28% GST On Online Gaming, Investors On Edge - Tradejini

GST Impact on Real-Money Gaming and Casino Industries

In September 2022, the Directorate General of GST Intelligence (DGGI) issued a notice to Gameskraft, operator of Rummy Culture, demanding ₹20,989 crore in GST. This was based on the claim that real-money skill-based gaming should be taxed at 28% GST on the total bet value, equating it to "betting and gambling." This led to prolonged legal and regulatory battles, culminating in a significant amendment to GST laws affecting the entire real-money gaming and casino sector in India.

Key Developments:

-

High Court Quashes GST Notice:

- Gameskraft initially challenged the DGGI notice in the Karnataka High Court, which ruled in their favor in May 2023.

- The central government appealed this decision to the Supreme Court, which subsequently set aside the High Court’s order.

-

GST Council Decision:

- In July 2023, the GST Council decided to remove the distinction between “games of skill” and “games of chance,” levying 28% GST on the full value of bets placed on online gaming platforms, casinos, and similar activities.

-

Massive GST Notices:

- By September 2023, notices totaling over ₹55,000 crore were issued to real-money gaming platforms, including ₹25,000 crore to Dream 11 and ₹16,800 crore to Delta Corp.

State-Wise Concerns:

- Goa and Sikkim: These states opposed the levy on total bet value due to the significant revenue and employment generated by casinos.

- Delhi: The state opposed taxing online gaming altogether.

- Recommendation: The GST Council recommended levying GST on buy-ins instead of every bet placed to avoid double taxation, effective October 1, 2023.

Impact on Publicly Listed Companies:

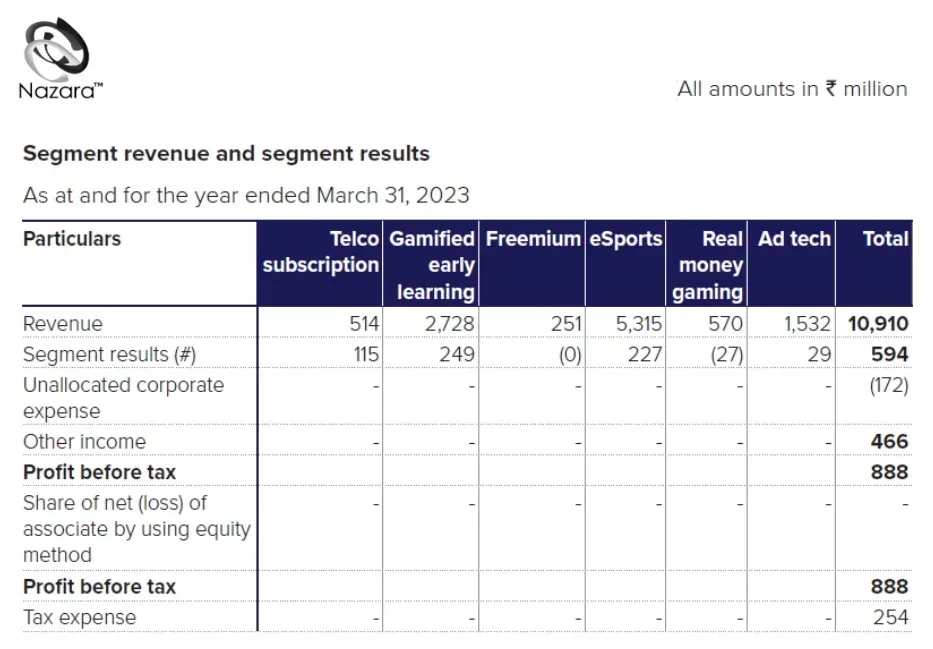

1. Nazara Technologies:

- Exposure: Real-money gaming constitutes 5.2% of revenue and 3.3% of profit before tax (PBT).

- Mitigation: Nazara stated that the impact would be minimal due to diversified revenue streams.

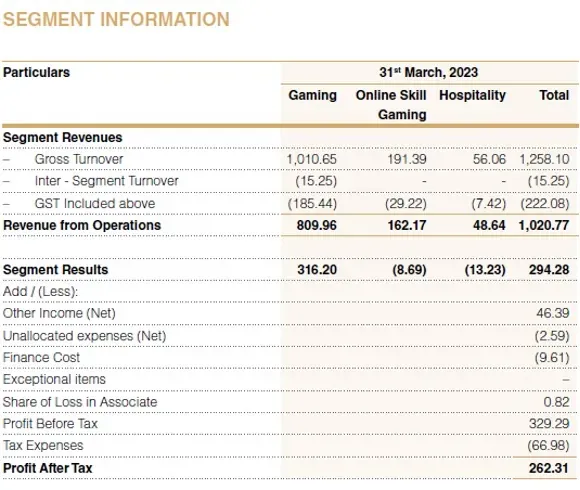

2. Delta Corp:

- Exposure: 95.2% of revenue and 93.4% of PBT stem from casinos and online skill gaming.

- GST Notice: Received a notice for ₹16,800 crore, compared to a market capitalization of ₹3,821 crore.

- Risk: The notice poses a severe threat to the company’s financial health and future operations.

Legal and Financial Ramifications:

Supreme Court Proceedings:

- The Gameskraft case in the Supreme Court will serve as a precedent for the industry.

- The government maintains that the 28% GST on total bet value is a clarification, not a retrospective tax change.

Potential Outcomes:

- Favorable Ruling: Could mitigate litigation risks for online gaming operators but may not resolve issues for casino operators like Delta Corp.

- Unfavorable Ruling: Could exacerbate financial pressures, especially for companies heavily reliant on casino revenues.

Industry Outlook:

-

Skill-Based Gaming:

- Platforms like Nazara are less likely to face significant disruption due to limited reliance on real-money gaming.

-

Casino Operators:

- Delta Corp’s reliance on casino gaming places it in a precarious position. State governments like Goa and Sikkim may need to advocate for relief at the central level to protect local industries.

-

Regulatory Landscape:

- The amendment signals stricter tax policies and may deter international investments in India’s gaming sector.

Conclusion:

The GST Council's decisions have set a challenging precedent for the gaming and casino industries. While Nazara may withstand the impact due to diversified revenues, Delta Corp faces an uncertain future heavily tied to state-level interventions and judicial outcomes. Investors and stakeholders must closely monitor the Supreme Court hearings and any potential policy adjustments to gauge the long-term viability of these sectors.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)