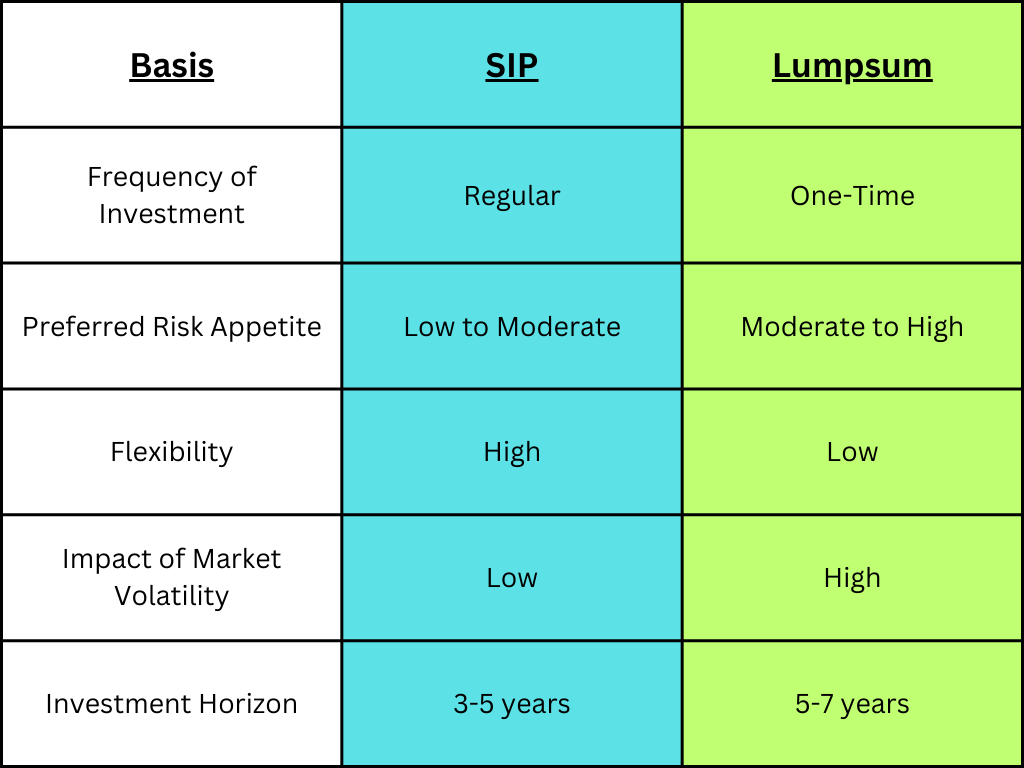

SIPs and Lump-sum

A great way to create wealth over time is through a SIP plan, which is a method for investors to invest a fixed amount of money regularly into mutual funds. They are better in volatile markets.

While lump-sum investing is a one-time investment of the complete amount at the beginning of the investment period, there is no subsequent payment made in this method, which can be done as an investment, insurance premium, retirement plan, and more. This can give a potential higher return if markets are steadily growing.

SIP is safer for volatile markets, while Lump Sum can be more rewarding when markets are rising steadily.

