Apply for

Upcoming IPOs

Open your FREE demat Account in minutes!

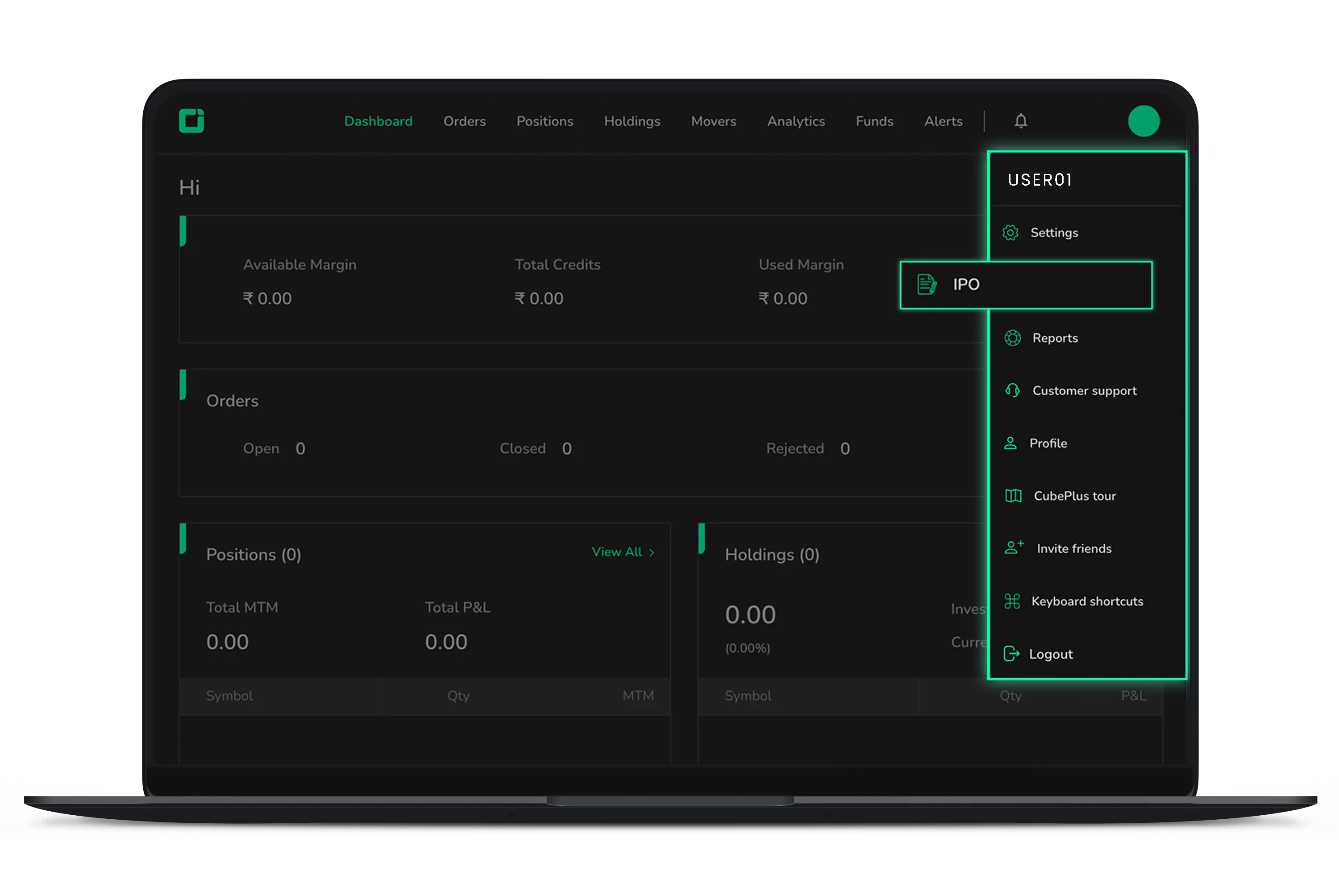

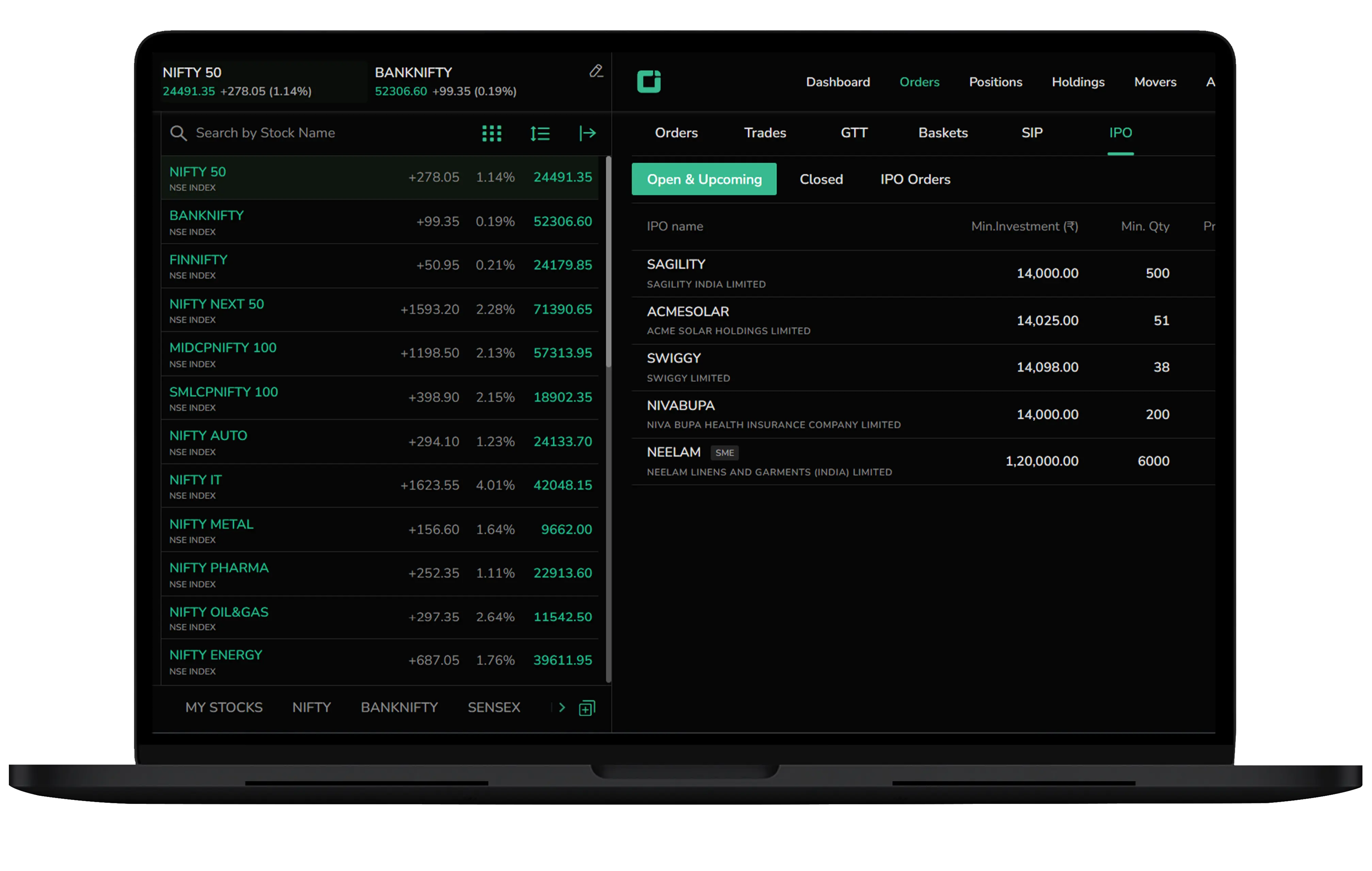

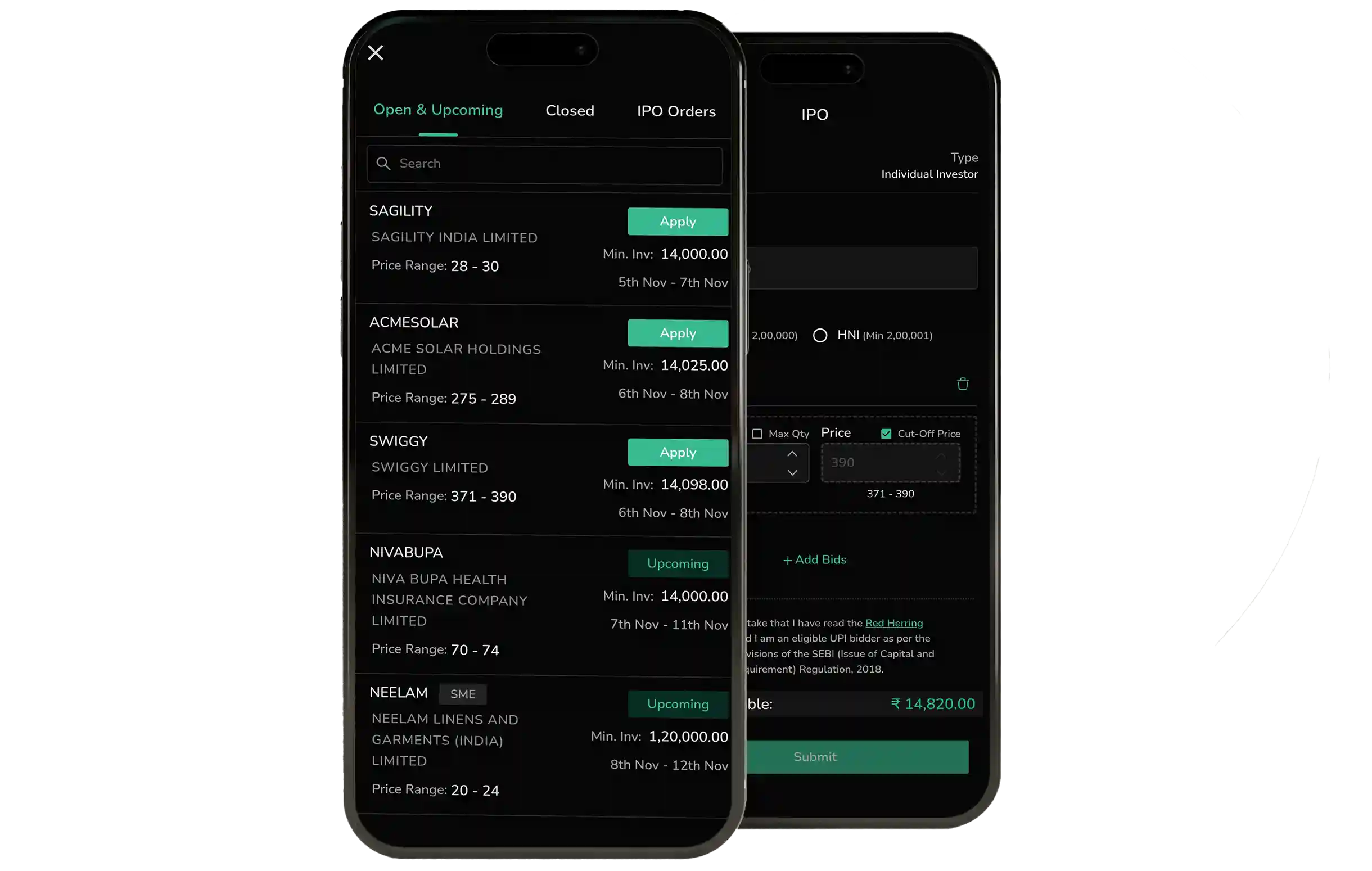

Apply for Ongoing and Upcoming IPOs with Tradejini

There are no upcoming IPOs available at the moment.

About IPOs

An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time and becomes publicly traded on a stock exchange. This allows the company to raise funds from retail and institutional investors, which can be used for purposes like business expansion, improving infrastructure, launching new projects, or paying off debts. For investors, an IPO provides an opportunity to invest early in a company and potentially benefit from its growth. However, it also involves risks, so careful analysis of the company’s financials and growth prospects is essential before investing.

Who Can Apply for an IPO in India?

To participate in an IPO in India, investors must meet certain eligibility criteria set by SEBI. The following types of investors can apply for an IPO:

Retail Investors

Individuals who wish to invest in IPOs.

Qualified Institutional Buyers (QIBs)

Institutional investors like banks, insurance companies, etc.

High Net-Worth Individuals (HNIs)

Investors with high capital can apply for larger amount of shares.

Key requirements for investors include

Minimum Age

Investors must be at least 18 years old.

Bank Account

Must have a working bank account, sufficient funds, and internet banking access.

Demat Account

A Demat account with a registered Depository Participant (DP) to hold IPO shares.

Trading Account

Trading account to sell or buy more shares post-listing.

PAN Card

A valid PAN for identification.

Apply for IPOs in Just 3 Steps!