Unlock Elite Trading

Performance

Performance

Open a free Demat account in minutes.

Fast Execution

Built on institutional-grade infrastructure

Pro-Level

Support & tools designed by traders, for traders

Stocks

Options

Futures

Commodity

Mutual Funds

ETF

Bonds

IPO

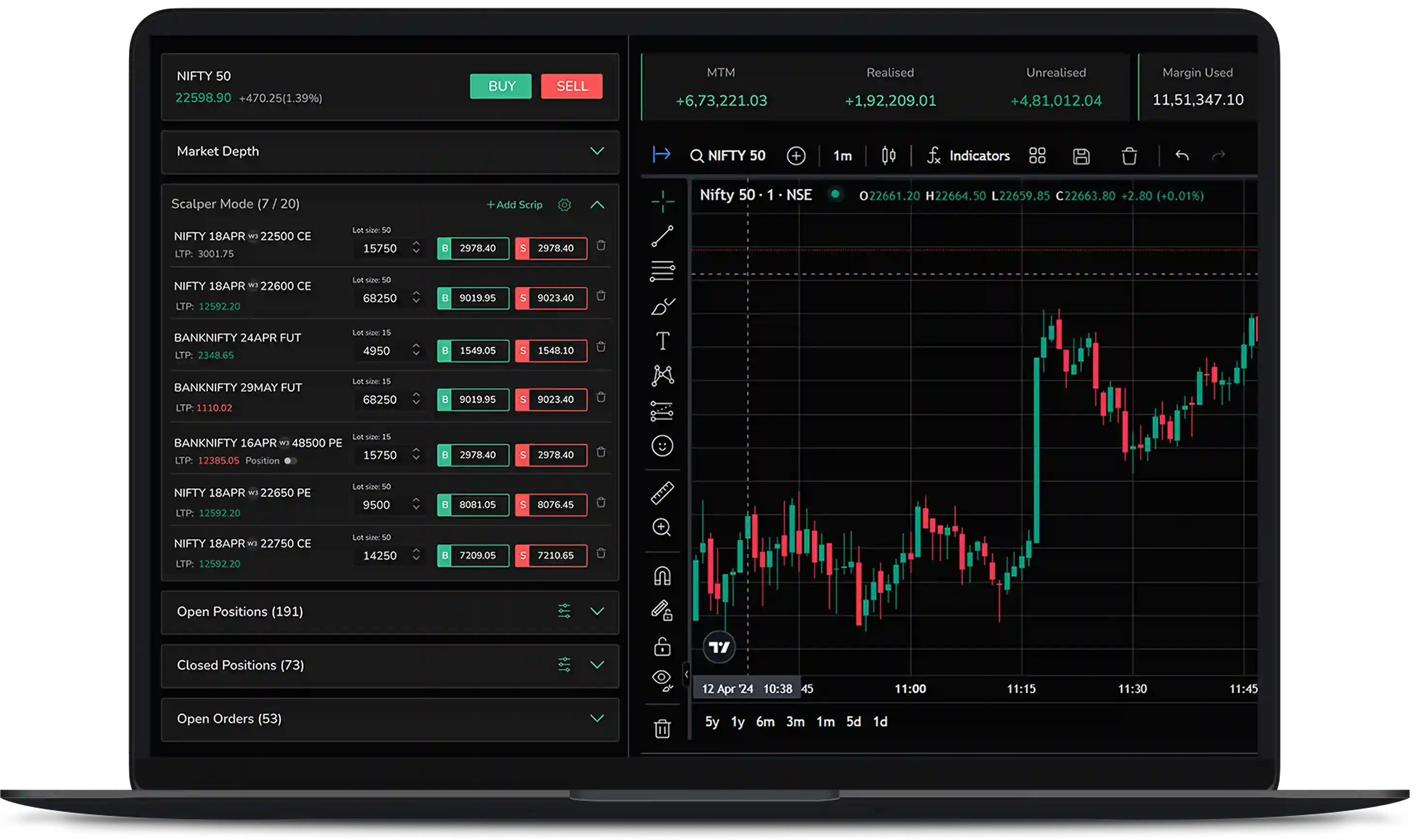

Built for Every Trader

We're on a mission to provide advanced trading tools and experiences for every kind of

trader. Whether you're a professional options trader, a high-speed scalper, or a long-

term investor, we have the features that matter to you!