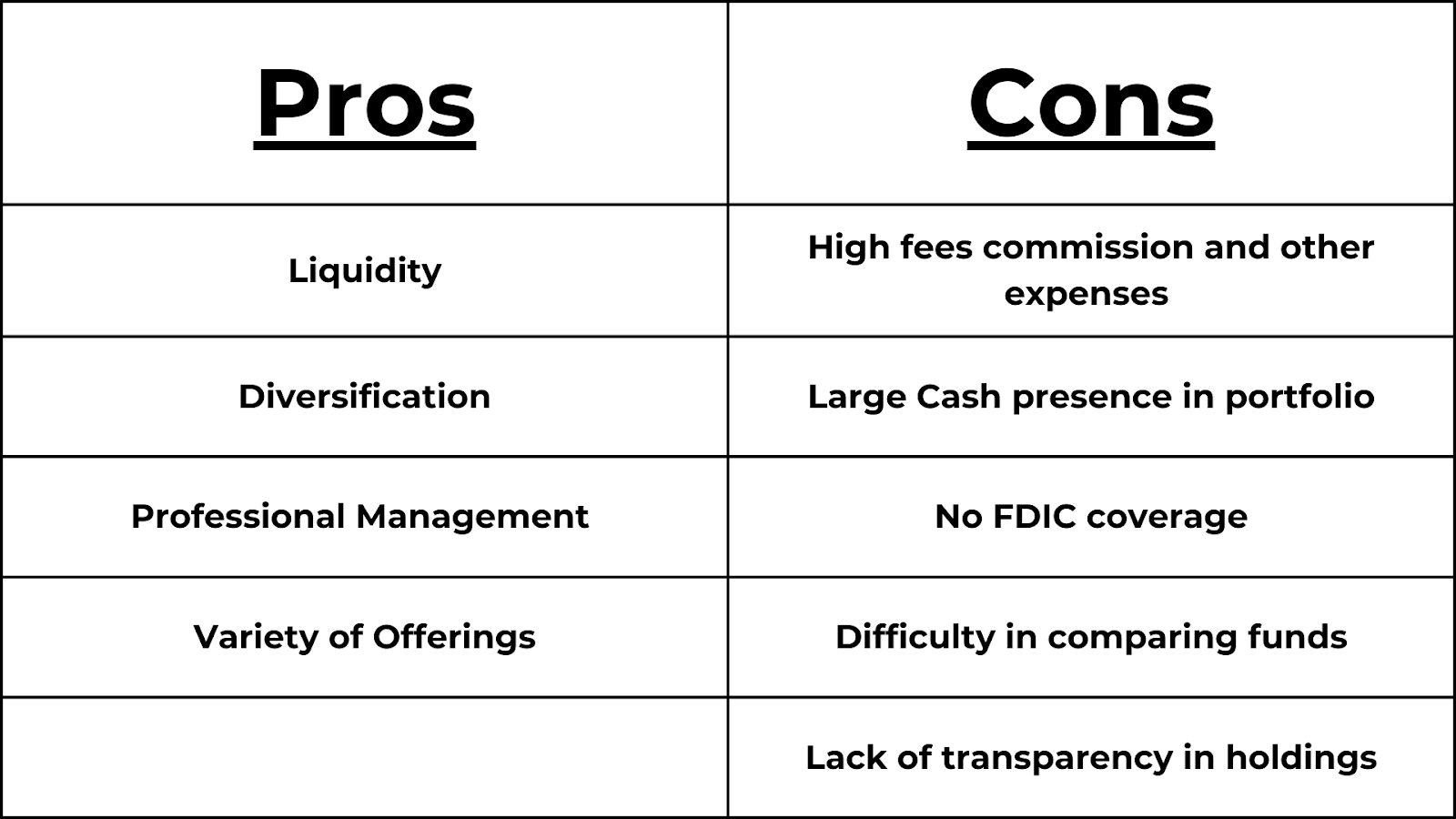

Pros and Cons

SIPs vs Lump-sum

FUN FACTS: You can save taxes by using mutual funds. This is done by investing in ELSS funds, which provide you with a tax rebate.

Factors to consider for a mutual fund

- AMC Performance: Before investing in an asset management company (AMC), investors must evaluate the AMC's performance. You can research the AMC and the top-picked stocks by them. Some funds may underperform but the overall track record is what matters here.

- AUM of the AMC- AUM tells you how many investors are involved in the MF. A large AUM inequity tell the assets are highly liquid, but also has the disadvantage of not being able to enter and exit a company as and when.

- Expense Ratio- Investing in MF also brings costs and fees related to it, which are managerial and operational charges as these funds are managed by professionals.Normally, the expense ratio comes in between 1-2 percent and sometimes even less than 1% and the slightest change can also be beneficial for an investor. Another factor to keep in mind is the exit load of an MF. This is because some of them will require some fees to exit before maturity if not it will be free.

- Net Asset Value- In most cases, a higher Net Asset Value (NAV) indicates a lower potential for growth while a lower NAV MF expects a higher return, but this cannot be true in every case because sometimes the manager would invest in quality stocks and bonds that would get a high return.

- Fund Performance- Investors should consider the historic performance of the funds. This will tell you how much return that fund in that category has given its investors. Compounding Annual Growth Rate (CAGR) is a tool to know how well the fund is performing. Benchmark indices serve as the standard for comparing a fund's performance and asset allocation within a specific category to other similar schemes.

Find the right Mutual Fund for you according to your risk tolerance

INTERESTING FACTS: Mutual Funds provide you Dividend !

There are certain MF Schemes that completely hold companies known to give good dividends and that becomes short term gain for the investor.

Governmental mutual fund schemes

Gilt funds are a type of debt mutual fund that primarily invests in government securities or Government Sectors. According to Sebi regulations, these funds must put at least 80% of their assets into government securities, meaning they are essentially lending to the government. Because of this focus, they have no credit risk or risk of default. However, they are highly sensitive to fluctuations in interest rates.

Investing in gilt funds can be challenging due to their sensitivity to interest rate changes. It's crucial to stay informed about shifts in the economy's interest rates. For instance, rates are expected to rise soon, and these cycles typically last several years. As mentioned, this can negatively affect gilt fund performance.

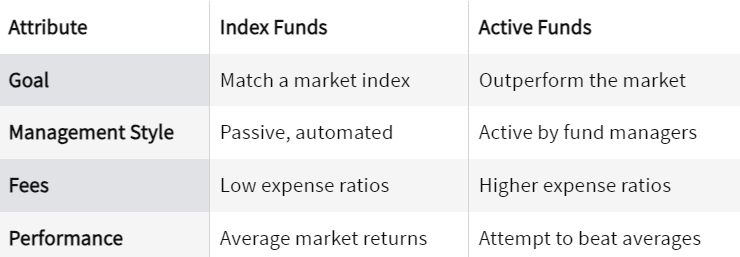

Active Mutual Funds VS Index Funds

The bottom line

To sum up, selecting the right mutual fund requires thoughtful consideration of various factors that align with your financial goals, risk tolerance, and investment timeline. Start by determining your investment objectives and time horizon, which will guide you toward suitable mutual fund categories such as equity, debt, or hybrid funds. Understand your risk tolerance and choose funds that match your comfort level with market fluctuations.

Ultimately, the best mutual fund for you is one that supports your financial goals, aligns with your risk appetite, and offers a track record of reliable performance. Regularly review your investment portfolio to ensure it continues to meet your needs and adjust your strategy as necessary. With careful planning and informed decision-making, you can navigate the world of mutual funds confidently and work toward achieving your investment objectives.

Also Read: Pump and Dump Schemes Explained: Tips for Safe Investing