Empowering trading community with

Performance

Expertise

Transparency

Customer Support

- Stocks

- Mutual Funds

- Equity

- IPO Investment

- Commodity

- Currency

- Derivatives

1

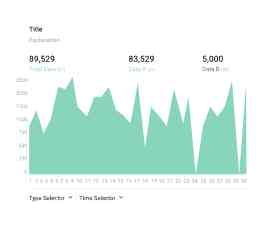

All in one platform

Experience the ability to seamlessly navigate your trading

needs within a single app. Our unwavering commitment to create cutting-edge

tools and products empowers traders, enabling them to effortlessly execute

complex orders through a unified interface.

2

Progressive Referral Program

Unlock the exhilarating potential of trading, as we

introduce an element of excitement by empowering you to generate an additional

income stream through referrals of CubePlus to your friends and family.

3

Dedicated Support

We have effectively done it for the last 10+ years and we

don’t plan on stopping. Best in class client support to provide meaningful

resolutions to all queries in a time bound manner.

4

Trusted Partner

We’ve bootstrapped our way to the top, with no proprietary

trading, and maintained an enviable 99.9% uptime. Our pristine record of

multiple clean audits underscores our dedication to transparency, establishing

us as a trustworthy companion in your trading voyage.

What people have to say about us?

★★★★★

Read More

The new app, cube plus is awesome!! The app is very fast, user friendly. Thanks to the UI/UX ppl worked on it.

Had a great and fast onboarding by Anita. Anita had helped all my friends to open the account seamlessly in a day!

★★★★★

Read More

As a customer of Trade Jini, I opened an account on 01/04/2022, and I have been fully satisfied with their services. The recent software, Cube Plus, is very good.

★★★★★

Read More

Arjun Prasad is very help and support to use the tradejini

Super the app is very nice

The app is very useful

★★★★★

Read More

I have been using Tradejini from last 3 years. It has been wonderful experience. Sunder, Divya and Puneet from Tradejini is been one point contact for me. They has been excellent in responding and fulfilling the requirements.

Would recommend Tradejini as Equity Trading platform to everyone.

★★★★★

Read More

Perfect application with easy to use interfaces. I have been their client for more than 4 years and it is just a perfect and professional place to work in. Their customers service is also very fast. Would highly recommend.

Read More

@tradejini has to be one of the best brokers I have used in trading stock market. Smooth and fast execution.

Thanks @chiragshenoy for recommend.

I am 100% sure it will be become the best broker in next few years.

★★★★★

Read More

I have been using Tradejini from last 2 years.. It has been wonderful experience .. Ms. Anitha from Tradejini is been one point contact for me.. she has been excellent in responding and fulfilling the requirements.

Would recommend Tradejini as Equity Trading platform to everyone..

cube software was ,good & now cube plus is more advanced & excellent

Read More

Smooth operation, Friendly atmosphere as I have visited personally.

Individual follow up

Thank you, I am proud to have demat a/c with you.

Read More

I have been using this company for almost 5 years now, their representative Are very friendly, they promptly respond to ur questions even if it is very silly. They don't try sell stuffs like mutual funds SIP for which I am very thankful . Finally their cube plus mobile app is great upgrade from the previous version which very easy UI.

★★★★★

Read More

The CubePlus app by Tradejini is truly excellent. It offers a seamless and user-friendly trading experience, providing both technical and fundamental data within a single app. One standout feature is its responsive customer support and human interaction and not any bot responding to my calls.

Previous

Next

Chetan Jain

★★★★★

Read More

I have been using Tradejini from last 3 years.. It has been wonderful experience .. Also Puneet from Tradejini is been one point contact for me.. He has been excellent in responding and fulfilling the requirements.

Would recommend Tradejini as Equity Trading platform to everyone.

Shashank .A.

★★★★★

Read More

TRADEJINI is providing an amazing platform for traders and an amazing API facility, they have a very supportive staff, any problem faced by the client is resolved instantly.

I would recommend all to trade through this platform.

★★★★★

Read More

Most beautiful application so please time to time apdet so I am very interested so good balance faster processing all orders so very happy happy happy

★★★★★

Read More

Highly recommend!!! Great User Interface!!! Smooth transition between portals and apps. Wonderful Experience...

★★★★★

Read More

Amazing app..neatly designed and user friendly .

Read More

Easy user interface! The learning curve to start with @tradejini is extremely

small, and most of their UI is really easy to work with! Looks like they have nailed the UI/UX to a very large extent!

Loving their platform!!

★★★★★

Read More

I have been using tradejini since last 3 years. It's good trading app. It provides good customer support & easy account opening process.

Read More

Just for trading @tradejini is the best never disconnected and even their customer service is appreciated.

Read More

cube software is very user freinly, tradejini team is supported every time best,

I will give us 5 star rating because any problem in software within 5 minites supportive team is solve the problem.

thank you

★★★★★

Read More

iam customer since 2013 , cube plus application is more advanced & well developed , customer support is good . i have given referal now , which is followed by Anitha

★★★★★

Read More

Superb trading platform!

Smooth, bug free and really easy to use. Can invest without any hassle! Loving it!

Previous

Next