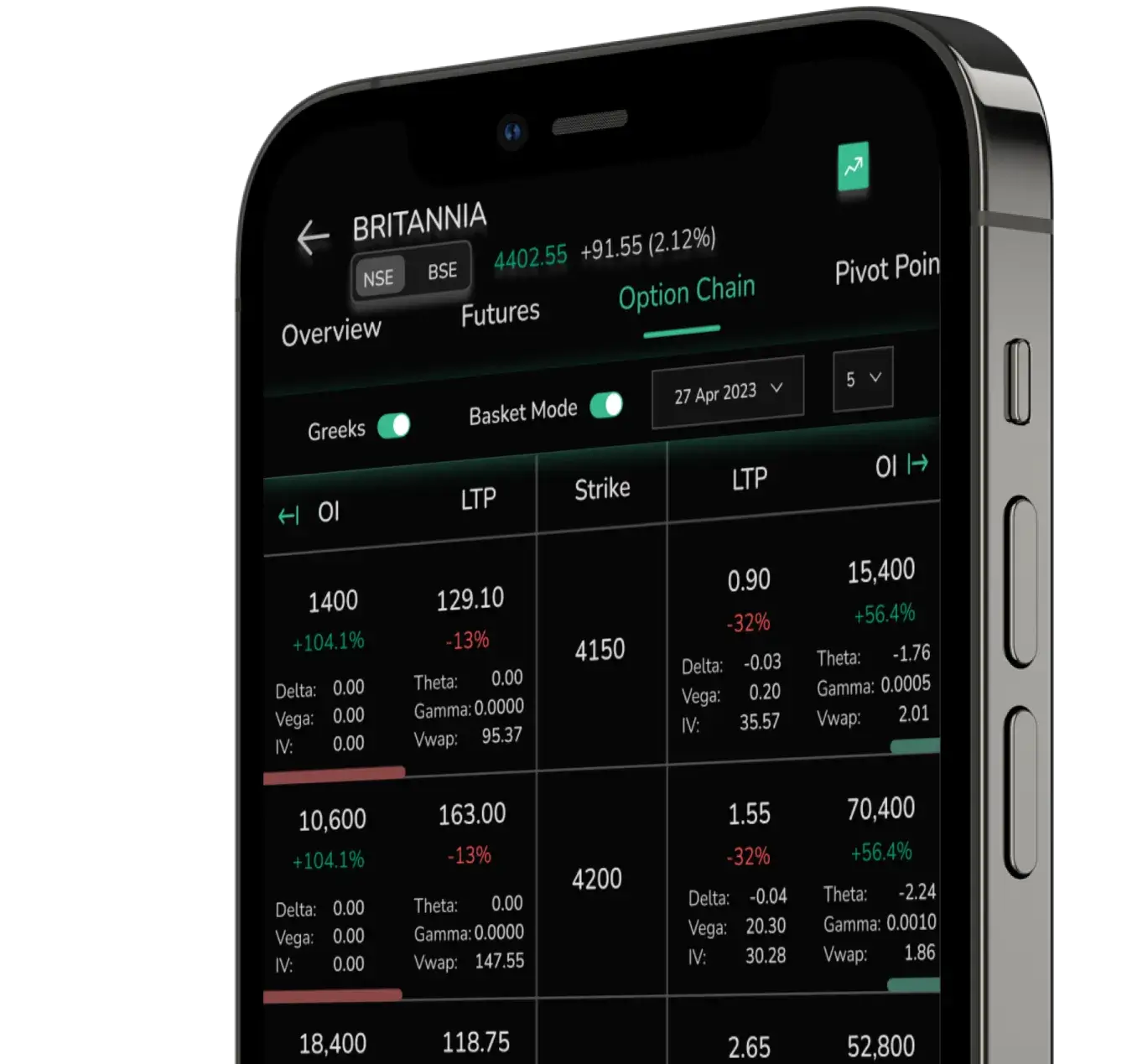

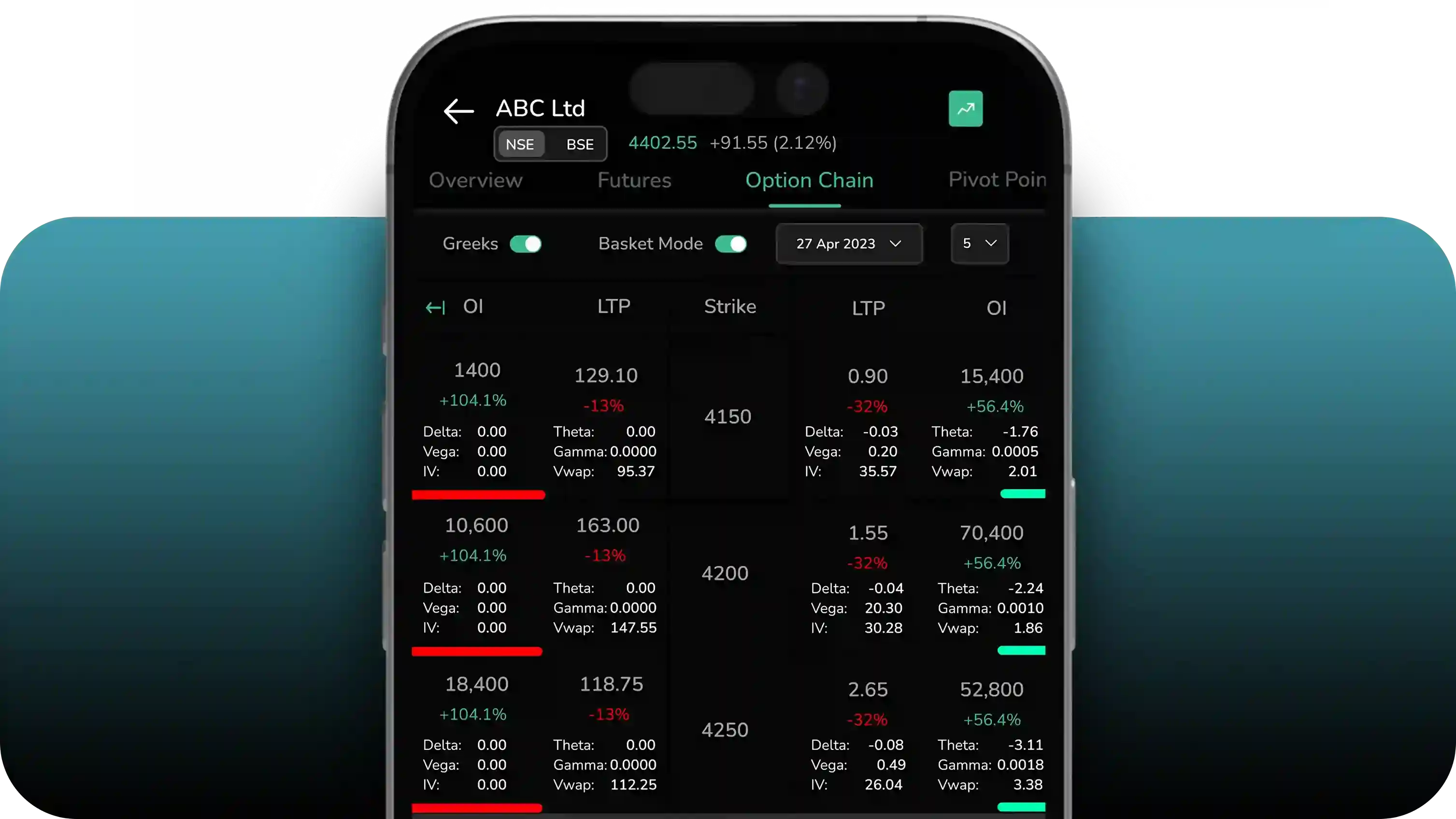

Option Traders

Real-time options data with Greeks and volatility metrics for precise analysis.

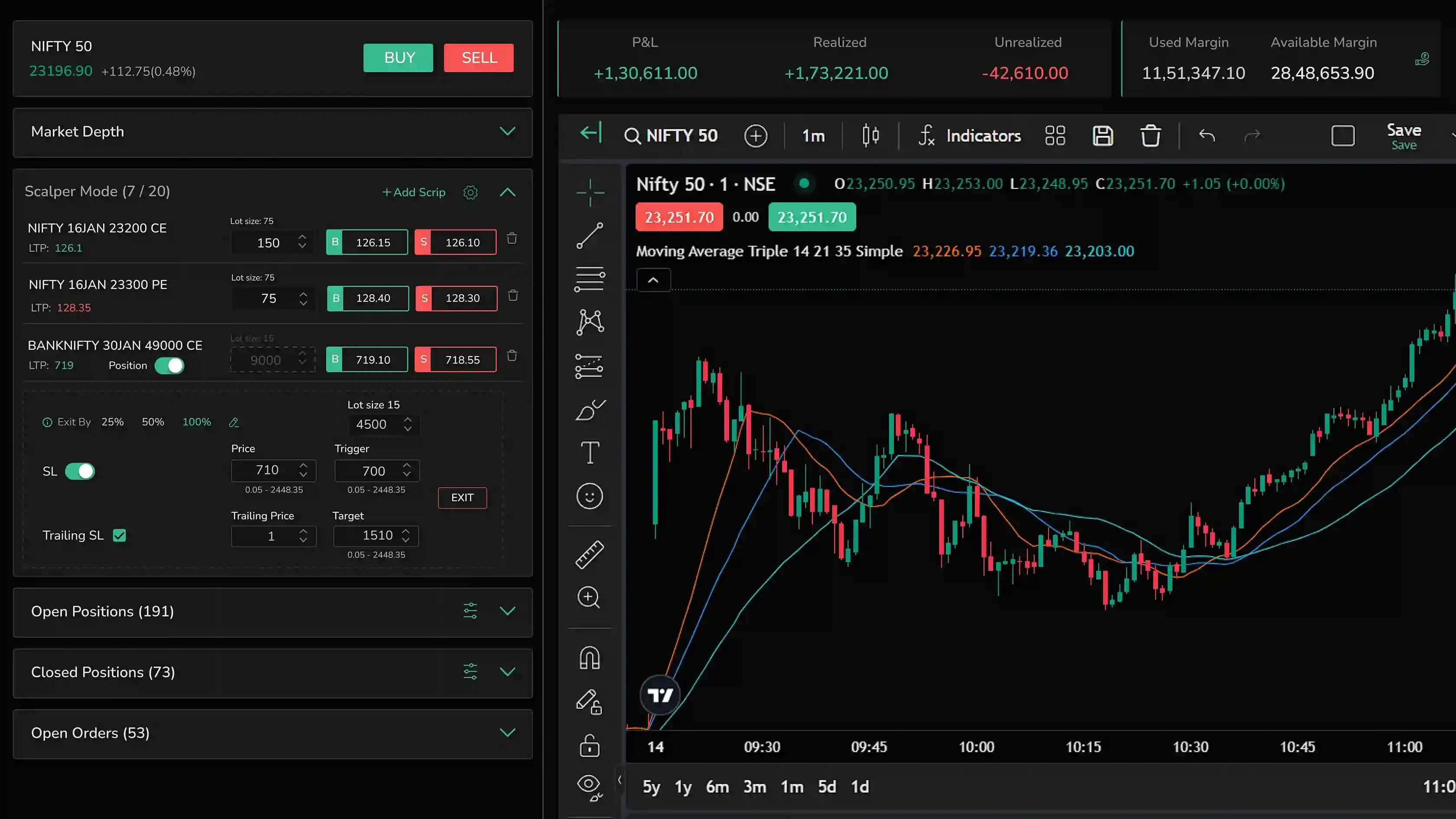

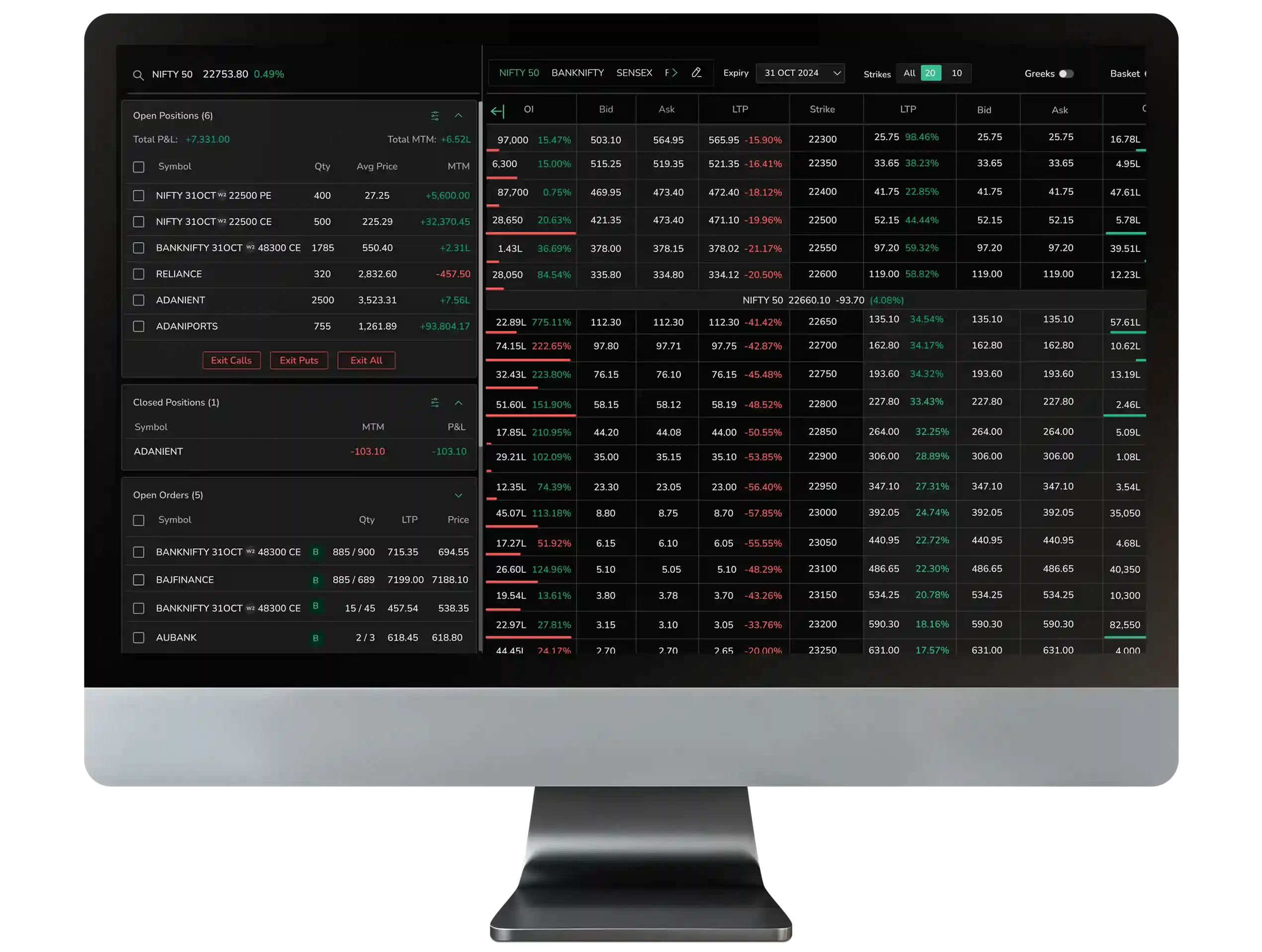

Scalpers

High-speed tools for precise and lightning-fast market execution.

Investors

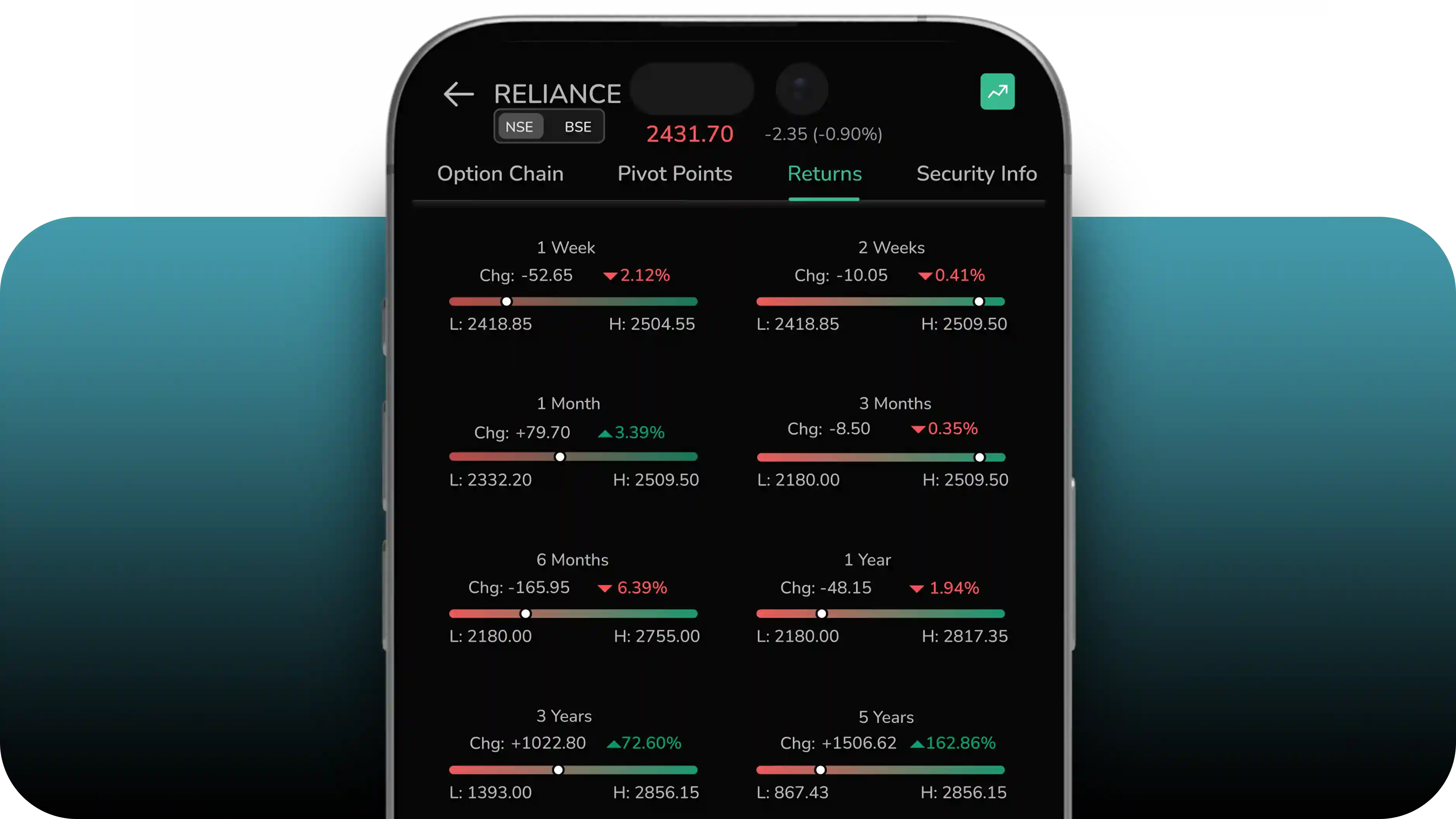

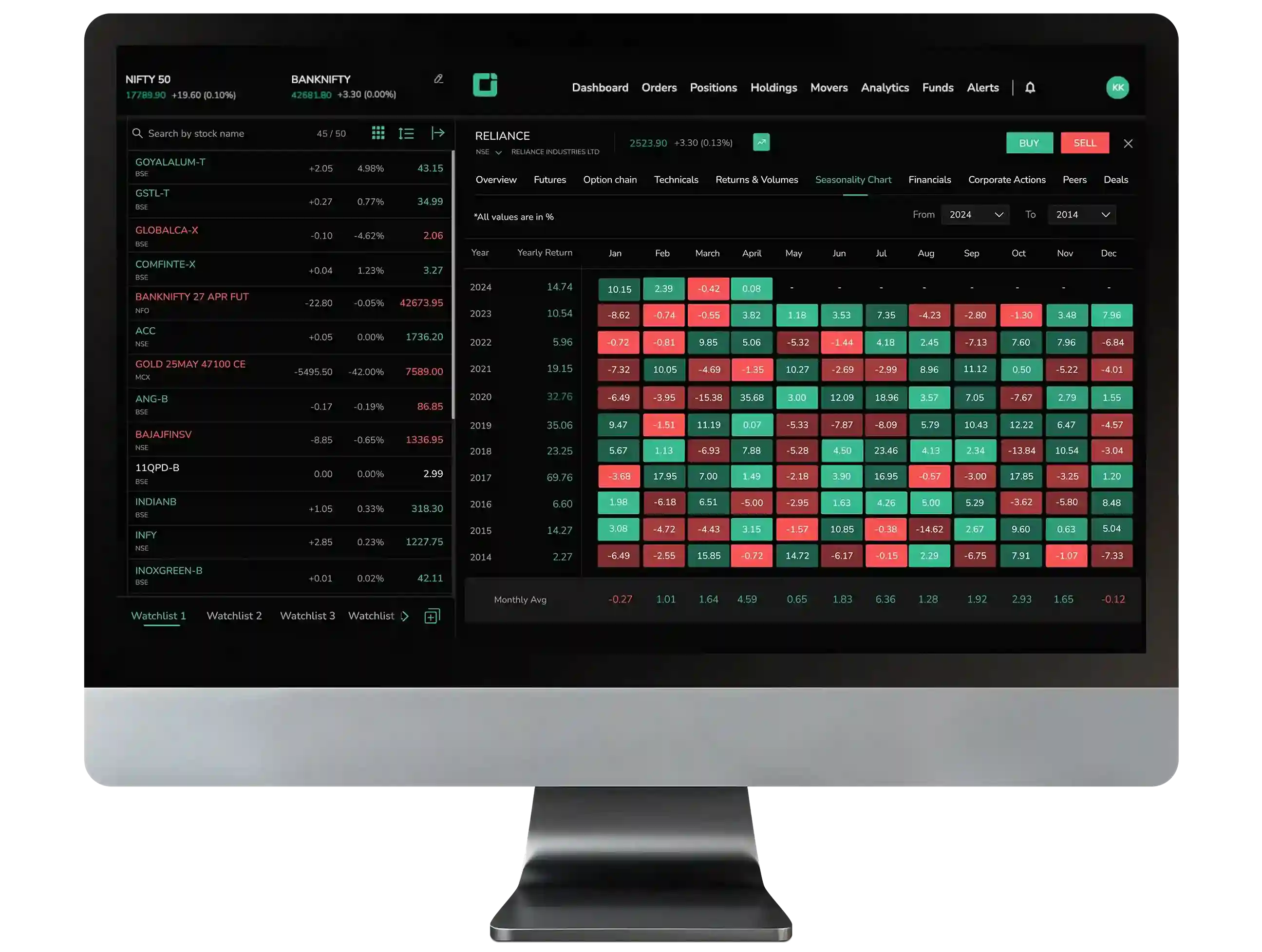

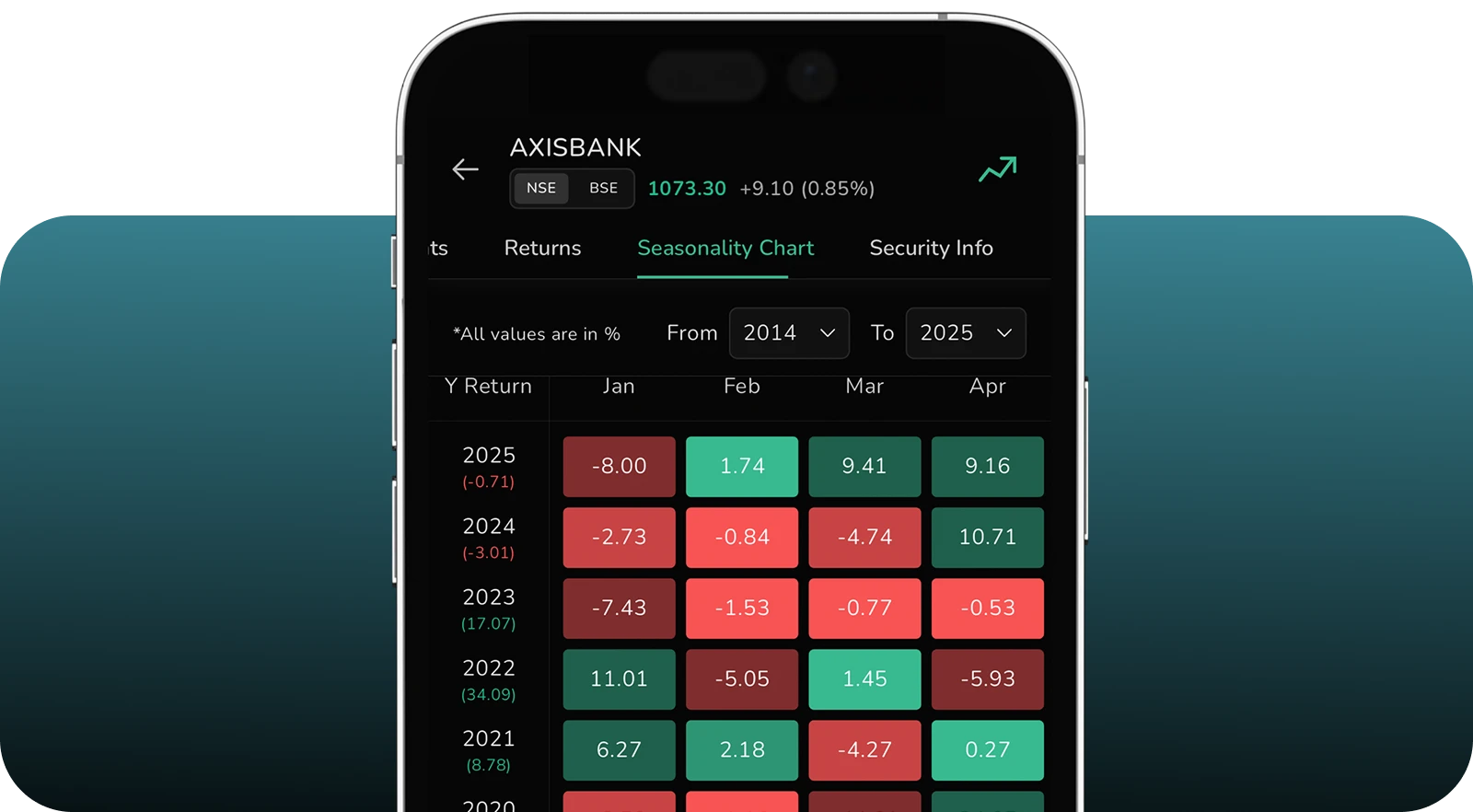

View seasonal trends of stocks to identify patterns and optimize investing strategies.

Loved by traders across India!

We are in the News

Awards and Recognition

Explore Our Latest Blogs

Loading blogs...

Discover Learn Engage

?

Frequently Asked Questions

Be part of the trading revolution

Trading Revolution

Faster

Open a free Demat account in minutes.